Vietnam central bank may up intervention with 4.5% VND devaluation forecast: broker

Vietnam’s central bank may have to ramp up intervention to safeguard the dong towards the year-end with the Vietnamese currency expected to devalue 4.5% this year, analysts say.

A teller counts dollars at an ABBank branch in Hanoi. Photo by The Investor/Trong Hieu.

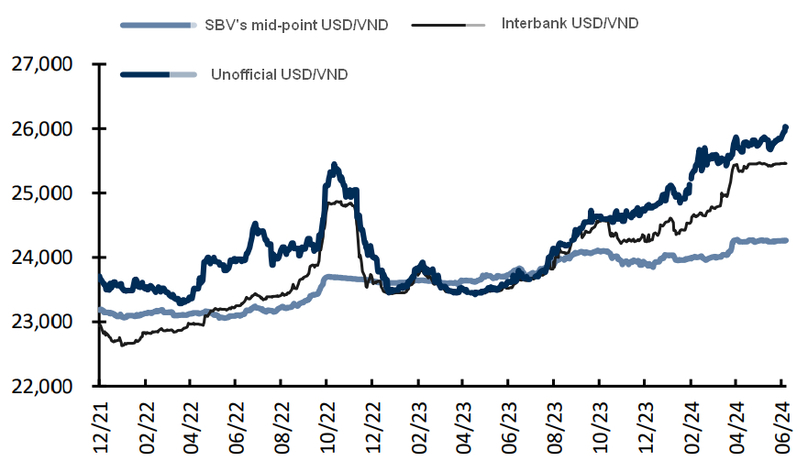

Analysts with KB Securities Vietnam JSC (KBSV) note in a recent report that the USD/VND exchange rate has stayed high persistently since the start of this year, trading at around 25,450 currently – a 4.9% depreciation in the year to date, despite the State Bank of Vietnam (SBV) selling around $6 billion in foreign currency to local commercial banks as of June 26.

The exchange rate is likely to remain under great pressure in the coming months, driven by rising demand for input material imports; the tendency to deposit USD overseas by exporting and foreign-invested enterprises; and the stubbornly high U.S. Dollar Index (DXY), they say.

They reckon that upward pressure on the USD/VND rate is unlikely to ease until the middle of Q3/2024, when the U.S. Fed is predicted to make the first interest rate cut in years.

USD/VND exchange rate movement. Source: FiinPro, Bloomberg, KBSV.

To handle the pressure, the SBV is likely to continue selling hard currency. However, room for this maneuver is limited as the central bank’s forex reserves are decreasing and approaching the safety threshold of three months of import cover recommended by the International Monetary Fund.

Therefore, it is possible that the SBV continues raising VND-denominated interest rates via open market operations (OMO) and Treasury bills. Higher interest rates will help narrow the USD-VND interest gap, dampen forex speculation, and lead to high rates of VND-denominated deposits, the report says

In addition, the SBV may increase the price of greenback at which it sells to commercial banks, allowing the dong to depreciate more than 5% this year as the devaluation would still be milder than that of regional peers.

The USD/VND rate is expected to stabilize in Q4/2024 thanks to stronger exports, rising inbound remittances, and a much anticipated rate cut by the Fed, the report says.

“KBSV forecasts the USD/VND rate will stabilize and increase 4.5% for the whole of 2024, ending the year at 25,360.”

Similarly, Ho Chi Minh City-based Viet Dragon Securities (VDSC) has said it expects the SBV to continue facing USD/VND rate pressures.

Analysts with VDSC predict that the central bank will continue selling forex to protect the VND, but may not succeed in reigning in the dong depreciation to expected extent. Therefore, it may continue raising OMO interest rates to narrow the USD-VND rate gap on the interbank market.

If the SBV fails to keep the USD/VND exchange rate steady by tapping forex reserves, it may lift its policy rates by 25-50 basis points, VDSC analysts feel.

Meanwhile, Vietcombank Securities Co., a unit of state-run Vietcombank, said Wednesday that the VND depreciation may reduce to 3-4% against the greenback by the end of this year.

- Read More

Vietnam Education Publishing House pledges $758,300 in textbooks for students in flood-hit areas

Vietnam Education Publishing House (VEPH) has pledged up to VND20 billion ($758,292) this year to provide textbooks for students in the areas stricken by typhoons, floods, and poor economic conditions.

Companies - Wed, December 3, 2025 | 12:23 pm GMT+7

International awards solidify PVI's position as top non-life insurer in Asia

PVI Insurance, the only non-life insurance company in Vietnam, has won two categories at the Insurance Asia News (IAN) Awards for Excellence 2025: General Insurer of the Year and Underwriting Initiative of the Year.

Companies - Wed, December 3, 2025 | 11:58 am GMT+7

Foxconn aims to produce unmanned aerial vehicles, Xbox consoles in northern Vietnam province Bac Ninh

Fushan Technology (Vietnam) LLC, a subsidiary of Taiwan-based electronics giant Foxconn, plans to add unmanned aerial vehicles (UAVs) and Xbox gaming consoles to its production portfolio under a VND8,354 billion ($316.74 million) project in Bac Ninh province.

Industries - Wed, December 3, 2025 | 11:24 am GMT+7

Three port majors bid for $1.8 bln Lien Chieu container terminal project

Three consortia have submitted bids for the $1.8 billion Lien Chieu container terminal project in Danang, all of them leading companies in global shipping and port operations, a local official said.

Infrastructure - Wed, December 3, 2025 | 9:04 am GMT+7

Vietnam's billionaire Pham Nhat Vuong rises to Southeast Asia’s second richest

Pham Nhat Vuong, chairman of Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, added $1.2 billion to his net worth in a single day, bringing it to $24.7 billion, according to Forbes data as of Tuesday.

Economy - Wed, December 3, 2025 | 8:39 am GMT+7

Malaysia forecasts 4.3-4.7% economic growth in 2026

Malaysia’s economy is expected to maintain steady growth in 2026 despite persistent global uncertainties, according to economic experts.

Southeast Asia - Tue, December 2, 2025 | 9:59 pm GMT+7

Vietnam drafts rules to upgrade professional standards for securities practitioners

Vietnam’s securities regulator has proposed amendments to licensing rules aimed at improving the quality and oversight of market professionals, including shifting from paper-based to electronic practising certificates and recognizing certain international qualifications.

Finance - Tue, December 2, 2025 | 8:57 pm GMT+7

EVF General Finance JSC labor union holds congress, sets priorities for 2025-2030 term

The labor union of EVF General Finance Joint Stock Company (EVF) recently held its sixth congress for the 2025-2030 term, outlining key tasks to strengthen worker representation and support the company’s development.

Companies - Tue, December 2, 2025 | 8:15 pm GMT+7

Hoa Phat Agriculture to maintain annual cash dividends after listing

Hoa Phat Group said its agriculture arm will continue paying annual cash dividends after listing, as its investment needs through 2030 amount to only about VND1.5 trillion ($56.87 million), funded by IPO proceeds and depreciation, leaving room to distribute profits to shareholders.

Companies - Tue, December 2, 2025 | 5:41 pm GMT+7

Elon Musk company close to securing pilot licence for Starlink satellite internet services in Vietnam: official

The U.S.'s SpaceX is preparing to resubmit its application for a pilot licence to provide Starlink satellite internet services in Vietnam, after addressing several issues raised by regulators.

Industries - Tue, December 2, 2025 | 4:44 pm GMT+7

Central Vietnam province Ha Tinh seeks investors for $664 mln wind power project

Ha Tinh province authorities have begun seeking investors for the 400MW Ky Anh wind power plant, the largest of its kind in north-central Vietnam, according to their announcement.

Energy - Tue, December 2, 2025 | 3:08 pm GMT+7

Growth recorded in Vietnam's manufacturing sector despite severe typhoons, floods

Output, new orders, and employment all continued to rise in November, despite reports of disruption caused by severe typhoons which impacted supply chains and the ability of manufacturers to complete work on time, according to S&P Global.

Economy - Tue, December 2, 2025 | 11:42 am GMT+7

Vietnam's multi-sector group Thaco to sell bananas to Fresh Del Monte under 10-year deal

Truong Hai Group (Thaco), a leading private conglomerate in Vietnam, will supply Fresh Del Monte, a leading global fruit and vegetable producer and distributor based in the U.S., with bananas under a 10-year contract, beginning with 71,500 tons this year.

Companies - Tue, December 2, 2025 | 8:30 am GMT+7

Malaysia’s e-commerce revenue rises sharply

Malaysia’s e-commerce revenue for the first nine months of 2025 totalled MYR937.5 billion ($226.8 billion), up 1.9% compared to the same period in 2024, according to the Department of Statistics Malaysia (DOSM).

Southeast Asia - Mon, December 1, 2025 | 10:31 pm GMT+7

Vietnam’s benchmark VN-Index climbs above 1,700 points

VN-Index, which represents the Ho Chi Minh Stock Exchange (HoSE), rose past the 1,700-point mark in the first trading session of December, supported mainly by gains in VIC (Vingroup), VPL (Vinpearl), and VHM (Vinhomes).

Finance - Mon, December 1, 2025 | 5:13 pm GMT+7

Samsung Vietnam appoints its first Vietnamese senior executive

Samsung Vietnam has appointed Nguyen Hoang Giang as vice president of Samsung Electronics Vietnam Thai Nguyen (SEVT), marking the first time a local national has been named to such a senior leadership position at a manufacturing unit of the company in Vietnam.

Companies - Mon, December 1, 2025 | 4:30 pm GMT+7

- Consulting

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery