Vietnam dong likely to narrow slide by end-2024: Vietcombank Securities

Vietnamese currency dong (VND) is likely to appreciate against the U.S. dollar towards the year-end, narrowing its year-to-date depreciation, analysts with Vietcombank Securities say.

They base their forecast on the anticipation that the U.S. Federal Reserve will start cutting rates.

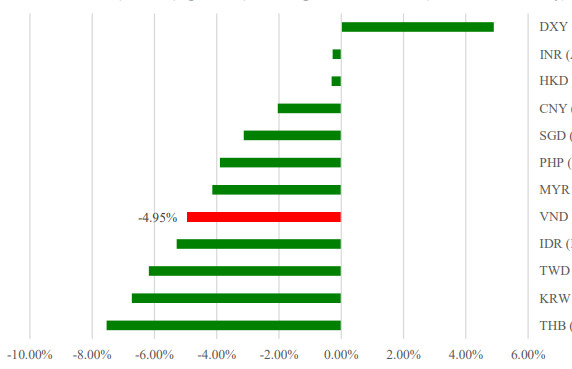

So far this year, the dong has slid 4.95% against the greenback, but this is mild compared to several regional peers, says a report by Hanoi-based Vietcombank Securities (VCBS).

The VND's depreciation in comparison to other regional currencies. Chart by Vietcombank Securities and CEIC.

In case the U.S. Dollar Index (DXY) stops going up or even wanes in H2/2024, and the State Bank of Vietnam manages the monetary policy flexibly, the VND is expected to depreciate at a “reasonable” 3% against the USD, reckons VCBS, a unit of leading forex trader Vietcombank.

Although VCBS analysts recognize constant downward pressure on the VND, they argue that such pressure has been factored in the dong’s slide. “In case there are no more global surprise events, or the DXY does not rise strongly, the VND’s depreciation will end in Q2 and Q3.”

They expect the State Bank of Vietnam (SBV), the country’s central bank, to manage monetary tools gradually and flexibly to ensure macroeconomic stability and help the country retain its status as an attractive and safe investment destination.

A stable dong will not only help buoy foreign investor confidence, but also guarantee Vietnam’s debt servicing, the VCBS report says.

As of end-2023, Vietnam’s foreign borrowings, including foreign loans taken by the government and companies, were estimated at $145 billion, or 37-38% of GDP.

A USD transaction at a bank in Vietnam. Photo courtesy of Thoi Bao Tai Chinh (Financial Times).

To meet macro goals, the central bank is expected to utilize more interest rate tools, with priority given to open market operations (OMOs). The first signal was seen on April 23 when the OMO rate increased from 4% to 4.25%.

With the SBV’s intervention, deposit interest rates are likely to rise gradually, helping narrow the disparity between USD- and VND-denominated rates, which has been a major cause of the dong’s recent slide.

Interest rates are likely to increase moderately, by 50-100 basis points, as there is no high demand for credit at the moment, VCBS analysts say.

Meanwhile, SBV officials have affirmed that the banking regulator would intervene, including through the sale of foreign currencies, to rein in the overdone weakening of the dong.

The SBV is estimated to have sold foreign currency worth $500-700 million via spot transactions in recent weeks, according to analysts with data provider WiGroup.

VCBS’s VND projection coincides with Singaporean banking major UOB. Earlier this month, UOB analysts forecast that the VND would appreciate against the greenback in H2/2024, with the Fed likely to cut interest rates twice this year, in September and December.

With receding Fed rate cut expectations, the USD/VND rate is likely to stay elevated for a while longer. “Beyond near-term external headwinds, we expect the VND to draw support from resilient fundamentals and a subsequent recovery in the CNY. Our updated USD/VND forecasts are 25,600 in Q2/2024, 25,100 in Q3, 24,800 in Q4 and 24,600 in Q1/2025,” the UOB analysts predicted.

Despite the dong’s depreciation, registered foreign direct investment (FDI) in Vietnam reached $9.27 billion $9.27 billion in the year to April 22, up 4.5% year-on-year. Disbursed FDI hit $6.28 billion, the highest figure in the last five years, up 7.4%, according to government data.

- Read More

Indonesia eyes trilateral data-center tie-up with Singapore, Malaysia

Indonesia is in talks with Singapore and Malaysia to develop a cross-border data-center network linked to its Green Super Grid.

Southeast Asia - Fri, November 28, 2025 | 9:57 pm GMT+7

Malaysia’s export growth expected to slow in 2026

Despite Malaysia’s trade growth in October 2025 surpassing expectations, with both exports and imports reaching record levels, economists warned that the country’s export expansion may slow in 2026.

Southeast Asia - Fri, November 28, 2025 | 9:53 pm GMT+7

Singapore promotes methanol use for bunkering

The Maritime and Port Authority of Singapore (MPA) will issue licences to supply methanol as marine fuel in the Port of Singapore from January 1, 2026, following the Call for Applications launched in March 2025.

Southeast Asia - Fri, November 28, 2025 | 9:46 pm GMT+7

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines

Vietravel, one of Vietnam’s largest tour operators, will divest its entire stake in Vietravel Airlines by year-end, drawing a close to its turbulent venture into aviation during five years.

Travel - Fri, November 28, 2025 | 9:22 pm GMT+7

VinSpeed, Thaco vie for investment role in North-South high-speed railway

Several major Vietnamese companies, including Vingroup subsidiary VinSpeed and automaker Thaco, are vying for a role in Vietnam’s gigantic North-South high-speed railway project.

Infrastructure - Fri, November 28, 2025 | 5:14 pm GMT+7

Finnish fund PYN Elite raises VN-Index forecast to 3,200 points

PYN Elite (Finland), one of the largest foreign funds in the Vietnamese stock market, has revised up its forecast for the benchmark VN-Index to 3,200 points, much higher than the 1,690.99 recorded on Friday.

Finance - Fri, November 28, 2025 | 4:49 pm GMT+7

Mind the gap

Without stronger digital and physical networks, global productivity will falter at precisely the moment the world needs new engines of growth, writes Benjamin Hung, president, International, Standard Chartered.

Consulting - Fri, November 28, 2025 | 3:49 pm GMT+7

Alliance claiming $100 bln investment for trans-Vietnam high-speed railway 'uncontactable'

An alliance between Mekolor, a relatively unknown Vietnamese company, and American entity Great USA, which claimed it could mobilize $100 billion for the North-South high-speed railway project, could not be contacted, said standing Deputy Prime Minister Nguyen Hoa Binh.

Infrastructure - Fri, November 28, 2025 | 3:19 pm GMT+7

Mitsui eyes new opportunites in Vietnam's energy sector, projects related to carbon emission reduction

Mitsui & Co., Ltd. plans to expand its investment in Vietnam in the energy sector and projects related to carbon emission reduction, president and CEO Kenichi Hori told Prime Minister Pham Minh Chinh at a Thursday meeting in Hanoi.

Industries - Fri, November 28, 2025 | 2:39 pm GMT+7

Russian heavyweight Zarubezhneft seeks to build energy center in Vietnam

Zarubezhneft, a wholly state-owned oil & gas group of Russia, wants to develop an energy center in Vietnam, as it seeks to expand into other fields including energy and minerals.

Energy - Fri, November 28, 2025 | 1:08 pm GMT+7

Carlsberg Vietnam accelerates its path toward net-zero emission in production by 2028 with stronger renewable-energy commitments

As Vietnam advances toward its 2050 net-zero vision, businesses are expected to play a decisive role in enabling the country’s green transition. At the Green Economy Forum 2025, Carlsberg Vietnam shared how a long-standing FDI enterprise is reshaping its operations and energy strategy to align with Vietnam’s sustainability goals.

Companies - Fri, November 28, 2025 | 11:52 am GMT+7

PV Power says profit may fall in 2026 despite higher output due to extreme weather

PV Power (HoSE: POW), a subsidiary of state-owned energy giant Petrovietnam, expects electricity output to rise next year, but says profit may decline from this year’s strong results due to increasingly erratic weather conditions.

Companies - Fri, November 28, 2025 | 9:00 am GMT+7

Decoding the attraction of 'A.I Real Combat' contest broadcast on Vietnam Television

Vietnam’s first national artificial intelligence competition, 'A.I Thực chiến' (A.I Real Combat), aired its opening round at 8 p.m. Wednesday on state broadcaster VTV2, with a rebroadcast on VTV3 two days later.

Companies - Thu, November 27, 2025 | 8:17 pm GMT+7

Foxconn Industrial Internet’s Vietnam revenue jumps 83% on automation, digitalization: CEO

Foxconn Industrial Internet (FII), a unit of Taiwanese electronics giant Foxconn, saw revenue from its new-technology applications in Vietnam rise 83% in the past fiscal year while headcount increased only 20%, driven by automation and digitalization.

Companies - Thu, November 27, 2025 | 4:56 pm GMT+7

SHB bank sees development drivers from capital-raising strategy, opportunities to attract foreign inflows

The upcoming capital-hike strategy is expected to position Saigon-Hanoi Bank (SHB) among the Top 4 private banks in Vietnam by charter capital, helping the lender maintain its competitive advantage via robust capital strength.

Banking - Thu, November 27, 2025 | 4:33 pm GMT+7

Vietnam's consumer finance major F88 launches first public bond issuance with 10% annual coupon

F88, a leading consumer finance company in Vietnam, has received regulatory approval for its first public bond issuance, offering a fixed annual coupon of 10% - a level seen as attractive amid low bank deposit rates and softer corporate bond yields.

Companies - Thu, November 27, 2025 | 4:16 pm GMT+7

- Consulting

-

Mind the gap

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery