Vietnam a frontier data center market with underdeveloped infrastructure

Vietnam is arguably among the most lacking in data center infrastructure regionally, suggesting a major opportunity at the content provision level, says real estate services firm Cushman & Wakefield.

An Cushman & Wakefield office. Photo courtesy of the consultancy.

Vietnam is a frontier data centre market, with only a small number of multinationals locallyrequiring high-level capacity. However, it is arguably among the most lacking in data centreinfrastructure regionally, suggesting a major opportunity at the content provision level.

Ho Chi Minh City has deployed over half of the national live capacity and the city’s vibrant economy, increasing digitalization, and growing demand for cloud services have contributed to the growing number of data center developments. Vietnam’s digital economy rose 28% year-on-year in 2022, with a report from Google, Temasek and Bain & Company estimating that annual growth rate to continue at 31% through to 2025.

While international operators such as NTT Global Data Centers, Telehouse and GIC-backed VNG Cloud have a presence in the market, the common approach for new players entering the market is to partner with local telcos such as FPT Telecom, Viettel Group, VNPT, and CMC Telecom.

The legal framework for data centers in Vietnam has not been finalized yet, but the government is actively working on the development of clear regulations around data protection and data center service in the country. The announcement of the new decree may affect the market in the short term but is expected to solidify the market’s information security platform in the long term.

Data centers in Asia Pacific

Data centers across Asia Pacific are growing in scale and new markets are being evaluated for expansion as operators anticipate increased demand from continued digitization and wider adoption of artificial intelligence.

According to Cushman & Wakefield’s latest Asia Pacific Data Center Update, five cities – Beijing, Shanghai, Singapore, Sydney and Tokyo – account for 62% of the operational data center capacity in Asia Pacific, with Sydney and Tokyo expected to join Beijing and Shanghai in the next one to two years as cities exceeding 1 gigawatt (GW) of operational capacity.

Emerging markets are also growing rapidly, with Indonesia, Malaysia, the Philippines and Thailand all on track to more than double [>200% increase] their operational capacity over the next five to seven years.

The report also shows that the scale of individual data centers is increasing. Within the top five markets, the average size of data centers under construction is up 32% to 20 MW, from an average size of 15 MW for data centers currently in operation. Across the broader Asia Pacific region, the percentage difference is even higher, with the average size of data centers under construction (14.5 MW), 57% higher than the average size of operational data centers (9.2 MW).

Maturity Index extrapolates growth trajectories to provide future insights

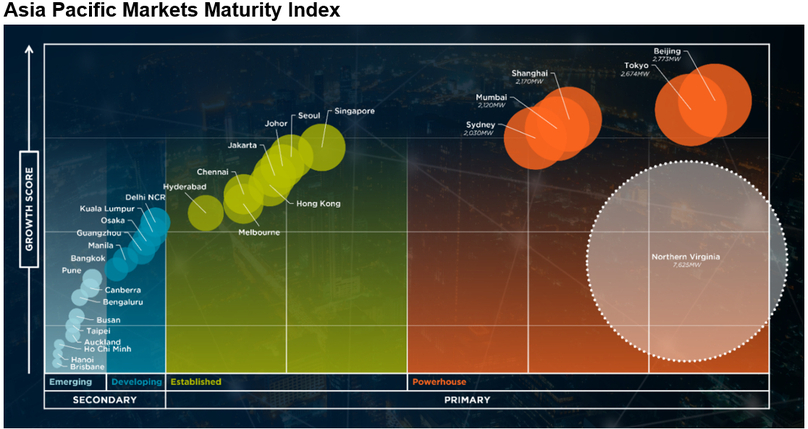

Supplementing the company’s global annual ranking of data center markets, which assesses data center markets on their current status, the latest Asia Pacific Data Center Update also includes a Markets Maturity Index, which classifies 29 data center cities across four categories (Emerging, Developing, Established and Powerhouse), based on their anticipated evolution over the next five to seven years.

Our Maturity Index tracks 29 data center markets across Asia Pacific to compare their current maturity status as well as their evolution over the next five to seven years. It is a statistical comparison that evaluates markets on 21 parameters, including the IT MW capacities of each market’s operational, under construction, planned and land banked stages of development, the summation of which is visually indicated by the size of each market’s circle on the graph.

The commonly used references to describe data center markets as primary and secondary have been broken down further into the below four categories:

Powerhouse: These are the largest markets in the region in terms of IT MW capacity and have extensive supply pipeline. Beijing, Mumbai, Shanghai, Sydney and Tokyo are categorized as powerhouse with the potential to develop into >2 GW-sized markets upon the full development of their supply pipeline. These 5 markets cumulatively account for more than 50% of the operational data center capacity in Asia Pacific and about 45% of the under construction and planned capacities combined. They attract the highest demand, and therefore have low vacancy rates. Owing to the extensive development in these markets, finding suitable land parcels for further data center development may be challenging.

Established: Chennai, Hong Kong, Hyderabad, Jakarta, Johor, Melbourne, Seoul and Singapore account for about 25% of the total operational capacity in the region. With the exception of Singapore, whose growth has been hindered by the recent moratorium and limited supply, all established markets are growing rapidly. Several operators are in the process of either expanding or setting up their first data centers in these markets. Typically, these markets have more land banks available for development than powerhouse markets.

Developing: The developing markets are those which may not have large data center capacities but are of strategic importance for operators to have a presence. Bangkok, Delhi NCR, Guangzhou, Kuala Lumpur, Manila and Osaka account for less than 10% of the operational capacity in Asia Pacific. Almost 90% of the operational data centers in these markets are smaller than 10 MW in size. Despite smaller data center sizes, these markets typically have higher vacancies because the absorption rates are slower than the new supply that gets added.

Emerging: The emerging markets are in nascent stages of maturity but have caught the interest of data center operators owing to factors including local enterprise and retail demand, presence of landing stations, geographic prominence and hyperscale entrants amongst others. Auckland, Bengaluru, Brisbane, Busan, Canberra, Ho Chi Minh City, Hanoi, Pune, Perth and Taipei cumulatively account for only about 6% of the total operational capacity in Asia Pacific. The supply pipeline of new data centers in these markets is limited as the number of operators exploring these markets is low.

Asia Pacific Markets Maturity Index. Photo courtesy of Cushman & Wakefield.

Cushman & Wakefield’s Director, Data Centers Research & Advisory for APAC and EMEA Pritesh Swamy said the Maturity Index showed that there remained plenty of development headroom in Asia Pacific compared to other regions.

“The opportunity for growth is quite significant. If we look at the US, Northern Virginia alone has around 3GW, which is one-third of the cumulative capacity across Asia Pacific, while the entire US market has almost 10 GW in operational capacity. Considering that Asia Pacific’s population is around 10 times greater than that of the US, we are far behind in terms of the overall capacity we may need,” Swamy added.

- Read More

Vietnam among world’s top 15 countries by im-export value: ministry

Vietnam’s import-export turnover is expected to reach $920 billion for the first time in 2025, placing the country among the world’s top 15 by trade value, according to the Ministry of Industry and Trade (MoIT).

Economy - Sun, December 21, 2025 | 11:07 am GMT+7

Dung Quat oil refinery operator BSR targets 187% net profit growth in 2026

Binh Son Refining and Petrochemical JSC (HoSE: BSR), operator of Dung Quat - Vietnam’s first oil refinery, expects net profit to surge in 2026, supported by stable oil price assumptions and a major investment plan to expand and upgrade its core refining assets.

Companies - Sun, December 21, 2025 | 8:00 am GMT+7

Dragon Capital-managed VEIL plans trio of 10% tender offers

Vietnam Enterprise Investments Limited (VEIL), the largest foreign-managed equity fund in Vietnam, has announced a tender offer for up to 10% of its issued share capital, with the option to conduct up to two additional tenders over the next year.

Finance - Sat, December 20, 2025 | 11:19 pm GMT+7

Vingroup builds development hubs across multiple sectors

With the groundbreaking and inauguration of 11 large-scale projects on Friday, Vingroup (HoSE: VIC), Vietnam's biggest listed company by market cap, reinforces its role as a pioneering private enterprise in urban development, infrastructure, energy, and industry.

Investing - Sat, December 20, 2025 | 6:32 pm GMT+7

Kinh Bac breaks ground on $437 mln industrial park in northern Vietnam province Thai Nguyen

Kinh Bac City Development Holding Corp (HoSE: KBC) on Friday broke ground on the VND11.5 trillion ($437.06 million) Phu Binh Industrial Park project in Thai Nguyen province.

Industrial real estate - Sat, December 20, 2025 | 5:46 pm GMT+7

Construction giant Fecon starts work on Hanoi metro line, northern Vietnam rail link

Fecon, a leading Vietnamese construction group, on Friday broke ground on two major rail projects: a metro line in Hanoi and a strategic railway linking the capital city with northern localities.

Infrastructure - Sat, December 20, 2025 | 2:08 pm GMT+7

SJ Group to build smart urban area in western Hanoi to bolster Hoa Lac High-tech Park

Vietnam's leading developer SJ Group JSC is outlining plans for its over 1,200-hectare Tien Xuan Smart Urban Area project in Hanoi, which is expected to be a residential and service hub of the Hoa Lac science and technology city.

Real Estate - Sat, December 20, 2025 | 10:36 am GMT+7

Indonesia to deepen role in global semiconductor supply chain

Indonesia is rolling out efforts to identify opportunities and map its natural resources to support the semiconductor industry, as part of a broader strategy to build domestic industrial capacity.

Southeast Asia - Sat, December 20, 2025 | 9:36 am GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Sat, December 20, 2025 | 8:00 am GMT+7

Northern Vietnam port city Hai Phong charts sustainable growth path for free trade zone

The establishment of Hai Phong Free Trade Zone (FTZ) is a strategic direction that will elevate the role and position of Vietnam in general and Hai Phong in particular within the global value chain, heard a conference held in the northern port city last week.

Economy - Fri, December 19, 2025 | 8:12 pm GMT+7

Construction begins on $32.5 bln Red River Scenic Boulevard project in Hanoi

The gigantic project Red River Scenic Boulevard, with a preliminary investment of about VND855 trillion ($32.49 billion) in Phu Thuong ward, Hanoi, broke ground on Friday.

Real Estate - Fri, December 19, 2025 | 4:57 pm GMT+7

Major Vietnamese groups kick off mega projects in south-central Vietnam

Vingroup, BIN Corporation, Hoa Phat, and FPT simultaneously broke ground on large-scale projects in south-central Vietnam on Friday, raising expectations for new national growth momentum in the coming period.

Economy - Fri, December 19, 2025 | 4:36 pm GMT+7

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

The first passenger flights touched down at Long Thanh International Airport in Dong Nai province on Friday morning, marking the inaugural civil aviation operation at Vietnam’s largest airport.

Economy - Fri, December 19, 2025 | 2:07 pm GMT+7

Vingroup starts work on $35.2 bln Olympic Sports Urban Area on Hanoi outskirts

Vingroup (HoSE: VIC), Vietnam's leading private conglomerate, on Friday broke ground on its 9,171-hectare Olympic Sports Urban Area project in Hanoi, which is expected to become a new growth engine for the southern part of the capital in the next decade.

Real Estate - Fri, December 19, 2025 | 1:59 pm GMT+7

Vietnam telecom giant VNPT establishes AI company

State-owned Vietnam Posts and Telecommunications Group (VNPT) on Thursday launched subsidiary VNPT AI, aiming to bring Vietnamese AI products to international markets.

Companies - Fri, December 19, 2025 | 11:50 am GMT+7

Quang Ngai Sugar develops sugar, biomass power projects worth $179 mln in central Vietnam

Quang Ngai Sugar JSC (UPCom: QNS), a top sugar producer in Vietnam, will simultaneously hold groundbreaking or inauguration ceremonies on Friday for three projects worth over VND4.7 trillion ($178.5 million) in Gia Lai province.

Companies - Fri, December 19, 2025 | 8:05 am GMT+7

- Travel

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines