Steelmaker Nam Kim to raise $63 mln with new share issuance

Nam Kim Steel Corporation has restarted a plan to raise VND1.58 trillion ($63.3 million) through fresh share issuance for investing in a steel sheet factory in Ba Ria-Vung Tau province, southern Vietnam.

In documents prepared for the upcoming 2024 annual general meeting (AGM) of shareholders, the company’s board of directors said that a maximum of 131.6 million shares will be offered to existing shareholders at VND12,000 ($048) per share.

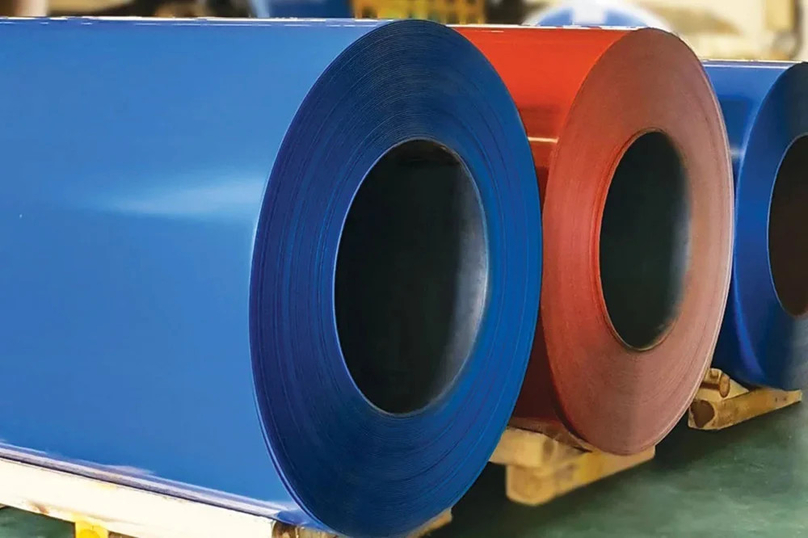

Steel products of Nam Kim Steel Corporation. Photo courtesy of the company.

The capital raised will be invested in the Nam Kim Phu My steel sheet factory, it said.

In recent years, Nam Kim has increased its capital through dividends and share bonuses. In 2017, it issued 30 million private placement shares at VND27,000 ($1.08) per share. The main buyers were foreign investment funds and securities companies.

NKG shares are currently priced at around VND24,400 ($0.98) per share, an increase of 65% in the past year.

Nam Kim made plans to invest in the steel sheet factory project in 2022 and just received an investment registration certificate early this year. The factory will produce metal products made of steel sheets, galvanized sheets, and zinc-aluminum alloy galvanized steel.

The project includes a 350,000-ton galvanizing line, two Zinc-aluminum alloy galvanizing lines with a capacity of 300,000 tons per year each, and a 150,000-ton color coated corrugated iron line.

It will have a first phase investment of VND4.5 trillion ($180.32 million). The company has already contributed VND500 billion ($20.03 million) to the project, whose construction is expected to start in the second quarter of 2024.

In addition, the company will issue a maximum of 2.5 million Employment Stock Ownership Plan (ESOP) shares at VND10,000 ($0.4) apiece and 20% of bonus shares (nearly 52.7 million shares).

The board of directors expect the steel industry will continue to recover this year at a modest pace, with the U.S. Federal Reserve (Fed) maintaining high interest rates.

Therefore, in addition to increasing profits, consolidating and expanding partnerships will be a key part of its 2024 business strategy.

It also targets an output of 1 million tons, total revenues of VND21 trillion ($841.26 million) and pre-tax profits of VND420 billion ($16.8 million), up 38%, 20% and 2.4 times year-on-year, respectively.

In 2023, amid the steel market’s gradual recovery, Nam Kim recorded pre-tax profits of VND177 billion ($7.09 million), compared to a loss of VND107 billion in 2022.

To reserve capital for development investment, the board of directors has presented a plan to withhold cash dividends in 2023 and 2024.

Nam Kim's leaders said that the company had completely paid off its long-term debt last year and financial pressures are expected to reduce this year.

In a business breakthrough, the firm successfully exported a shipment of high-quality Zinmag corrugated iron sheets to Australia, opening up the prospect of penetrating deeper into the value chain of the galvanized steel industry in choosing markets such as North America and the E.U, the directors said.

NKG closed Monday at VND24,600 ($0.99) per share.

- Read More

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Society - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7

Sun Group-led consortium to build $616 mln Red River bridge in Hanoi

Hanoi authorities have approved a consortium led by Sun Group as the investor for the Tran Hung Dao bridge project, with a total investment estimated at VND16.27 trillion ($616.14 million).

Infrastructure - Thu, December 18, 2025 | 3:26 pm GMT+7

Shinhan Bank Vietnam accompanies SMEs in promoting cashless payments

With modern, secure and convenient payment solutions designed to meet the specific needs of businesses, particularly the SME segment, Shinhan Bank Vietnam continues to accompany enterprises in building a modern corporate image and keeping pace with the digital economy.

Banking - Thu, December 18, 2025 | 2:10 pm GMT+7

JC&C to divest 4.6% stake at Vietnam's dairy giant Vinamilk to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has announced the sale of more than 96 million shares, or a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM) to F&N Dairy Investments Pte. Ltd., part of the Fraser and Neave (F&N) group controlled by Thai billionaire Charoen Sirivadhanabhakdi.

Companies - Thu, December 18, 2025 | 1:36 pm GMT+7

Siemens to supply high-speed trains, key railway systems to Vingroup's subsidiary VinSpeed

Siemens Mobility on Wednesday signed a comprehensive strategic cooperation and high-speed railway technology transfer agreement with VinSpeed, a unit of Vietnam’s Vingroup, to supply high-speed trains and key railway systems for planned rail projects in Vietnam.

Companies - Thu, December 18, 2025 | 1:24 pm GMT+7