Rising industrial property rents may harm Vietnam's appeal to FDI

Rents for industrial real estate in both the northern and southern regions of Vietnam are forecast to continue rising this year, undermining the country’s appeal to foreign direct investment (FDI), researchers with Vietcombank Securities have said.

Rising rents

Rent hikes in 2023 were driven by the sustained increases in FDI amid scarce supply, they said in a report released Tuesday.

In the southern region, the average rent jumped 15% year-on-year to $188/square meter/lease cycle in 2023. The rate event rose faster in the northern region, by 27% to $127/m2/lease cycle, due to an investment wave from electronics manufacturers.

In Q1/2024, the average rent in the North and South was $133/m2/lease cycle and $189/m2/lease cycle, up 7.8% and 2.4% year-on-year, respectively.

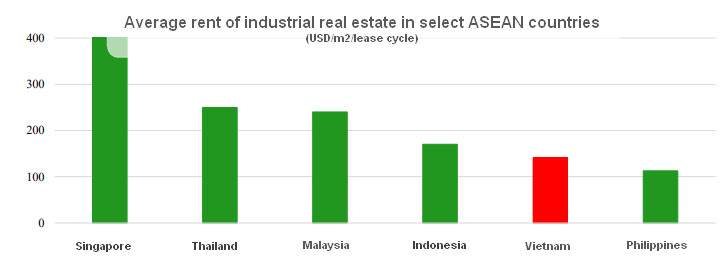

Despite the increases, the researchers noted that the average rent at industrial parks (IPs) in Vietnam is 20-40% lower than its regional peers.

Source: Report on indutrial real estate in Vietnam by Vietcombank Securities, May 2024.

The factors behind the rent hikes include thinner supply, and increases in land use rights fees and site clearance and compensation costs. Real estate developers will likely bear higher land use rights fees from 2026 onwards as land prices will be determined by market conditions, said the researchers.

They reckoned that rents in the northern region are projected to rise faster than those in the South due to higher demand as manufacturers of electronic devices are set to continue relocating their facilities to Vietnam this year.

They noted that industrial property supply, after seeing a boom driven by rampant incentives, has become scarcer since 2005 when the prime minister ordered illegal incentives to be dealt with, while legal obstacles have impeded new developments.

In addition, prime locations for developments have been disappearing while underdeveloped infrastructure has hindered the expansion of manufacturing activities.

Property services firm CBRE said last month that industrial real estate rents may increase 7-9% per year in the coming years given continued robust inflows of foreign investment and limited new supply. Rents for industrial land in the northern region could go up by 3-9% per year, while the southern region is likely to see a 3-7% per year increase.

Contrasting pictures in two key economic regions

According to the Ministry of Planning and Investment, as of end-2023, Vietnam had 416 IPs with a combined area of 89,200 hectares. Of them, 296 were operational with an average occupancy rate of 72.4%.

The northern region saw stronger supply last year, with 11,500 ha of the tier-1 market and 8,802 ha of the tier-2 market coming online, up 12.1% and 1.7% year-on-year.

The tier-1 market refers to more developed ones, including Hanoi, Hai Phong, Bac Ninh, Hai Duong, and Hung Yen. Meanwhile, the tier-2 market consists of Bac Giang, Quang Ninh, Thai Nguyen, Vinh Phuc, Ha Nam, Ninh Binh, and Thai Binh.

A view of Pho Noi A Iindustrial Park. Photo courtesy of Nhan Dan (People) newspaper.

Supply in the North outnumbered that in the south in 2023 owing to speedier site clearance, with most of the sites being agricultural land, and shortages of construction materials, particularly sand, in the South.

During 2023, tenants leased over 800 ha in the North, up 36% year-on-year, and another 110 ha in Q1 this year, leading to an average occupancy rate of 83%.

The latest tenants operate mainly in the fields of spare parts, electronics, equipment, automobiles, and renewable energy.

The report pointed out that IP supply is becoming scarcer in the South. As of end-2023, the accumulative supply in the region consisted of 22,780 ha in the tier-1 market, up 0.82% year-on-year, and 10,897 ha in the tier-2 market, flat from a year earlier.

The tier-1 market in the South includes Ho Chi Minh City, Binh Duong, Long An, and Dong Nai. The tier-2 market refers to Ba Ria-Vung Tau, Tay Ninh, Binh Phuoc, and Binh Thuan.

The researchers attributed slow supply in the South to difficulties in site clearance due to compensation disagreements, and longer-than-expected approval procedures.

In 2023, the absorbed area in the South dropped 30.6% year-on-year to 530 ha owing to the already high occupancy rate in key markets. In Q1, only 20 ha was leased out, resulting in an overall occupancy rate of 92%.

Foreign tenants mainly operate in the fields of rubber, plastics, consumer food, construction materials, and textile & garments.

Relocation trend of supply chains

According to the report, major transnational companies like Apple, Samsung, LG, Intel, and Lego are accelerating the relocation of manufacturing facilities and restructuring of supply chains to reduce reliance on China, known as the China+1 strategy.

Vietnam has emerged as a potential destination for that shifting trend, and major companies like Apple, Luxshare, Pegatron, Wistron, and Samsung have increased their investments.

“In the context of slower investment globally due to the economic slowdown and high interest rates, FDI inflows into Vietnam have been continuously increasing,” the researchers said.

In January-April, registered FDI in Vietnam reached $9.27 billion, up 4.5% year-on-year, and actual FDI totaled $6.28 billion, up 7.4%, according to government data.

A view of Vietnam-Singapore Industrial Park 1 (VSIP 1) in Binh Duong province, southern Vietnam. Photo courtesy of the company.

They also noted the shift of FDI flows from the tier-1 market to the tier-2 one is taking place at a faster pace in the North than in the South, with increased presence of manufacturers of spare parts, computers, electronics, solar panels, and cars.

Large-scale projects were seen in key northern tier-2 markets like Bac Giang, Quang Ninh, and Hai Phong.

In 2023, an estimated $4.5 billion worth of FDI was poured into tier-2 markets in the North, soaring 46.2% year-on-year. Meanwhile, in the South, FDI projects were mainly seen in tier-1 markets such as Dong Nai, Binh Duong, and Long An.

In Q1/2024, FDI flows were stronger in tier-2 markets in the North than in the South, thanks to major projects in the spare parts, electronics, and energy industries.

Several notable FDI projects licensed since last year have been a $621-million project by Taiwan’s Fulian Precision Technology Component in Bac Giang, a $1.5-billion project by China’s Jinko Solar Holding Co. Ltd. in Quang Ninh, a $690-million project by Taiwan’s LITEON Technology in Quang Ninh, and a $500-million project by SK Corp in Hai Phong.

In a report released last week, Agribank Securities Co. (Agriseco), a unit of state-owned Agribank, said that the local industrial real estate market will likely see a boost this year thanks to robust FDI and a rent uptrend.

New generation FDI inflows, characterized by high technology, semiconductors, and green energy, from major powers such as the U.S., China, and the EU are forecast to increase thanks to Vietnam’s competitive edges and conducive policies.

Tenants will increasingly look for industrial spaces in tier-2 localities due to a scarcity in tier-1 markets, the report said.

- Read More

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Society - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7

Sun Group-led consortium to build $616 mln Red River bridge in Hanoi

Hanoi authorities have approved a consortium led by Sun Group as the investor for the Tran Hung Dao bridge project, with a total investment estimated at VND16.27 trillion ($616.14 million).

Infrastructure - Thu, December 18, 2025 | 3:26 pm GMT+7

Shinhan Bank Vietnam accompanies SMEs in promoting cashless payments

With modern, secure and convenient payment solutions designed to meet the specific needs of businesses, particularly the SME segment, Shinhan Bank Vietnam continues to accompany enterprises in building a modern corporate image and keeping pace with the digital economy.

Banking - Thu, December 18, 2025 | 2:10 pm GMT+7

JC&C to divest 4.6% stake at Vietnam's dairy giant Vinamilk to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has announced the sale of more than 96 million shares, or a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM) to F&N Dairy Investments Pte. Ltd., part of the Fraser and Neave (F&N) group controlled by Thai billionaire Charoen Sirivadhanabhakdi.

Companies - Thu, December 18, 2025 | 1:36 pm GMT+7

Siemens to supply high-speed trains, key railway systems to Vingroup's subsidiary VinSpeed

Siemens Mobility on Wednesday signed a comprehensive strategic cooperation and high-speed railway technology transfer agreement with VinSpeed, a unit of Vietnam’s Vingroup, to supply high-speed trains and key railway systems for planned rail projects in Vietnam.

Companies - Thu, December 18, 2025 | 1:24 pm GMT+7