Vietnam’s central bank likely to further cut rates: UOB

The State Bank of Vietnam would continue to lower its rates cautiously and deliberately in the second quarter of this year because one area of focus for the central bank is clearly the domestic inflation trend, says the United Overseas Bank’s (UOB) Global Economics & Markets Research team.

An UOB office. Photo courtesy of the bank.

SBV cuts key interest rate

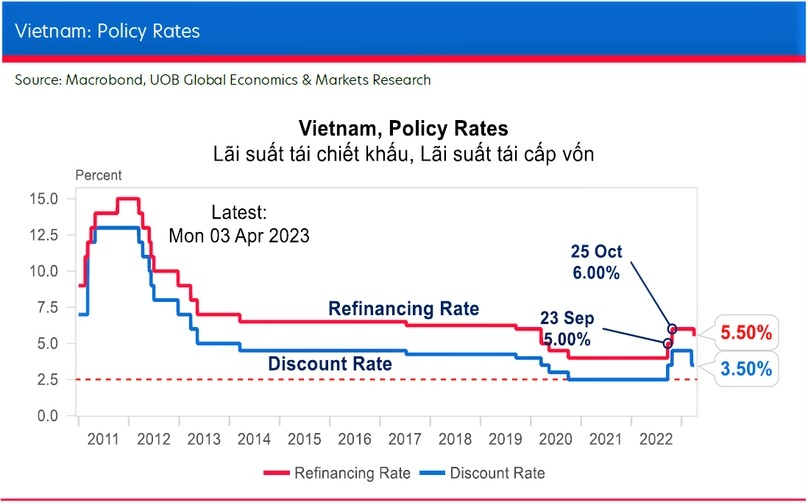

The SBV announced the lowering of the key refinancing rate by 50 basis points to 5.5%, effective from April 3. This is the latest policy move to support economic growth. The SBV’s move did not come as a surprise, given the earlier announcements, and the unexpectedly soft Q1/2023 GDP growth rate which was released a day earlier.

We continue to see the scope for the SBV to lower by a total of 100 basis points in Q2. This means that there is likely another reduction of the refinancing rate by a further 50 basis points before the end of June. Beyond that, the central bank is likely to approach further rate cuts in a cautious and deliberate manner due to considerations for domestic prices and global developments.

Regarding the FX outlook, the VND stood out as one of the most stable currencies in Asia. Despite the big shifts in Fed rate hike expectations, global recession worries and U.S. banking turmoil, the VND traded a tight 0.8% from either side of 23,600/USD. Overall, we expect the USD/VND pair to track other USD/Asia pairs higher to 24,200 in Q2 before easing lower to 24,000 in Q3.

SBV lowers key policy rate

In just about two weeks after an earlier notice of various interest rate cuts, the SBV announced late in the evening last Friday (March 31) the lowering of the key refinancing rate by 50 basis points to 5.5%, effective from April 3. This is the latest policy move to support economic growth.

The discount rate, which SBV unexpectedly reduced by 100 basis points to 3.5% (from 4.5%) on March 16, will be kept unchanged at 3.5% and the overnight lending rate in the inter-bank market will also remain at 6% and unaffected by the latest policy announcement.

In its latest announcement, the central bank also said it would lower caps on interest rates of deposits in Vietnamese dong by 50 basis points to between 0.5% and 5.5% for maturities below six months. The ceiling on interest rates for short-term loans in some priority sectors will be reduced further to 4.5% from 5%. Note that in its March 16 announcement, the SBV trimmed the cap on the lending interest rates for short-term loans in some sectors to 5% from 5.5%.

Potential for rates to head lower

The SBV’s move to lower its key refinancing rate did not come as a surprise, given that the central bank had announced the lowering of other related interest rates back on March 16. Another catalyst for the SBV to push forward was the unexpectedly soft Vietnam’s Q1/2023 GDP growth rate which decelerated to 3.32%, from 5.92% in Q4/2022 that was released just one day earlier.

In addition, there were also signs of market stability with the disturbances to the U.S. and European banking sectors from the recent shocks subsiding (Silicon Valley Bank’s failure and the acquisition of Credit Suisse by Swiss bank UBS) and the US Federal Reserve on the verge of reaching the end of its rate hike cycle.

As we suggested in our earlier report on March 30, there would be an “increasing bias for the SBV to shift towards a more accommodative stance ahead”, with a 100 basis point cut to the refinance rate in Q2/2023.

While the SBV has shifted towards a more accommodative stance, it does not mean the start of a rate-cut cycle, at least not just yet. The central bank is likely to approach further rate cuts cautiously and deliberately. One area of focus for the SBV is clearly the domestic inflation trend.

While some easing signs have surfaced on the inflation front, with Vietnam's consumer price index gaining 4.18% year-on-year in Q1/2023, below the government’s target of 4.5%, core inflation has yet to see a meaningful slowdown.

Core inflation (which excludes food, energy, and other public services prices) accelerated to 5.01% year-on-year in Q1-2023 from 4.76% in Q4/2022 and 3.17% in Q3/2022. This trend is likely to be of concern to the central bank with core inflation gaining 4.88% year-on-year in March, the sixth straight month that the indicator is hovering above the 4.5% target.

Besides considerations on consumer prices, any cumulative cut larger than 100 basis points would also depend on stability in the banking sector in the U.S. and Europe, particularly the extent of the spillover effects on global demand from the year-long US Fed’s rate hike campaign.

Including the 50 basis points cut just announced, we continue to see the scope for the SBV to lower by a total of 100 basis points in Q3/2023. This means that there is likely another reduction of the refinancing rate by a further 50 basis points before the end of June in a bid to support domestic economic activities.

FX outlook: dong to stay stable

The VND stood out as one of the most stable currencies in Asia. Despite the big shifts in Fed rate hike expectations, global recession worries and U.S. banking turmoil, the VND traded a tight 0.8% from either side of 23,600/USD.

Despite the SBV’s surprise 100 basis points rate cut to the discount rate on 16 March, a rebound in exports and industrial production in the months ahead together with easing inflation are likely to anchor the VND stability.

Overall, we expect the USD/VND pair to track other USD/Asia pairs higher to 24,200 in Q2/2023 before easing lower to 24,000 in Q3/2023, 23,800 in Q4/2023, and 23,600 in Q1/2024.

- Read More

Japan food major Acecook eyes new plant in southern Vietnam

Acecook, a leading instant noodle maker with 13 plants operating in Vietnam, is studying a new project in the southern province of Tay Ninh.

Industries - Wed, November 19, 2025 | 9:39 am GMT+7

Vietnam’s largest Aeon Mall to take shape in Dong Nai province

Authorities of Dong Nai province, a manufacturing hub in southern Vietnam, on Monday awarded an investment registration certificate to Japanese-invested Aeon Mall Vietnam Co., Ltd. for its Aeon Mall Bien Hoa project.

Industries - Tue, November 18, 2025 | 8:17 pm GMT+7

Police propose prosecuting Egroup CEO Nguyen Ngoc Thuy for fraud, bribery

Vietnam’s Ministry of Public Security has proposed prosecuting Nguyen Ngoc Thuy, chairman and CEO of Hanoi-based education group Egroup, along with 28 others, for fraud to appropriate property, giving bribes, and receiving bribes.

Society - Tue, November 18, 2025 | 4:01 pm GMT+7

Singapore-backed VSIP eyes large urban-industrial complex in southern Vietnam

A consortium involving VSIP, a joint venture between local developer Becamex IDC and Singapore’s Sembcorp, plans a large-scale urban-industrial development named the "Moc Bai Xuyen A complex along the Tay Ninh-Binh Duong economic corridor in southern Vietnam.

Industrial real estate - Tue, November 18, 2025 | 2:38 pm GMT+7

Aircraft maintenance giant Haeco to set up $360 mln complex in northern Vietnam

Hong Kong-based Haeco Group, Vietnam's Sun Group, and some other partners plan to invest $360 million in an aircraft maintenance, repair and overhaul (MRO) complex at Van Don International Airport in Quang Ninh province - home to UNESCO-recognized natural heritage site Ha Long Bay.

Industries - Tue, November 18, 2025 | 2:13 pm GMT+7

Thai firm opens 20,000-sqm shopping center in central Vietnam hub

MM Mega Market Vietnam (MMVN), a subsidiary of Thailand's TCC Group, on Monday opened its MM Supercenter Danang, a 20,000 sqm commercial complex with total investment capital of $20 million, in Danang city.

Real Estate - Tue, November 18, 2025 | 12:20 pm GMT+7

Vietnam PM asks Kuwait fund to expand investment in manufacturing, logistics, renewable energy

Prime Minister Pham Minh Chinh on Monday called on the Kuwait Fund for Arab Economic Development (KFAED) to strengthen cooperation with Vietnam, particularly in the areas of industrial production, logistics, renewable energy, green economy, and the Halal ecosystem.

Economy - Tue, November 18, 2025 | 11:53 am GMT+7

Thai dairy brand Betagen to build first plant in Vietnam

Betagen, a famous Thai dairy brand, plans to build its first manufacturing plant in Vietnam, located in the southern province of Dong Nai.

Industries - Tue, November 18, 2025 | 8:49 am GMT+7

Banks dominate Vietnam's Q3 earnings season, Novaland posts biggest loss

Banks accounted for more than half of the 20 most profitable listed companies in Vietnam’s Q3/2025 earnings season, while property developer Novaland recorded the largest loss.

Finance - Tue, November 18, 2025 | 8:24 am GMT+7

Highlands Coffee posts strongest quarterly earnings in 2 years on robust same-store sales

Highlands Coffee, Vietnam’s largest coffee chain, delivered its best quarterly performance in two years, with Q3 EBITDA exceeding PHP666 million ($11.27 million), parent company Jollibee Foods Corporation (JFC) said in its latest earnings report.

Companies - Mon, November 17, 2025 | 10:21 pm GMT+7

Hong Kong firm Dynamic Invest Group acquires 5% stake in Vingroup-backed VinEnergo

VinEnergo, an energy company backed by Vingroup chairman Pham Nhat Vuong, has added a new foreign shareholder after Hong Kong–based Dynamic Invest Group Ltd. acquired a 5% stake, according to a regulatory filing on Saturday.

Companies - Mon, November 17, 2025 | 9:52 pm GMT+7

Thai giant CP’s Q3 Vietnam revenue drops 20% as hog prices slump

Thailand’s Charoen Pokphand Foods PCL (CPF) reported a sharp downturn in its Vietnam business in Q3, making the country its only major market to contract.

Companies - Mon, November 17, 2025 | 4:16 pm GMT+7

Surging demand for gas turbines tightens supply chains, extends lead times: Siemens Energy

Demand for gas turbines is rising rapidly, especially in regions with a surge in data center development, tightening supply chains and extending lead times - factors that investors must closely track during project preparation, according to Siemens Energy.

Companies - Mon, November 17, 2025 | 1:34 pm GMT+7

Novaland completes first phase of restructuring, targets 'returning to growth' from 2027

Novaland, a leading real estate developer in Vietnam, said it has completed the first phase of its multi-year restructuring plan and aims to finish the entire program by end-2026, positioning the company to return to growth from 2027.

Companies - Mon, November 17, 2025 | 12:26 pm GMT+7

Vietnam's property developer Regal Group to list shares on HCMC bourse in Q4

Regal Group JSC, a property developer based in the central city of Danang, has applied to list its 200 million RGG shares on the Ho Chi Minh City Stock Exchange (HoSE) in Q4/2025.

Real Estate - Mon, November 17, 2025 | 10:52 am GMT+7

Vietnam's upstream oil & gas stocks surge on project momentum, regulatory easing

Stocks of Vietnam’s upstream oil and gas companies have surged in recent weeks, boosted by rising exploration activity and new rules that accelerate project approvals, while midstream and downstream players face pressure from falling crude prices.

Companies - Mon, November 17, 2025 | 8:57 am GMT+7

- Travel

-

Impressive Standard Chartered Hanoi Marathon Heritage Race 2025

-

Nguyen Hong Hai wins 'Investors' golden heart' golf tournament 2025

-

140 players compete at “Investors’ golden heart” golf tournament

-

‘Investors’ golden heart’ golf tournament to tee off on Saturday

-

Vietnam, Hong Kong Aircraft Engineering sign deal on aircraft maintenance hub at northern airport

-

Sun Group gets nod for $375 mln inland waterway tourism project in central Vietnam