Vietnam economy hit by slumping exports, power blackouts

Vietnam is expected to continue being a key beneficiary of the shift in global manufacturing supply chains towards competitive Southeast Asian manufacturing hubs, wrote Rajiv Biswas, Asia Pacific chief economist, S&P Global Market Intelligence.

Vietnam's GDP growth softens as exports weaken

Vietnam's real GDP grew by 8% in 2022, as the economy rebounded strongly from the economic disruption caused by the Covid-19 pandemic during second half of 2021. However, economic growth momentum moderated to 3.3% in the first quarter of 2023, reflecting the impact of weakening growth in industrial production and exports.

Vietnam's goods exports rose by 10.6% in 2022. However, the economic slowdown in the U.S. and EU, which together account for 42% of Vietnam's total goods exports, has resulted in a significant weakening in exports during the first four months of 2023, with Vietnam's total goods exports declining by 13% year-on-year.

The U.S. remains Vietnam's largest export market, accounting for 29.4% of total merchandise exports. Vietnam's exports to the U.S. rose by 13.6% in 2022, with the bilateral trade surplus with U.S. increasing to $95 billion. However, in the first four months of 2023, merchandise exports to the US fell by 21.6% year-on-year.

Exports to the EU were also weak, declining by 10.8% year-on-year in the first four months of 2023. Exports to the EU of computers, electrical products and components fell by 30% year-on-year in the January-April 2023 period, while exports of textiles and garments to the EU fell by 10.6% year-on-year.

Exports to mainland China also showed a significant decline, falling by 12.9% year-on-year in the four-month period. Exports of computers, electrical products and components as well as mobile phones to mainland China fell by 14.9% year-on-year.

Reflecting the slump in exports, the manufacturing sector has slowed in early 2023, with industrial production contracting by 1.8% year-on-year for the first four months of 2023, compared with positive growth of 7.8% year-on-year in the same period of 2022. Vietnam's industrial production had risen by 7.8% year-on-year in 2022, with manufacturing output up by 8.0% year-on-year.

The downturn in Vietnam's construction sector has also hit manufacturing output for building materials, with domestic cement sales down by 16% year-on-year in the January to April 2023 period. Construction steel sales in April 2023 were down by an estimated 15% year-on-year. For the first four months of 2023, steel sales were estimated to have declined by 23% year-on-year.

The challenges facing Vietnam's manufacturing sector have been compounded during May and June by power shortages resulting in electricity supply disruptions. A heat wave has driven up electricity consumption and reduced hydroelectric power supply, causing widespread disruption to manufacturing output due to power outages. Manufacturing production in industrial parks in northern regions of Vietnam have been particularly badly impacted, notably in Bac Ninh and Bac Giang provinces.

The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) dropped to 45.3 in May from 46.7 in April, thereby signalling a third successive monthly deterioration in operating conditions. Moreover, the latest decline was the most marked since September 2021. There were widespread reports of customer demand weakness across the latest survey.

The impact of this was most clearly felt with regards to new orders, which declined rapidly and to the greatest extent in 20 months. New export orders remained weak, with new business from abroad decreasing for the third month running.

With new orders continuing to fall, firms also reduced output midway through the second quarter of the year. Production was down for the third successive month, and at a marked pace that was the fastest since January. Output decreased across each of the three broad categories of manufacturing, with the sharpest decline at intermediate goods producers.

The May survey also showed that waning demand led suppliers to reduce their prices. Input costs decreased for the first time in three years as a result. The drop in input prices provided some leeway for firms to reduce their own charges in a bid to boost demand. Manufacturing output prices decreased for the second month running.

The CPI inflation rate moderated to 2.8% year-on-year in April 2023 compared with 3.4% year-on-year in March and 4.3% year-on-year in February. Core CPI inflation rose by 4.6% year-on-year in April and was up 4.9% year-on-year for the first four months of 2023.

In response to rising inflation and the strengthening USD versus the VND, Vietnam's central bank, the State Bank of Vietnam (SBV), raised its policy rate by 200 basis points (bps) in two 100bp steps during September and October 2022.

However, with Vietnam's economy slowing significantly in early 2023, the SBV has started easing monetary policy. The SBV cut its policy rates by 100 bps on March 15 and again by 50 bps on April 3 as concerns have increased about the impact of rising interest rates on the property sector, which has faced rising liquidity pressures. A further 50 bps rate cut was announced on May 23 as the economy has continued to slow.

Medium term growth drivers

Over the medium-term outlook for the next five years, a number of key drivers are expected to continue making Vietnam one of the fastest growing emerging markets in the Asian region.

Firstly, Vietnam will continue to benefit from its relatively lower manufacturing wage costs relative to coastal Chinese provinces, where manufacturing wages have been rising rapidly over the past decade.

Secondly, Vietnam has a relatively large, well-educated labour force compared to many other regional competitors in Southeast Asia, making it an attractive hub for manufacturing production by multinationals.

Third, rapid growth in capital expenditure is expected, reflecting continued strong foreign direct investment by foreign multinationals as well as domestic infrastructure spending. For example, the Vietnamese government has estimated that $133 billion of new power infrastructure spending is required by 2030, including $96 billion for power plants and $37 billion to expand the power grid. Severe power shortages during 2023 have highlighted the critical importance of rapid development of new power infrastructure as a key economic policy priority.

Fourth, Vietnam is benefiting from the fallout of the U.S.-China trade war, as higher U.S. tariffs on a wide range of Chinese exports have driven manufacturers to switch production of manufacturing exports away from China towards alternative manufacturing hubs in Asia.

Fifth, many multinationals have been diversifying their manufacturing supply chains during the past decade to reduce vulnerability to supply disruptions and geopolitical events. This trend has been further reinforced by the Covid-19 pandemic, as protracted disruptions created turmoil in global supply chains for many industries, including autos and electronics.

Vietnam has been one of the preferred destinations for South Korean and Japanese firms choosing to shift their production to the ASEAN region.

Economic outlook

Due to the severe economic impact of lockdowns triggered by the Covid-19 Delta wave in mid-2021, the pace of Vietnam's economic growth moderated to 2.6% in 2021, compared with the 2.9% growth rate recorded in 2020. There was a strong rebound in GDP growth momentum in 2022, at a pace of 8.0 % year-on-year, as domestic demand and manufacturing export production returned to more normal levels. However, in 2023, Vietnam's economy has shown moderating growth momentum as the slowdown in key export markets, notably the U.S. and the EU, has hit Vietnam's manufacturing exports.

Despite near-term headwinds to Vietnam's economic growth, over the medium-term economic outlook, a large number of positive growth drivers are creating favourable tailwinds and will continue to underpin the rapid growth of Vietnam's economy. This is expected to drive strong growth in Vietnam's total GDP as well as per capita GDP. The economic outlook from 2023 to 2026 is for rapid economic expansion.

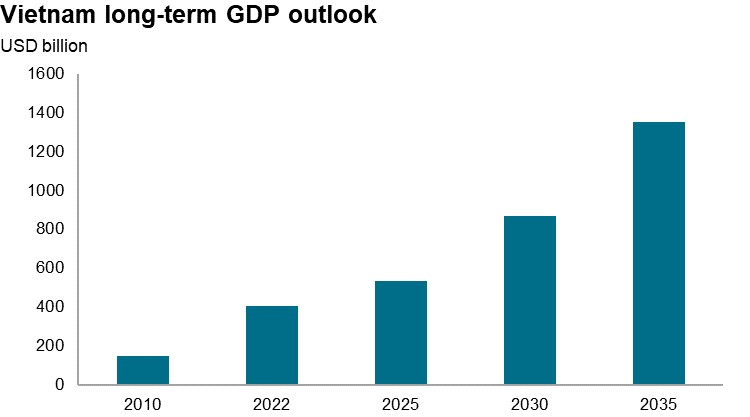

With strong economic expansion projected over the next decade, Vietnam's total GDP is forecast to increase from $327 billion in 2022 to $470 billion by 2025, rising to $760 billion by 2030. This translates to very rapid growth in Vietnam's per capita GDP, from $3,330 per year in 2022 to $4,700 per year by 2025 and $7,400 by 2030, resulting in substantial expansion in the size of Vietnam's domestic consumer market.

Vietnam's role as a low-cost manufacturing hub is also expected to continue to grow strongly, helped by the further expansion of existing major industry sectors, notably textiles and electronics, as well as the development of new industry sectors such as autos and petrochemicals. Vietnam already has a domestic automaker of electric vehicles (EV), VinFast, which launched its first EV in Vietnam in 2021. In March 2022, VinFast announced a $2 billion investment to build an auto manufacturing plant in North Carolina, for manufacturing EV buses and SUVs, as well as EV battery manufacturing, with construction expected to commence in 2023.

For many multinationals worldwide, significant supply chain vulnerabilities have been exposed by the protracted disruption of industrial production in China as well as some other major global manufacturing hubs during the Covid-19 lockdowns. This will drive the further reshaping of manufacturing supply chains over the medium term, as firms try to reduce their vulnerability to such extreme supply chain disruptions. With U.S.-China trade and technology tensions still remaining high, this is likely to be a further driver for reconfiguring of supply chains. A key beneficiary of the shift in global manufacturing supply chains will be the ASEAN region, with Vietnam expected to be one of the main winners.

- Read More

Korean textile maker Panko Vina to shut Vietnam operations from Feb

Panko Vina Co Ltd, a South Korean textile manufacturer, will cease all production and business operations in Vietnam from February 1, 2026, ending more than 23 years of operations in the country.

Companies - Wed, December 24, 2025 | 9:13 pm GMT+7

Vietnam's garment giant Vinatex posts second-highest profit in 30 years despite trade headwinds

Vietnam National Textile and Garment Group (Vinatex), the country's top garment maker, expects consolidated profit to reach VND1,355 billion ($51.5 million) in 2025, the second-highest result in its 30-year history, despite mounting global trade and cost pressures on the industry.

Companies - Wed, December 24, 2025 | 5:03 pm GMT+7

Finding a new balance

The State Bank of Vietnam's proactive and flexible monetary policy in 2026 is expected to maintain market operations within a stable range. For businesses, particularly those in the external sector, it remains essential to proactively hedge against exchange rate and interest rate risks to protect their bottom line, writes Vu Binh Minh, associate director, FX Trading, MSS, HSBC Vietnam.

Consulting - Wed, December 24, 2025 | 4:47 pm GMT+7

Thai giant Central Retail sells Vietnam electronics business to Pico for $36 mln

Thailand’s Central Retail has announced the sale of its Vietnamese electronics retail business to local retailer Pico Holdings JSC for nearly THB1.14 billion ($36 million), as it sharpens its focus on core businesses in the country.

Companies - Wed, December 24, 2025 | 2:00 pm GMT+7

What should investors reasonably expect from IPO stocks?

Experience from both Vietnam and global markets shows that initial public offering (IPO) stocks rarely deliver immediate gains. However, investors who select companies with solid fundamentals and maintain a long-term holding strategy can be rewarded for their patience.

Finance - Wed, December 24, 2025 | 10:45 am GMT+7

Vingroup completes $325 mln overseas bond issuance

Vingroup, Vietnam's biggest listed company by market capitalization, has completed its international issuance of bonds totaling $325 million, with a 5-year maturity, and listed on Austria's Vienna Stock Exchange.

Finance - Wed, December 24, 2025 | 10:17 am GMT+7

Vietnam's public investment-linked stocks seen benefiting in 2026

Capital flows in 2026 are expected to favor sectors that stand to benefit from Vietnam’s public investment drive, including infrastructure, energy, and construction, market experts said.

Finance - Wed, December 24, 2025 | 9:33 am GMT+7

High gold prices to drive prices of property, goods in Vietnam: Sunhouse chairman

In a scenario where gold prices remain elevated in Vietnam, the real estate market is likely to follow suit, pushing income levels higher and driving up prices across other goods, said Nguyen Xuan Phu, chairman of Sunhouse, a leading home appliance manufacturer, while outlining his 2026-2030 forecast.

Economy - Wed, December 24, 2025 | 8:00 am GMT+7

Malaysia’s economy grows robustly in 2025: IMF

Malaysia has shown notable resilience amid global trade tensions and policy uncertainty, with its economy growing at a healthy pace this year, supported by strong domestic consumption and investment, solid employment growth, and a global upcycle in the technology sector, according to Masahiro Nozaki, Mission Chief for Malaysia at the International Monetary Fund (IMF).

Southeast Asia - Tue, December 23, 2025 | 10:07 pm GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Tue, December 23, 2025 | 10:04 pm GMT+7

Indonesia faces challenge of balancing wages, labor costs

Indonesia plans to raise minimum wages by about 5-7% in 2026 under a new formula signed into law by President Prabowo Subianto, a move that could test the country’s cost competitiveness in Southeast Asia.

Southeast Asia - Tue, December 23, 2025 | 10:00 pm GMT+7

Philippines extends sugar import ban

The Philippine Government has decided to extend its ban on sugar imports until the end of December 2026, as domestic supply has improved.

Southeast Asia - Tue, December 23, 2025 | 9:56 pm GMT+7

Duc Giang Chemical stock comes under heavy selling pressure as bottom-fishing shares return

DGC shares of Duc Giang Chemical Group JSC (DGC) closed Tuesday at VND71,600 apiece, down 4% from Monday which saw a 6.27% increase after four sessions of sharp declines last week.

Companies - Tue, December 23, 2025 | 9:49 pm GMT+7

Hanoi clears zoning for major mall project after Aeon exit, Thaco arm steps in

Hanoi authorities have approved a detailed zoning plan for an 8.03-hectare mixed-use site in Hoang Mai district, paving the way for a shopping mall-led development after Japan’s Aeon withdrew and a unit of Vietnam’s Thaco Group moved in.

Real Estate - Tue, December 23, 2025 | 5:05 pm GMT+7

Viettel Commerce partners with China’s Dreame Technology to expand home appliance ecosystem in Vietnam

Viettel Commerce and Import-Export Co. Ltd., one of the core pillars in trade and logistics of the military-run telecom giant Viettel, has signed a strategic cooperation agreement with China-based Dreame Technology, a global high-end technology brand, in Hanoi.

Companies - Tue, December 23, 2025 | 3:38 pm GMT+7

Former LPBank chairman becomes acting Sacombank CEO

Former chairman of Vietnamese private lender LPBank Nguyen Duc Thuy on Tuesday assumed the role of acting CEO at Sacombank, immediately after completing the handover at LPBank.

Banking - Tue, December 23, 2025 | 3:30 pm GMT+7

- Travel

-

Mega-airport Long Thanh in southern Vietnam welcomes first passenger flights

-

Vietnam defeat Thailand to win men’s football gold at SEA Games 33

-

Which beach in Vietnam boasts the Pantone - 'color of the year 2026'?

-

Unprecedented national milestone in 65 years: Vietnam welcomes 20 millionth international visitor

-

Techcombank HCMC International Marathon affirms global standing

-

Vietnam's tour operator Vietravel announces full exit from Vietravel Airlines