Vietnam central bank expected to further cut rates in Q3: HSBC

The State Bank of Vietnam (SBV) is expected to deliver one more 50-basis point rate cut in the current easing cycle, sometime in this year’s third quarter, to further support the country’s growth, HSBC Vietnam said.

HSBC Vietnam predicted the likely SBV cut in its newest analysis of the country’s economic conditions.

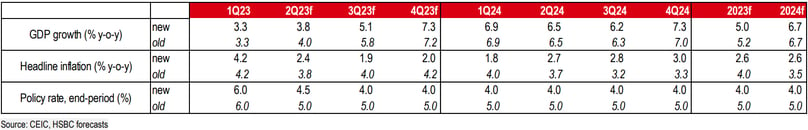

HSBC's updated forecasts for Vietnam’s key indicators

“We are trimming our 2023 growth forecast slightly to 5% from our previous 5.2%, taking into account a protracted and a deeper-than-expected trade downturn. We now expect a meaningful economic rebound from this year’s fourth quarter, warranting further monetary support,” the HSBC report said Monday.

“After delivering an accumulative of 150-basis point rate cuts in the second quarter, we expect one more 50-basis point cut in the third quarter.”

This will likely bring Vietnam’s policy rate to 4.0%, reversing all tightening efforts in 2022, also on par with its rate cuts during the pandemic.

However, HSBC said there is also a risk that further cuts may not be needed in this year’s second half if growth bottoms out earlier than expected.

The SBV’s latest cuts took effect on Monday, with its refinancing rate being 4.5% per annum, 50 basis points lower. Other key rates are also lowered: the discount rate is cut by 50 basis points to 3%, while the overnight lending interest rate in inter-bank electronics payments is lowered to 5%. Meanwhile, the maximum interest rate for demand deposits with terms of less than one month is kept unchanged at 0.5% per year, but demand deposits with a term of between 1 and 6 months are reduced by 25 basis points to 4.75% per year.

The newest SBV cuts continue to reduce financing costs for businesses and households, thus spurring business investment and supporting consumer sentiment.

This year has been a tough year for Vietnam’s economy. After seeing sharply slowing growth of only 3.3% year-on-year in the first quarter of 2023, Vietnam continues to brace for strong headwinds. While high-frequency indicators point to no further deterioration, there are also no clear signs that Vietnam’s economy is bottoming out.

Vietnam’s exports have fallen by over 10% year-on-year so far this year. Despite external woes, Vietnam’s services sector remains a bright spot, partially shielding some weakness to an extent, the HSBC report said.

However, there is a clear divergence between big-ticket items, including automotive sales and tourism-related services. On a three-month-moving average, the former plunged over 40% year-on-year, almost on par with that during the lockdown period in 2021. This suggests weakness in the external sector has filtered through to private consumption.

Encouragingly, Vietnam continues to see a positive influx of tourists. Vietnam has welcomed close to one million tourists in the past two months, equivalent to 70% of 2019’s levels. Two of its major sources of tourism merit attention. South Korean tourists have recovered to 80% of the pre-pandemic level, but the ratio stands at only 35% for Chinese tourists. Fortunately, the supply-side of bottlenecks continue to show signs of further easing.

A foreign tourist (right) buys street food in Vietnam. Photo courtesy of Labor newspaper.

Vietnam has restored direct flights with China to around 40% of 2019’s level, the second highest in ASEAN, just after Singapore (53%). Meanwhile, the long-anticipated relaxation on visa restrictions is under National Assembly consideration. With efforts to boost tourism, Vietnam will likely see a punchier boost in this year’s fourth quarter, though later than HSBC Vietnam’s original estimates.

HSBC said the Vietnamese central bank’s newest rate cuts mean the SBV has maintained its optimistic tone about inflation prospects, again citing that “inflation is under control”.

The move also shows currency stability. Despite recent strength in the USD, VND has remained relatively stable, thanks to its improving current account dynamics. While Vietnam has been suffering trade headwinds, its imports have plunged much more than exports, given its import-intensive nature in the manufacturing sector.

Therefore, Vietnam’s trade surplus doubled to $2 billion per month on average so far this year. That said how USD-VND evolves warrants a closer watch, as the U.S. Federal Reserve is unlikely to have completed its tightening cycle, according to HSBC Vietnam.

- Read More

Intel urged to expand chip packaging, testing operations in Vietnam

Vietnam has urged Intel to step up investment in semiconductor packaging and testing operations in the country, as Hanoi accelerates efforts to build a domestic chip ecosystem aligned with global supply chains.

Investing - Mon, December 22, 2025 | 3:37 pm GMT+7

Korean energy giant LS intends to inject $19.3 mln into Vietnam rare earth business

LS Eco Energy, a subsidiary of South Korea’s cable and energy giant LS Cable & System, has decided to invest KRW28.5 billion ($19.26 million) in advancing its rare earth metals business in Vietnam.

Industries - Mon, December 22, 2025 | 3:11 pm GMT+7

Vietnam's Petrosetco estimates 2025 net profit rises 46% to over $12 mln

PetroVietnam General Services Corporation (Petrosetco) expects its net profit to reach VD322 billion ($12.23 million) in 2025, up 46% year-on-year and exceeding the company's full-year target by 32%.

Companies - Mon, December 22, 2025 | 11:50 am GMT+7

Vietnam's 13th Party Central Committee convenes 15th meeting

The 15th meeting of Vietnam's 13th Party Central Committee opened in Hanoi on Monday.

Politics - Mon, December 22, 2025 | 11:13 am GMT+7

Duc Giang Chemical chairman’s family loses $129 mln in a week as shares plunge

Shares of Vietnam’s Duc Giang Chemical Group JSC (DGC) fell sharply last week (December 15-19), wiping nearly VND3.4 trillion ($129.2 million) off the stock-based wealth of the family of chairman Dao Huu Huyen.

Companies - Mon, December 22, 2025 | 6:58 am GMT+7

Vietnam launches International Financial Center, pledges 'special process' to resolve investor hurdles

Vietnam on Sunday announced the establishment of its International Financial Center (IFC), with Prime Minister Pham Minh Chinh pledging to fast-track the resolution of investor difficulties through a “special process”.

Economy - Sun, December 21, 2025 | 9:18 pm GMT+7

The new target for VN-Index is 3,200: Finnish fund PYN Elite

The earnings growth of listed companies in Vietnam will continue to support equity prices in 2026. According to the consensus forecast, a market P/E of 10.0 for 2026 looks very attractive, writes Petri Deryng, portfolio manager at Finnish fund PYN Elite.

Consulting - Sun, December 21, 2025 | 6:33 pm GMT+7

Mastering AI key to Vietnam’s leap beyond middle-income trap: FPT chairman

Mastering and innovating technology is no longer optional but the sole path for Vietnam to escape the middle-income trap and rise alongside global powers, said tech giant FPT Corporation chairman Truong Gia Binh.

Economy - Sun, December 21, 2025 | 2:33 pm GMT+7

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7

Vingroup builds development hubs across multiple sectors

With the groundbreaking and inauguration of 11 large-scale projects on Friday, Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, reinforces its role as a pioneering private enterprise in urban development, infrastructure, energy, and industry.

Investing - Sat, December 20, 2025 | 6:32 pm GMT+7

Kinh Bac breaks ground on $437 mln industrial park in northern Vietnam province Thai Nguyen

Kinh Bac City Development Holding Corp (HoSE: KBC) on Friday broke ground on the VND11.5 trillion ($437.06 million) Phu Binh Industrial Park project in Thai Nguyen province.

Industrial real estate - Sat, December 20, 2025 | 5:46 pm GMT+7

Construction giant Fecon starts work on Hanoi metro line, northern Vietnam rail link

Fecon, a leading Vietnamese construction group, on Friday broke ground on two major rail projects: a metro line in Hanoi and a strategic railway linking the capital city with northern localities.

Infrastructure - Sat, December 20, 2025 | 2:08 pm GMT+7

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

- Consulting

-

The new target for VN-Index is 3,200: Finnish fund PYN Elite

-

Vietnam M&A 2025: Opportunities reshaped by disciplined capital

-

VN-Index rises 3.1% in Nov, Finnish fund PYN Elite records -5.8%

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas