Can Vietnam’s tech sector withstand US tariff shockwaves?

Vietnam’s technology sector has grown significantly, often capitalizing on trade tensions between the U.S. and China rather than being adversely affected, but this time it feels different, writes Dr Sam Goundar, a senior lecturer in IT, School of Science, Engineering & Technology, RMIT University Vietnam.

Dr Sam Goundar, a senior lecturer in IT, School of Science, Engineering & Technology, RMIT University Vietnam. Photo courtesy of RMIT.

The latest shock comes from Washington’s announcement of steep, reciprocal tariffs, imposing a punishing 46% on many Vietnamese exports. Although President Trump has announced a 90-day delay in implementing the tariffs, the prevailing uncertainty is already causing widespread concern among businesses.

Vietnam has avoided direct confrontation, opting not to retaliate and instead removing tariffs on U.S. imports to maintain good relations. Yet even diplomacy has its limits, especially when global supply chains become collateral damage.

The critical question now is whether Vietnam’s thriving tech industry can absorb this unprecedented tariff shock or whether the damage could be deeper and longer lasting than expected.

A fragile supply chain under threat

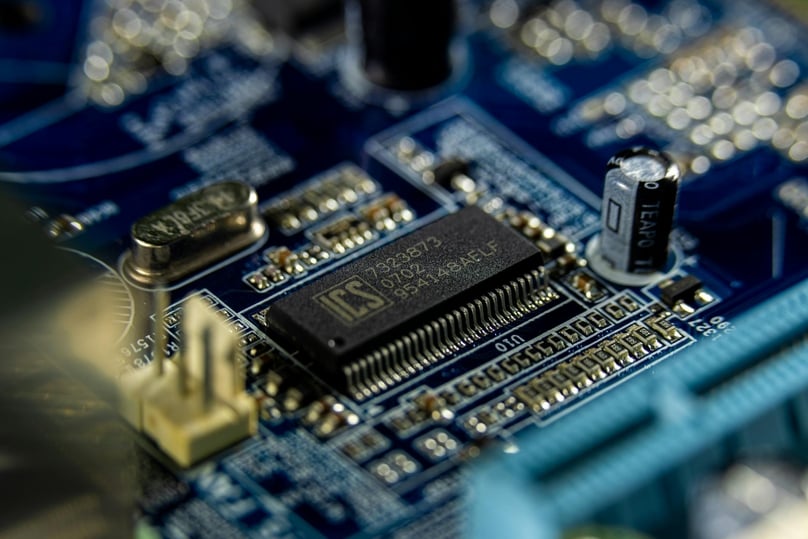

According to Statista, in 2025, projected revenue for Vietnam’s semiconductors market is set to reach $21.45 billion. Vietnam’s semiconductor industry has rapidly evolved into a crucial global player, but the U.S. tariffs now pose a serious threat. With the addition of a 46% tariff to the price, Vietnamese semiconductors would not be competitive in the U.S. market.

The U.S. is Vietnam’s largest market for semiconductors. This is likely to force semiconductor manufacturing companies in Vietnam to rethink their production and export strategies. It will lead to potential instability in the supply chain, elevated costs associated with sourcing alternative markets or materials, and increased uncertainty for both investors and manufacturers.

Companies like Luxshare, a key Apple supplier, are considering shifting production to other countries, including the U.S., to mitigate tariff impacts. This could result in a reconfiguration of supply chains that currently include Vietnam.

Beyond semiconductors, there is the broader electronics export market such as phones, laptops, and consumer electronics, historically a powerhouse of Vietnam’s economy. It is now at risk as American buyers hesitate to absorb higher prices due to tariffs. There is an inherent risk that Vietnam will lose electronic market share to countries like India, Mexico, and Eastern Europe, which face lower tariffs.

Vietnam has developed a specialized role in the final assembly of high-end electronics. Photo courtesy of RMIT.

Unlike other nations in Southeast Asia, Vietnam has developed a specialized role in the final assembly of high-end electronics. Prominent companies such as Foxconn, Samsung, LG Electronics, Intel, and Luxshare depend on Vietnam not only for labor but also for low-risk export channels.

The new U.S. tariffs challenge this model. While multinationals can shift production or absorb short-term losses, Vietnamese-owned SMEs that manufacture components or serve as subcontractors will likely shut down. The impact on factories, workers, and local economies could be immediate and significant.

Investment uncertainty and the road to resilience

The imposition of high tariffs creates an unpredictable economic environment, undermines Vietnam's appeal as an investment destination, and prompts foreign investors to exercise caution or seek more stable markets.

Already, tech giants based in Vietnam such as Foxconn, Samsung and LG Electronics are reconsidering or pausing new investments and expansion plans. According to Reuters, manufacturers are exploring relocation of operations to countries not affected by the tariffs, which could diminish Vietnam’s role as a tech manufacturing hub.

Foreign investors, who previously viewed Vietnam as a stable environment amid geopolitical uncertainties, may now reconsider their stance, potentially impacting the country’s technology sector. Vietnam is shifting from basic electronics assembly to high-precision, high-value component manufacturing, such as semiconductors, sensors, and AI hardware, which depends heavily on foreign investment in advanced infrastructure and precision technology. This opportunity might now be lost.

Vietnam’s heavy reliance on U.S. markets for tech exports has become a liability. Tech companies should strengthen ties with the EU, India, Japan, and ASEAN regions, where trade relations are stable and demand for electronics and semiconductors is growing. Diversification reduces exposure to geopolitical shocks.

To move up the value chain, Vietnam must transition from low-margin assembly to high-tech production. This means attracting capital for research and development, cleanroom facilities, and AI-chip fabrication so that Vietnam isn’t just assembling phones but inventing and designing the next generation of hardware.

Tech companies also need to adopt clear origin tracing, blockchain-based tracking, or local sourcing alternatives. This not only protects exports from punitive tariffs but also boosts Vietnam’s reputation for manufacturing independence.

Many companies can absorb tariff shocks by refining operational expenditures, leveraging AI, automation, and predictive analytics to streamline production, reduce waste, and maintain margins without cutting jobs.

- Read More

Maersk eyes building major container ports in Vietnam

A.P.Moller - Maersk (Maersk) is exploring investment opportunities to develop large, modern and low-carbon container ports in Vietnam.

Infrastructure - Wed, November 19, 2025 | 4:36 pm GMT+7

Taiwan semiconductor giant Panjit acquires 95% of Japan-based Torex’s Vietnam arm

Panjit International Inc, a Taiwan-listed semiconductor major, has approved the acquisition of a 95% stake in Torex Vietnam Semiconductor, a subsidiary of Japan-based Torex.

Companies - Wed, November 19, 2025 | 3:59 pm GMT+7

Vietnam PM urges Kuwait Petroleum to expand Nghi Son refinery, build bonded fuel storage facility

Prime Minister Pham Minh Chinh on Tuesday called on Kuwait Petroleum Corporation (KPC) to expand the Nghi Son oil refinery and build a bonded fuel storage facility in Vietnam.

Industries - Wed, November 19, 2025 | 3:18 pm GMT+7

Southern Vietnam port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam