Cash grants: innovative solution to attract FDI in new era

To sustain and enhance Vietnam's appeal as a prime destination for foreign investors in the decades ahead, as well as to channel investment into key strategic sectors, the country should contemplate revising its investment attraction policies, writes Huong Vu, general director of EY Consulting Vietnam JSC.

Navigating the changing business landscape

Since the 1990s, Vietnam has achieved notable success in drawing foreign direct investment (FDI) through a variety of compelling policy mechanisms, particularly tax incentives.

According to the Foreign Investment Agency (FIA) under the Ministry of Planning and Investment, by the end of 2023, the country had over 39,000 active FDI projects, with total registered capital nearing $469 billion.

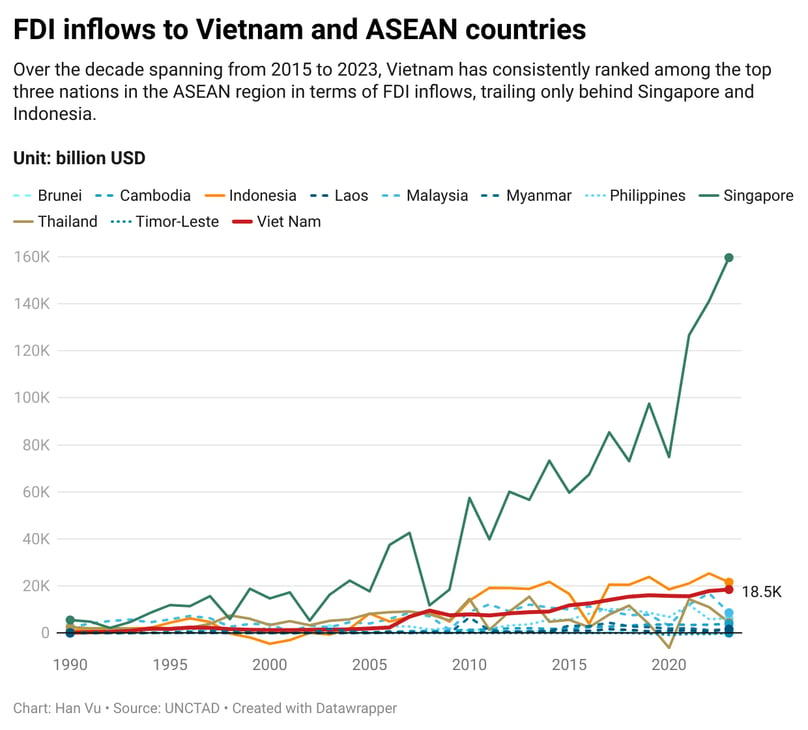

The cumulative actualized investment of FDI projects was approximately $297 billion, representing 63.4% of the total registered investment capital still in effect. This milestone has positioned Vietnam among the ASEAN leaders in FDI attraction, consistently ranking third since 2015, following Singapore and Indonesia.

Even in the current challenging climate, Vietnam's stature in the eyes of foreign investors remains robust, with total FDI pledges in the first half of 2024 reaching nearly $15.2 billion, a surge of over 13% compared to H1/2023. The disbursed capital in H1 hit $10.84 billion, marking an increase of over 8.2% year-on-year, as reported by the FIA.

Owing to its high and stable economic growth, coupled with a youthful, skilled labor force and a vast consumer market exceeding 100 million individuals, Vietnam is projected to remain an attractive investment haven amidst global trade tensions.

Nevertheless, in this new phase of development, it is my conviction that the country requires fresh investment incentive policies to maintain and elevate its investment appeal.

Firstly, these adjustments are intended to align with global economic shifts, with the aim of attracting investment in high-tech and sustainable sectors. The second objective is to preserve competitiveness relative to regional counterparts such as Thailand, Indonesia, and Malaysia.

The third objective is to steer investment towards sectors that Vietnam seeks to prioritize, including high-tech, eco-friendly industries, and nascent industries. Fourthly, enhancing the business environment through institutional and administrative reforms is crucial.

In addition to traditional policies like tax incentives, provision of preferential loans, credit guarantees, or interest rate support for businesses investing in pivotal sectors, and investment in infrastructure and human resource development, cash grants emerge as an effective instrument to attract and guide investment.

A call for prompt, decisive actions

As the implementation of Global Minimum Tax (GMT) regulations diminishes the efficacy of tax incentive policies, nations worldwide are racing to introduce compensatory measures for impacted enterprises, with many opting for cash incentives.

For instance, the United States has implemented cash subsidies for semiconductor projects, recognizing their vital importance to national security, economic competitiveness, and technological innovation.

In Europe, several countries offer cash grants or financial inducements to attract investments in industries deemed strategic for economic growth and development. These incentives are often integral to broader economic development strategies.

For example, Germany provides cash grants to bolster investment in certain industries, particularly in economically disadvantaged regions. The French government extends various incentives, including cash grants, especially for new investments in research and development, innovation, and job creation. Poland, Spain, Italy, the UK, the Netherlands, Ireland, Portugal, and Hungary have adopted comparable policies.

In Asia, Japan has initiated measures to support and fortify its domestic semiconductor industry, including the establishment of a semiconductor production support fund endowed with substantial financial resources by the government.

The fund's objectives include financial backing for production facility construction, research and development (R&D) encouragement, cooperative endeavors, supply chain security, and foreign investment attraction. Japan also provides direct cash subsidies and other financial assistance programs to foreign investors, including land purchase support.

China, too, has introduced policies that offer cash grants or financial incentives to attract foreign investment into high-tech industries, green energy, environmental technology, R&D, or projects in special economic zones (SEZs), free trade zones (FTZs), and select development-focused provinces or cities. Eligible businesses in China can deduct 175% of qualified R&D expenses for tax purposes, and high-tech and new technology enterprises may carry forward losses for up to ten years for tax calculations.

In Thailand, businesses are permitted to claim an additional 100% deduction (double deduction) for R&D expenses paid to authorized government bodies or private R&D service providers. Additionally, Thailand offers other benefits, including unrestricted visa and work permit issuance for eligible foreign workers and preferential credit for enterprises with R&D projects.

To avoid lagging behind and to fulfill its strategic objectives in attracting foreign investment into preferred sectors, Vietnam should consider similar initiatives. Cash support can compensate for increased tax liabilities, stimulate R&D investment, facilitate continued expansion in Vietnam, and assist in the effective restructuring of international financial operations to comply with new tax regulations.

It is important to recognize that no single measure is a cure-all, but cash grants can be strategically applied to support enterprises in special or strategic sectors vital to Vietnam's economy, such as renewable energy, green and sustainable production, high-tech fields, and other investment-encouraged areas.

One point to consider is that a one-time cash grant holds considerable persuasive power while incurring significantly lower aggregate costs compared to multi-year income tax reliefs. In other words, in a variety of specific situations, cash grants surpass tax reductions in terms of overall cost-effectiveness and the capacity to effectively oversee the fulfillment of commitments.

In the strategic competition among major nations, the current significant adjustments in FDI flows present a significant opportunity for Vietnam to capitalize on attracting quality investment by implementing policies that precisely address the practical needs of investors.

* The opinions expressed in this article are those of the author and do not necessarily represent the views of the global EY organization and its members.

- Read More

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

After conceding two goals in just over 30 minutes, Vietnam reversed the situation to finally beat host nation Thailand 3-2 in the men’s football final of the 33rd SEA Games.

Society - Thu, December 18, 2025 | 10:43 pm GMT+7

Sun Group to commence construction on 5 landmark projects worth $5.7 bln

Sun Group is scheduled to start construction of five large-scale projects across Vietnam’s three regions on Friday, with a total investment of nearly $5.7 billion.

Companies - Thu, December 18, 2025 | 8:39 pm GMT+7

Unpaid credit card balances in Singapore hit record high in 10 years

Singapore's credit card debt has exceeded SGD9.07 billion (about $7 billion) in 2025's third quarter, a 10-year high that was last seen in 2014.

Southeast Asia - Thu, December 18, 2025 | 7:54 pm GMT+7

Thailand, Japan deepen transport, infrastructure cooperation

Thai Deputy Prime Minister and Minister of Transport Phiphat Ratchakitprakarn has met with Japanese Ambassador Otaka Masato to advance cooperation in Thailand’s transportation and infrastructure projects.

Southeast Asia - Thu, December 18, 2025 | 7:50 pm GMT+7

Masan's FMCG arm MCH to list on HCMC bourse at $8 per share, valuation tops $8.6 bln

Masan Consumer Corporation (UpCoM: MCH), the fast-moving consumer goods arm of Vietnam’s Masan Group, will officially debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25, with a reference price set at VND212,800 ($8.08) per share.

Companies - Thu, December 18, 2025 | 4:57 pm GMT+7

Sun Group-led consortium to build $616 mln Red River bridge in Hanoi

Hanoi authorities have approved a consortium led by Sun Group as the investor for the Tran Hung Dao bridge project, with a total investment estimated at VND16.27 trillion ($616.14 million).

Infrastructure - Thu, December 18, 2025 | 3:26 pm GMT+7

Shinhan Bank Vietnam accompanies SMEs in promoting cashless payments

With modern, secure and convenient payment solutions designed to meet the specific needs of businesses, particularly the SME segment, Shinhan Bank Vietnam continues to accompany enterprises in building a modern corporate image and keeping pace with the digital economy.

Banking - Thu, December 18, 2025 | 2:10 pm GMT+7

JC&C to divest 4.6% stake at Vietnam's dairy giant Vinamilk to F&N for $228 mln

Singapore-listed Jardine Cycle & Carriage Limited (JC&C) has announced the sale of more than 96 million shares, or a 4.6% stake, in Vietnam’s dairy giant Vinamilk (HoSE: VNM) to F&N Dairy Investments Pte. Ltd., part of the Fraser and Neave (F&N) group controlled by Thai billionaire Charoen Sirivadhanabhakdi.

Companies - Thu, December 18, 2025 | 1:36 pm GMT+7

Siemens to supply high-speed trains, key railway systems to Vingroup's subsidiary VinSpeed

Siemens Mobility on Wednesday signed a comprehensive strategic cooperation and high-speed railway technology transfer agreement with VinSpeed, a unit of Vietnam’s Vingroup, to supply high-speed trains and key railway systems for planned rail projects in Vietnam.

Companies - Thu, December 18, 2025 | 1:24 pm GMT+7