Vietnam not yet a ‘net winner’ of production relocation from China: S&P Global

Vietnam and other emerging markets in Asia are not yet major net winners of production relocation from China, whose role in global trade will not diminish drastically as global supply chains continue to evolve, an S&P Global report says.

China's consistency in global supply chain

In a recent commentary, S&P Global noted geopolitical friction, trade barriers, and industrial policy are challenging Asia's dominant supply chains, especially businesses' operations in China.

Before the trend, firms in the textile and footwear sectors relocated their production lines away from China due to higher costs and wages. The trend has intensified and broadened the relocation to other industries, including semiconductors and smartphones. In addition to moving out of China, multinationals are now more likely to install new capacity elsewhere.

However, trends in exports and foreign direct investment (FDI) show that, overall, the role of Asian economies, including China, in the global supply chains is changing only modestly.

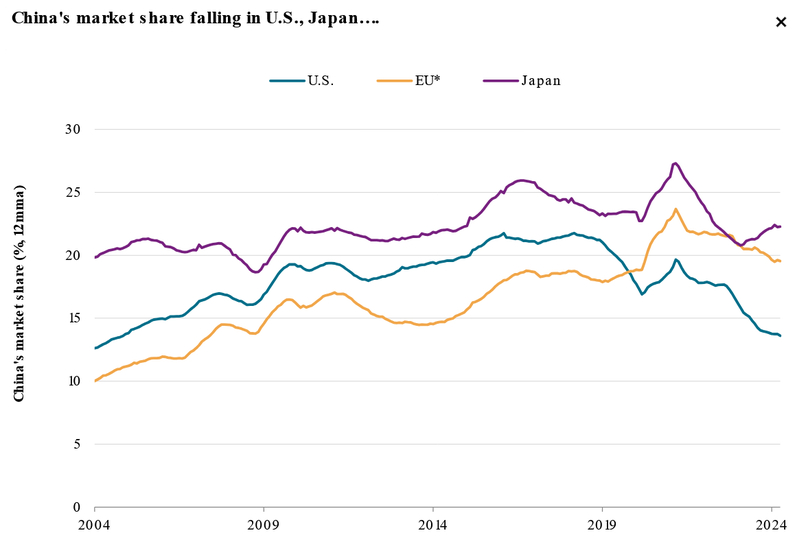

China's falling market share in the U.S., Japan and Europe. Photo courtesy of S&P Global.

S&P Global pointed out that China's share of U.S. goods imports has shrunk since the Trump administration increased tariffs on most imports from China, with other Asian emerging markets and Mexico filling most of the gap. Similar developments were noted in Japan and Europe.

Meanwhile, China's exporters have expanded their share of the imports in emerging markets. This matters as emerging markets' imports make up a large and rising proportion of the global total. S&P Global attributed the changes to China's growth in exporting "normal" goods, which outpaced the growth of exporting components assembled in China for re-export to third countries.

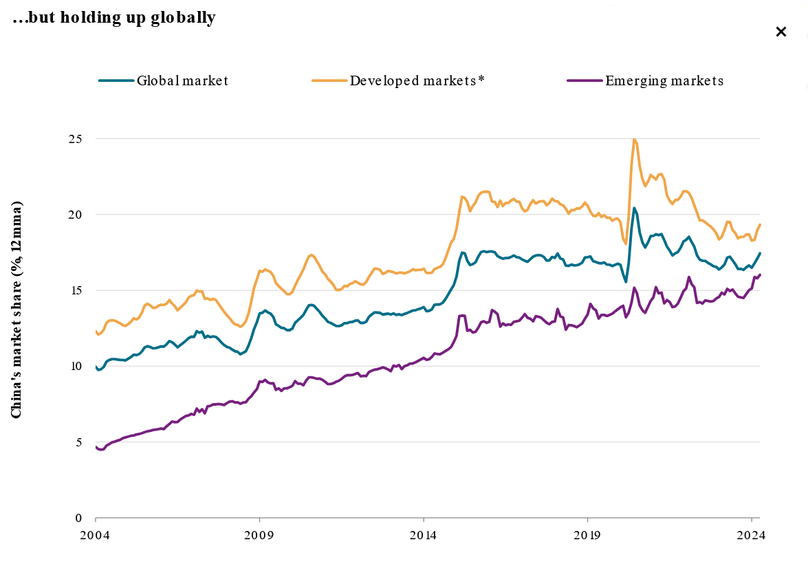

China's global market share with minor changes. Photo courtesy of S&P Global.

China's export market share rose to 39.8% in the year to mid-2024, from 36% six years earlier, S&P Global highlighted.

Asia's emerging markets grow modestly at changes in China

As data show, the supposed change is far less than the common understanding, and China's share has improved in the global export market, S&P Global pointed out that Asian emerging markets and Mexico have only made modest gains.

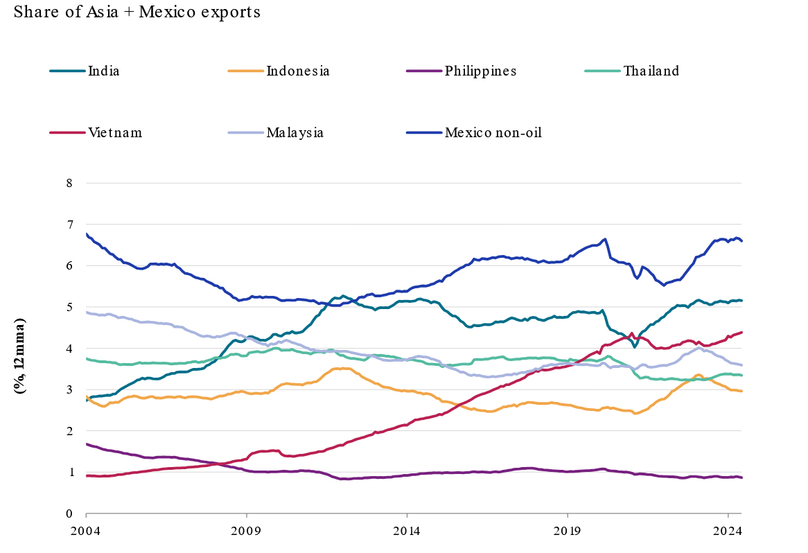

Vietnam's growth in share of Asia and Mexico exports. Photo courtesy of S&P Global.

In particular, for Vietnam, the country's share of total Asian + Mexico exports expanded impressively in the 15 years through early 2020. Its rise was subsequently disrupted for several years amid the Covid-19 pandemic. While recent trends suggest the growth may have resumed, Vietnam doesn't seem to have been as much of a winner in the recent global supply-chain shifts as is sometimes assumed, according to S&P Global.

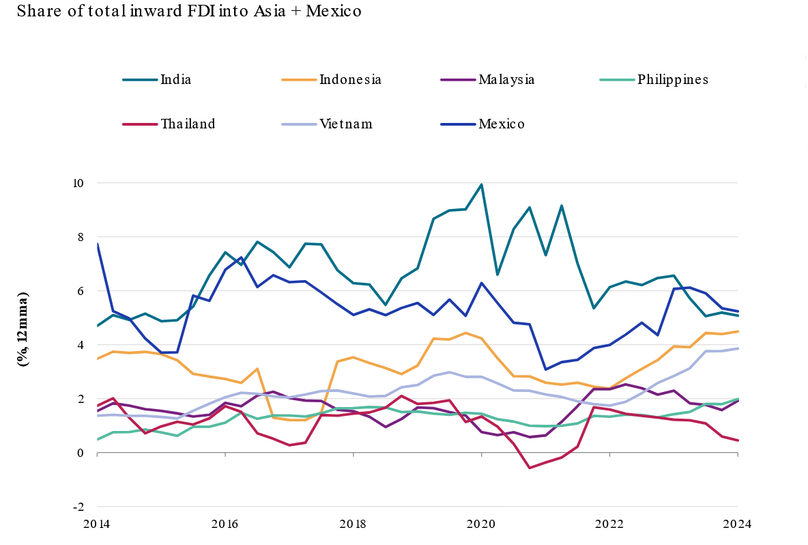

Vietnam and Indonesia with improvements in share of total FDI into Asia and Mexico. Photo courtesy of S&P Global.

Regarding FDI into Asia and Mexico, the plunge in China since 2022 suggests some emerging markets would benefit from the trend. In fact, S&P Global data shows that only Vietnam and Indonesia reap benefits with higher shares of the total FDI in Asia and Mexico than six years ago. Vietnam is the only "manufacturing" economy that has a significant increase of 1.7 percentage points in progress, according to S&P Global.

For absolute figures, FDI into Asian emerging markets excluding China was $24 billion lower in the year to March 2024 than six years earlier. The total for Asia-Pacific excluding China rose. But that was more than driven by Australia, Hong Kong, and Singapore, S&P Global stressed.

- Read More

MBBank partners with Visa, Kotra to launch new MB Visa Hi BIZ corporate card

MBBank (MB) on Wednesday launched a new version of its MB Visa Hi BIZ corporate card, offering enhanced spending management tools and cross-border payment capabilities through partnerships with Visa and South Korea’s trade promotion agency Kotra.

Banking - Thu, November 20, 2025 | 9:38 pm GMT+7

Germany looks to Vietnam's largest tungsten mine for critical mineral supply diversification

Germany is turning its attention to Vietnam’s Nui Phao mine, one of the world’s largest tungsten deposits outside China, as part of efforts to diversify supplies of strategic minerals.

Industries - Thu, November 20, 2025 | 5:27 pm GMT+7

Vietnam's tech firms should pursue end-to-end product strategy, avoid ‘halfway’ innovation: minister

Vietnamese technology firm ought to pursue a product-driven strategy and sustain long-term global ambitions, said Minister of Science and Technology Nguyen Manh Hung.

Economy - Thu, November 20, 2025 | 5:23 pm GMT+7

Vietnam’s gaming market needs more than just a 'pho restaurant'

To keep up with the booming gaming industry, Vietnamese developers must innovate by embracing stronger technology adoption while still forging a unique identity, and sometimes, that unique identity could simply be represented by a humble bowl of pho (noodle soup).

Economy - Thu, November 20, 2025 | 4:14 pm GMT+7

F88 named among Best Managed Companies 2025 by Deloitte

Vietnam’s consumer finance major F88 has been recognized by Deloitte as one of the “Vietnam Best Managed Companies 2025”, meeting international governance standards.

Companies - Thu, November 20, 2025 | 2:47 pm GMT+7

PTC1 unit assesses information security at 220kV northern Vietnam substations

The Northeast Power Transmission Team 3, a unit of Power Transmission Company No.1 (PTC1), coordinated with Cyberspace Operations Command (Command 86) to conduct an information security (IS) assessment at the 220kV Lang Son and Bac Quang substations from November 10-14.

Companies - Thu, November 20, 2025 | 1:12 pm GMT+7

Vietnam’s largest listed firm to double charter capital

Vingroup, the biggest company by market capitalization on Vietnam's bourses, said it will double its charter capital to more than VND77 trillion ($2.92 billion) after issuing nearly 3.9 billion bonus shares to existing shareholders at a 1:1 ratio.

Companies - Thu, November 20, 2025 | 11:50 am GMT+7

Consortium plans $12.8 bln boulevard-landscape project in Hanoi

A consortium including Vietnam’s transport infrastructure giant Deo Ca Group has proposed developing the VND338 trillion ($12.81 billion) Red River boulevard and landscape, which could become Hanoi’s largest-ever infrastructure project.

Infrastructure - Thu, November 20, 2025 | 8:58 am GMT+7

Viettel, UAE-based EDGE partner on defense, dual-use technologies

Military-run Viettel, Vietnam’s largest telecommunications and technology group, has signed an MoU with EDGE, one of the world’s leading advanced technology and defence companies, in a move that underscores the country’s ambition to expand high-tech manufacturing.

Companies - Thu, November 20, 2025 | 8:53 am GMT+7

Maersk eyes building major container ports in Vietnam

A.P.Moller - Maersk (Maersk) is exploring investment opportunities to develop large, modern and low-carbon container ports in Vietnam.

Infrastructure - Wed, November 19, 2025 | 4:36 pm GMT+7

Taiwan semiconductor giant Panjit acquires 95% of Japan-based Torex’s Vietnam arm

Panjit International Inc, a Taiwan-listed semiconductor major, has approved the acquisition of a 95% stake in Torex Vietnam Semiconductor, a subsidiary of Japan-based Torex.

Companies - Wed, November 19, 2025 | 3:59 pm GMT+7

Vietnam PM urges Kuwait Petroleum to expand Nghi Son refinery, build bonded fuel storage facility

Prime Minister Pham Minh Chinh on Tuesday called on Kuwait Petroleum Corporation (KPC) to expand the Nghi Son oil refinery and build a bonded fuel storage facility in Vietnam.

Industries - Wed, November 19, 2025 | 3:18 pm GMT+7

Southern Vietnam port establishes strategic partnership with Japan’s Port of Kobe

Long An International Port in Vietnam’s southern province of Tay Ninh and Japan’s Port of Kobe on Monday signed an MoU establishing a strategic port partnership which is expected to boost trade flows, cut logistics costs, and deliver greater benefits to businesses across the region.

Companies - Wed, November 19, 2025 | 10:14 am GMT+7

Thaco's agri arm seeks to expand $44 mln cattle project in central Vietnam

Truong Hai Agriculture JSC (Thaco Agri), the agriculture arm of conglomerate Thaco, looks to aggressively expand its flagship cattle farming project in the central Vietnam province of Gia Lai.

Industries - Wed, November 19, 2025 | 9:56 am GMT+7

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7