Central bank may lift foreign ownership limit at three banks

The State Bank of Vietnam is mulling over lifting the foreign ownership limit at HDBank, MBBank and VPBank, said brokerage house Yuanta Securities Vietnam.

The trio might receive such a preference from the central bank as they have participated in restructuring some "weak" banks.

It is also part of the banking system's plan to raise equity to counter heavy leverage risks. The capital adequacy ratio (CAR) of Vietnam's banking system reached 11.7% in October 2022, above the 8% requirement under the Basel II risk management standards.

The broker added that the foreign ownership limit hike, if any, would not exceed the 49% threshold. "If the figure is increased to higher than 30%, to 35% for instance, it will help improve the capital buffer of those banks."

The state ownership at MBBank is 32.42%. Photo courtesy of the bank.

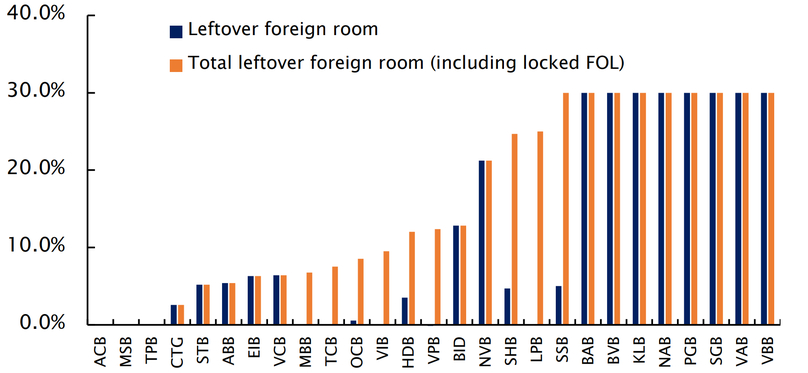

Under the government's Decree No.01/2014/ND-CP on foreign investors buying stakes in Vietnamese credit institutions, the foreign ownership ratio must not exceed 5% of charter capital for an individual and 15% for an institution. The aggregate foreign ownership is capped at 30%.

According to a draft decree released last December, Vietnamese banks that acquire or participate in restructuring "weak" banks can raise their foreign ownership ratio to 49%, higher than the current maximum level of 30%. The draft will amend Decree No.01.

Foreign ownership at some banks in Vietnam. Photo courtesy of Yuanta Securities Vietnam.

Private bank VPBank plans to lift its current foreign ownership ratio of 20.5% to 30%, the highest allowed by law. In a document seeking its shareholders’ nod last year, the lender, listed on the Ho Chi Minh Stock Exchange (HoSE) as VPB, said a 30% ratio would offer “big chances” to both foreign investors and existing shareholders.

Yuanta said VPBank wants to sell 15% of its shares to foreign investors and the broker expects the deal to be completed in early 2023.

Vietcombank is looking to implement and finish its delayed-by-two-years plan of selling 6.5% of its chartered capital to strategic foreign investors in late 2023 or early 2024.

In October 2022, the central bank raised credit growth limits for four banks as an incentive as they had participated in restructuring some "weak" banks.

HDBank (HoSE: HDB) reportedly has supported Dong A Bank; MBBank (HoSE: MBB) has helped Ocean Bank, VPBank (HoSE: VPB) has assisted GPBank, and Vietcombank (HoSE: VCB) has aided Construction Bank (CBBank).

Credit growth this year is set at 14-15%, subject to adjustments according to actual developments, the State Bank of Vietnam said in a directive on goals for the banking sector in 2023.

- Read More

Vietnam's garment giant Vinatex posts second-highest profit in 30 years despite trade headwinds

Vietnam National Textile and Garment Group (Vinatex), the country's top garment maker, expects consolidated profit to reach VND1,355 billion ($51.5 million) in 2025, the second-highest result in its 30-year history, despite mounting global trade and cost pressures on the industry.

Companies - Wed, December 24, 2025 | 5:03 pm GMT+7

Finding a new balance

The State Bank of Vietnam's proactive and flexible monetary policy in 2026 is expected to maintain market operations within a stable range. For businesses, particularly those in the external sector, it remains essential to proactively hedge against exchange rate and interest rate risks to protect their bottom line, writes Vu Binh Minh, associate director, FX Trading, MSS, HSBC Vietnam.

Consulting - Wed, December 24, 2025 | 4:47 pm GMT+7

Thai giant Central Retail sells Vietnam electronics business to Pico for $36 mln

Thailand’s Central Retail has announced the sale of its Vietnamese electronics retail business to local retailer Pico Holdings JSC for nearly THB1.14 billion ($36 million), as it sharpens its focus on core businesses in the country.

Companies - Wed, December 24, 2025 | 2:00 pm GMT+7

What should investors reasonably expect from IPO stocks?

Experience from both Vietnam and global markets shows that initial public offering (IPO) stocks rarely deliver immediate gains. However, investors who select companies with solid fundamentals and maintain a long-term holding strategy can be rewarded for their patience.

Finance - Wed, December 24, 2025 | 10:45 am GMT+7

Vingroup completes $325 mln overseas bond issuance

Vingroup, Vietnam's biggest listed company by market capitalization, has completed its international issuance of bonds totaling $325 million, with a 5-year maturity, and listed on Austria's Vienna Stock Exchange.

Finance - Wed, December 24, 2025 | 10:17 am GMT+7

Vietnam's public investment-linked stocks seen benefiting in 2026

Capital flows in 2026 are expected to favor sectors that stand to benefit from Vietnam’s public investment drive, including infrastructure, energy, and construction, market experts said.

Finance - Wed, December 24, 2025 | 9:33 am GMT+7

High gold prices to drive prices of property, goods in Vietnam: Sunhouse chairman

In a scenario where gold prices remain elevated in Vietnam, the real estate market is likely to follow suit, pushing income levels higher and driving up prices across other goods, said Nguyen Xuan Phu, chairman of Sunhouse, a leading home appliance manufacturer, while outlining his 2026-2030 forecast.

Economy - Wed, December 24, 2025 | 8:00 am GMT+7

Malaysia’s economy grows robustly in 2025: IMF

Malaysia has shown notable resilience amid global trade tensions and policy uncertainty, with its economy growing at a healthy pace this year, supported by strong domestic consumption and investment, solid employment growth, and a global upcycle in the technology sector, according to Masahiro Nozaki, Mission Chief for Malaysia at the International Monetary Fund (IMF).

Southeast Asia - Tue, December 23, 2025 | 10:07 pm GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Tue, December 23, 2025 | 10:04 pm GMT+7

Indonesia faces challenge of balancing wages, labor costs

Indonesia plans to raise minimum wages by about 5-7% in 2026 under a new formula signed into law by President Prabowo Subianto, a move that could test the country’s cost competitiveness in Southeast Asia.

Southeast Asia - Tue, December 23, 2025 | 10:00 pm GMT+7

Philippines extends sugar import ban

The Philippine Government has decided to extend its ban on sugar imports until the end of December 2026, as domestic supply has improved.

Southeast Asia - Tue, December 23, 2025 | 9:56 pm GMT+7

Duc Giang Chemical stock comes under heavy selling pressure as bottom-fishing shares return

DGC shares of Duc Giang Chemical Group JSC (DGC) closed Tuesday at VND71,600 apiece, down 4% from Monday which saw a 6.27% increase after four sessions of sharp declines last week.

Companies - Tue, December 23, 2025 | 9:49 pm GMT+7

Hanoi clears zoning for major mall project after Aeon exit, Thaco arm steps in

Hanoi authorities have approved a detailed zoning plan for an 8.03-hectare mixed-use site in Hoang Mai district, paving the way for a shopping mall-led development after Japan’s Aeon withdrew and a unit of Vietnam’s Thaco Group moved in.

Real Estate - Tue, December 23, 2025 | 5:05 pm GMT+7

Viettel Commerce partners with China’s Dreame Technology to expand home appliance ecosystem in Vietnam

Viettel Commerce and Import-Export Co. Ltd., one of the core pillars in trade and logistics of the military-run telecom giant Viettel, has signed a strategic cooperation agreement with China-based Dreame Technology, a global high-end technology brand, in Hanoi.

Companies - Tue, December 23, 2025 | 3:38 pm GMT+7

Former LPBank chairman becomes acting Sacombank CEO

Former chairman of Vietnamese private lender LPBank Nguyen Duc Thuy on Tuesday assumed the role of acting CEO at Sacombank, immediately after completing the handover at LPBank.

Banking - Tue, December 23, 2025 | 3:30 pm GMT+7

Workforce shortages accelerate global demand for integrated facility management

Labor shortages and rising expectations for operational performance are prompting many businesses to reassess traditional management models, write Savills Vietnam analysts.

Consulting - Tue, December 23, 2025 | 3:00 pm GMT+7

- Consulting

-

Finding a new balance

-

Workforce shortages accelerate global demand for integrated facility management

-

The new target for VN-Index is 3,200: Finnish fund PYN Elite

-

Vietnam M&A 2025: Opportunities reshaped by disciplined capital

-

VN-Index rises 3.1% in Nov, Finnish fund PYN Elite records -5.8%

-

Mind the gap