Vietnam banking sector shows positive outlook for 2025: VinaCapital

Vietnamese bank stocks significantly outperformed the VN-Index in 2024, and strong performance is expected this year, given the low valuation of bank stocks (1.3x P/B vs 16% ROE), write chief economist Michael Kokalari and senior bank analyst Thuy Anh Nguyen at VinaCapital.

Michael Kokalari, chief economist of VinaCapital. Photo courtesy of the company.

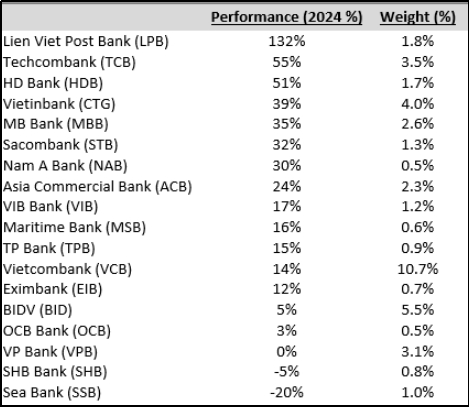

Bank stocks account for 40% of the VN-Index and vastly outperformed the benchmark index in 2024. The 18 banks listed on the Ho Chi Minh Stock Exchange surged 26% in VND terms vs 12% for the VN-Index.

We believe the sector will deliver a strong performance again this year, partly because we expect sector-wide bank earnings growth to accelerate from 14% in 2024 to 17% in 2025, as the main drivers of Vietnam’s GDP growth shift from exports and tourism in 2024 to consumption, infrastructure spending, and real estate in 2025.

Earnings growth acceleration, coupled with attractive valuations (1.3x P/B versus 16% ROE), should drive further stock price appreciation.

The performance of individual bank stocks in Vietnam varies considerably, creating ample opportunities for active managers to outperform the broader stock market. The wide range of stock price performance reflects the widely varying business strategies, risk profiles, and valuations of banks in Vietnam.

We discuss the current thinking of VinaCapital’s portfolio managers and research team on bank stock selection below, as well as how our outlook for Vietnam’s economy, which was discussed in our Looking Ahead at 2025 report, informs our current stock picking strategy.

In short, we expect Vietnam’s export growth to the U.S. to plunge this year, which should be offset by increases in infrastructure spending, real estate development activity, and consumer spending.

Slower export growth will weigh on GDP growth because exports are nearly 100%/GDP, but most of Vietnam’s exports are produced by FDI companies that are not reliant on local banks for financing; while slower exports will affect the economy, they will not significantly hurt the banks.

Furthermore, banks should be the biggest beneficiaries of the shift to more domestically driven growth because Vietnamese banks touch nearly every part of the country’s domestic economy, and banks are especially exposed to real estate and consumption, which we expect will help drive the economy in 2025.

We expect the Government will take concrete steps to boost the real estate market this year, which could result in mortgage loan growth doubling from around 10% in 2024 to 20% in 2025.

A real estate market revival would also boost consumer confidence, as well as other forms of high margin consumer lending, such as auto loans and buy-now-pay-later purchases.

Consumer confidence in Vietnam was very weak throughout 2023 and in the beginning of 2024 but began recovering from mid-2024. A real estate market revival would further boost confidence and lending to consumers.

The Government also plans to support 2025 GDP growth by spending more on infrastructure development, which should create more lending opportunities for banks. That said, the most important takeaway from all of the above is that the combination of increased infrastructure spending, improved consumer sentiment, and a real estate market revival would all propel banks’ credit growth, support banks’ NIMs, and foster the ongoing recover of asset quality in Vietnam.

Recovering asset quality & improving loan mix

We expect the earnings of Vietnam’s listed bank shares to grow 17% this year, driven by 15% system-wide credit growth and by a slight increase in system-wide NIM (by 6 bps to 355 bps in 2025). The ongoing recovery in asset quality will also support earnings growth somewhat this year, as will an improved composition of loan growth.

We discuss both of those topics below, as well as interdependencies between loan growth, NIM, and asset quality. For example, weak demand for mortgages in 2024 prompted banks to grow their business lending by nearly 20% last year, but much of that new lending was short-dated working capital loans, lent at highly competitive interest rates, which in-turn depressed NIMs.

We expect Vietnam’s system-wide loan growth to remain at around 15% in 2025 but for high-margin retail loan growth to accelerate from around 12% in 2024 to 15% in 2025. We also expect banks to make more long-dated loans this year by lending to infrastructure projects, which typically have long time horizons.

The resulting “maturity transformation” associated with those new long-dated loans will support NIMs (banks earn higher profits by gathering short term deposits and extending long-term loans that usually earn higher interest rates).

That said, some banks extending long term loans will also need to raise additional long-term deposits/funding to fund that lending, which will temper the profitability of those loans. Finally, real estate lending picked up considerably last year as the market recovery gathered steam, although some lending to real estate developers was for the refinancing of maturing corporate bonds that developers previously sold to retail and other investors.

Mixed NIM dynamics

We expect system-wide NIM to tick-up slightly in 2025. Consumer and infrastructure lending should boost NIMs, and the real estate market rebound means that banks will not need to roll-over loans to problematic borrowers at low interest rates in order to “rescue” their customers.

Also, some banks extend “window dressing” loans with de minimis NIMs to reach their credit quotas when credit demand is low – in order to ensure being granted comparable credit quotas by the SBV the following year. Such lending depresses reported NIMs, but banks should be able to meet their credit growth quotas with real loan demand this year, which in-turn should alleviate this source of downward NIM pressure in 2025.

All of that said, system-wide loan growth in Vietnam outstripped deposit growth by 4% pts as of end-September (9% year-to-date loan growth versus 5% year-to-date deposit growth), which is putting upward pressure on deposit rates.

We would characterize the current state of system-wide liquidity in Vietnam as “tight, but not stretched.” That characterization is consistent with the fact that six-month deposit rates initially fell by about 60 bps in early-2024 (reaching a low of 3.5% in March), and then bounced back to over 4% by end-2024.

Note that: 1) The VND depreciation (5% in 2024) is also currently putting upward pressure on deposit rates, and 2) inflation averaged 3.6% in 2024 and is not significantly impacting deposit rates.

In short, we expect the average six-month deposit rates of all Vietnam’s banks to increase by 50-70 bps this year to nearly 5% by end-2025 (note that state-owned banks typically pay savers interest rates that are typically around 1% pts below the average rates private sector banks pay). That modest increase in deposit rates, coupled with all of the factors discussed above, means NIMs are likely to finish this year nearly unchanged.

Recovering asset quality

Asset quality issues in Vietnam reached a crescendo in early-2023, following the collapse of Saigon Commercial Bank (SCB) in late-2022. The official, system-wide NPL figure has hovered around 2% since then, thanks in part to various forbearance measures, although the official number looks set to start declining despite the fact that most of those measures have now expired.

More importantly, some banks started reporting “Other Income” from the recovery of bad loans that had already been written off. This so-called “write-back” income is a concrete sign that banks asset problems are now essentially finished, and it boosted sector-wide earnings by about 10% pts in 2024.

Write-backs are recorded as Non-Interest Income (NOII), which in-turn accounts for about 20% of the Total Operating Income (TOI) of Vietnamese banks. We expect NOII to grow by over 10% this year, driven by write-backs and by other non-interest income such as bancassurance fees.

However, credit costs are only likely to drop slightly (from 1.2% in 2024 to 1.3% in 2025), despite recovering asset quality. This is because the average Loan Loss Reserve in Vietnam fell from well over 150% two years ago to around 100% on average now (the median LLR is around 70% and some banks’ LLRs are well below 100%).

In short, banks in Vietnam were essentially over-provisioned in the lead-up to the SCB collapse, and then depleted their LLRs during 2023-24 to manage their reported earnings. Vietnamese banks have now started rebuilding their LLRs, which is why we do not expect a bigger drop in credit costs this year, despite improving asset quality.

Picking the winners

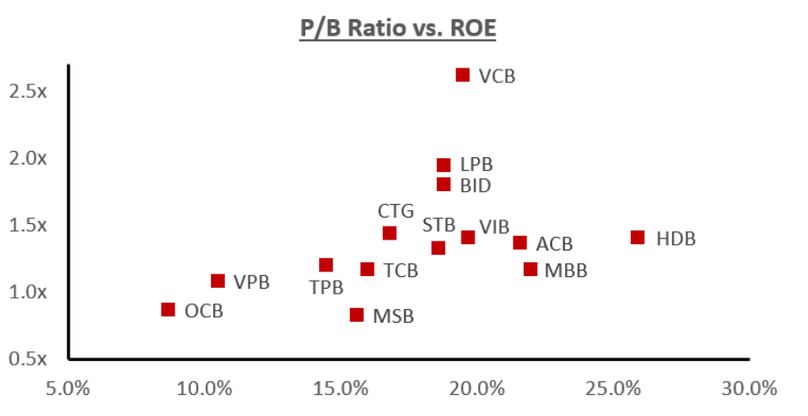

Vietnamese bank stocks are trading at a 1.3x FY25 P/B versus 16% expected ROE, which is ~2 standard deviations below banks’ 5-year average P/B (banks that generate 16% ROE typically trade above 2x P/B).

Valuation is also cheap on a Price Earnings Ratio basis at 0.5x PEG (8x FY25 P/E vs. 17% EPS growth). Last year, valuations were even cheaper before a partial re-rating of bank stock valuations, when the increase in bank stock prices (26%) outpaced EPS growth (14%).

One reason for that cheap valuation is that Vietnam’s 30% foreign ownership limit (FOL) for banks essentially makes local retail investors the marginal buyers who set bank stock prices in Vietnam, and those investors are not as focused on valuations as foreigners.

Investors in Vietnam’s stock market are generally aware of the sector’s inexpensive valuation, but many do not realize how big the divergence is between the valuations and stock price performance of individual banks, or how much divergence there is between the operating, asset quality, and other metrics among individual banks.

These all factor into how we select the bank stocks for our diversified portfolios, as does our expectation for a shift to more domestically driven growth this year that would benefit banks focusing on the real estate sector and lending to consumers, as well as banks that lend to infrastructure projects (the latter are likely to be state-owned banks).

We bifurcate those banks into two groups: banks with good asset quality and more diversified loans/less exposure to the real estate sector, and banks with higher exposure to the real estate sector and/or that are more aggressively geared to a recovery of consumer borrowing. We then carefully consider valuation metrics to make our actual stock picks given the wide variation as can be seen in the chart below.

The former cohort includes tickers like ACB, VCB, CTG, BID, STB, and VIB, which are all banks that have the capacity to benefit from the “rising tide lifting all boats” dynamic that we expect for Vietnam’s banks this year.

Those banks are especially able to expand their lending to the real estate sector since they are not encumbered by legacy issues and/or the need to support their distressed customers. These are also the banks benefitting the most from write-back income because their prior prudent lending practices mean that they have more recoverable collateral assets backing their loans.

The latter cohort includes more aggressive banks like TCB, VPB, MBB, and HDB, which may either directly benefit by increasing lending to real estate developers or will likely see some of their legacy asset quality issues resolved by a revival of the real estate market.

For example, we mentioned above that the LLRs of some banks are well below 100%; the stock prices of thinly provisioned banks (or banks that the market believes have underreported their bad debts) should be highly geared to a recovery in the real estate market.

A strategy for 2025

The portfolios of our active investment funds include both “fast mover” banks that are highly geared to Vietnam’s likely economic scenario this year, plus some more conservative banks that are unencumbered with legacy issues.

We think of this as a “barbell” bank investment strategy and also overlay bank-specific considerations into our investment decisions, such as picking banks that have recently resolved (or are likely to soon resolve) legacy issues, banks with particularly strong digitization plans, and/or banks that can (and will) raise substantial amounts of capital in order to fund their growth going forward.

Conclusions

Bank stocks significantly outperformed the VN-Index in 2024, and we expect strong performance this year, given the low valuation of bank stocks (1.3x P/B vs 16% ROE). That said, there is a wide dispersion between the valuations, asset quality, and earnings growth drivers of listed banks, giving active fund managers ample opportunities to outperform that market.

Finally, we expect sector-wide earnings growth to pick up this year, driven by a shift in Vietnam’s GDP growth drivers from external factors in 2024 to domestic driven growth in 2025.

- Read More

Nokia, VNPT expand partnership to upgrade Vietnam’s radio infrastructure

Nokia has extended its long-term partnership with state-run Vietnam Posts and Telecommunications Group (VNPT) through a new agreement to upgrade and expand radio infrastructure across the country.

Companies - Mon, October 27, 2025 | 9:12 pm GMT+7

Private firms encouraged to invest in digital infrastructure per Vietnam government's new decision

Private companies in Vietnam are encouraged to engage in building telecom infrastructure and other infrastructure for national digital transformation through 2030 per a newly approved program.

Economy - Mon, October 27, 2025 | 4:59 pm GMT+7

Vietnam tech giant FPT's logo to be featured on Chelsea FC sleeves

Vietnamese tech giant FPT Corporation has taken social media by storm after being named a principal partner and official sleeve partner of Chelsea Football Club for the 2025/26 season.

Companies - Mon, October 27, 2025 | 4:34 pm GMT+7

EU seeks to strengthen trade-investment, green transition ties with Vietnam: European Council President

The EU wishes to enhance its cooperation with Vietnam, particularly in the areas of trade-investment, green transition, digital transformation, global challenges response, and promotion of a rules-based international order, said President of the European Council Antonio Costa.

Economy - Mon, October 27, 2025 | 4:12 pm GMT+7

The Investor to hold green energy transition seminar on Thursday

The Investor will organize a seminar entitled “Green Energy Transition from Perspective of Politburo’s Resolution No. 70” in Hanoi on Thursday, October 30.

Companies - Mon, October 27, 2025 | 3:51 pm GMT+7

Central Vietnam hub Danang names 5 property projects eligible to raise investment capital

The Department of Construction in Danang city has announced a list of five property projects that have been approved to mobilize a total of over VND22 trillion ($836.34 million) in investment capital.

Real Estate - Mon, October 27, 2025 | 11:59 am GMT+7

Petrovietnam’s arm PTSC posts 140% profit surge in Q3 on higher deposit income

PetroVietnam Technical Services Corporation (PTSC, HoSE: PVS), a subsidiary of state-run Petrovietnam, reported VND324 billion ($12.3 million) in Q3 net profit, up 140% year-on-year, driven by higher financial income and reduced borrowing costs.

Companies - Mon, October 27, 2025 | 11:20 am GMT+7

Price war squeezes profit margins at Vietnam's auto distributors

Vietnam’s auto market continues to expand in size, but distributors are seeing profits erode as aggressive price competition spreads beyond luxury vehicles to mass-market segments.

Companies - Mon, October 27, 2025 | 8:14 am GMT+7

Vietnam-US issue joint statement on Reciprocal Trade Agreement Framework

Vietnam and the United States on October 26 issued a joint statement on the Framework for a Balanced and Fair Reciprocal Trade Agreement after many months of negotiations.

Economy - Sun, October 26, 2025 | 9:28 pm GMT+7

MBBank achieves sustainable growth in 9 months, leads digital transformation

Hanoi-based MBBank recorded positive growth across scale, efficiency, and asset quality in the first nine months of the year, underscoring its strong internal resilience amid continued volatility in the financial market.

Banking - Sun, October 26, 2025 | 5:38 pm GMT+7

Vingroup to develop 6,300 ha urban complex project in Congo

Vietnam's leading private conglomerate Vingroup (HoSE: VIC) and the government of Kinshasa, the capital of the Democratic Republic of the Congo (DRC), will jointly explore and develop a 6,300-hectare riverfront mega-urban project.

Real Estate - Sun, October 26, 2025 | 12:57 pm GMT+7

Vietnam’s Ministries of Foreign Affairs, Natural Resources & Environment, and Home Affairs have new heads

Le Hoai Trung was appointed on Saturday as Minister of Foreign Affairs, Tran Duc Thang as Minister of Natural Resources and Environment, and Do Thanh Binh as Minister of Home Affairs.

Politics - Sun, October 26, 2025 | 11:22 am GMT+7

Intel eyes shifting more production to Vietnam

U.S. chipmaker Intel plans to shift its assembly, packaging, and testing operations from its Costa Rica facility to potential markets such as Vietnam, said Kenneth Tse, general director of Intel Products Vietnam.

Industries - Sun, October 26, 2025 | 9:05 am GMT+7

Vietnam's securities regulator seeks to expand institutional market participation

The State Securities Commission of Vietnam (SSC) is preparing a comprehensive package of measures to allure more institutional investors to the stock market, which currently sees up to 85-90% of total transaction value come from retail investors.

Finance - Sun, October 26, 2025 | 8:00 am GMT+7

VAFIE, Nghe An province tax authority help businesses update new tax policies

The Vietnam's Association of Foreign Invested Enterprises (VAFIE) and the Nghe An province Tax Department on Friday co-hosted a tax policy workshop titled “New tax policies impacting business operations and accounting standards under IFRS.”

Companies - Sat, October 25, 2025 | 7:28 pm GMT+7

Vietnam parliament okays appointing 2 new Deputy Prime Ministers

Vietnam's legislature has approved Prime Minister Pham Minh Chinh's proposal to appoint Ho Quoc Dung, former Party chief of Gia Lai province, as Deputy Prime Minister, while Pham Thi Thanh Tra, a Party Central Committee member, became the country's first female Deputy Prime Minister.

Politics - Sat, October 25, 2025 | 6:32 pm GMT+7

- Consulting

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation

-

Vietnam’s rapid capital market reforms set to pay dividends in coming decades