With multiple coal-fired power plants facing closure, Vietnam still has no transition roadmap

While dozens of coal-fired power plants (CFFPs) in Vietnam are facing closure or forced to transition to cleaner input fuels to meet net-zero emissions target by 2050, the government has yet to set a clear roadmap to help them in this process.

Domestic and foreign experts and financiers gathered at a technical meeting last week to identify barriers and work on measures to aid Vietnam in the ongoing energy transition process.

The event, hosted by the United Nations Development Program (UNDP) Vietnam, focused on discussing options for the decommissioning, repurposing, and refurbishment of different types of coal-fired power plants. International and domestic agencies explored viable transition pathways for Vietnam’s major CFPPs, namely Pha Lai in the northern province of Quang Ninh, Cao Ngan in the northern province of Thai Nguyen, and Van Phong in the central province of Khanh Hoa.

No roadmap for coal-fired power plant transition

Nguyen Xuan Trung from the Institute of Energy (IoE) under the Ministry of Industry and Trade informed that Vietnam had a total of 25,312 MW of coal-fired power capacity at the end of 2022, accounting for 32.5% of the total installed capacity of power sources nationwide.

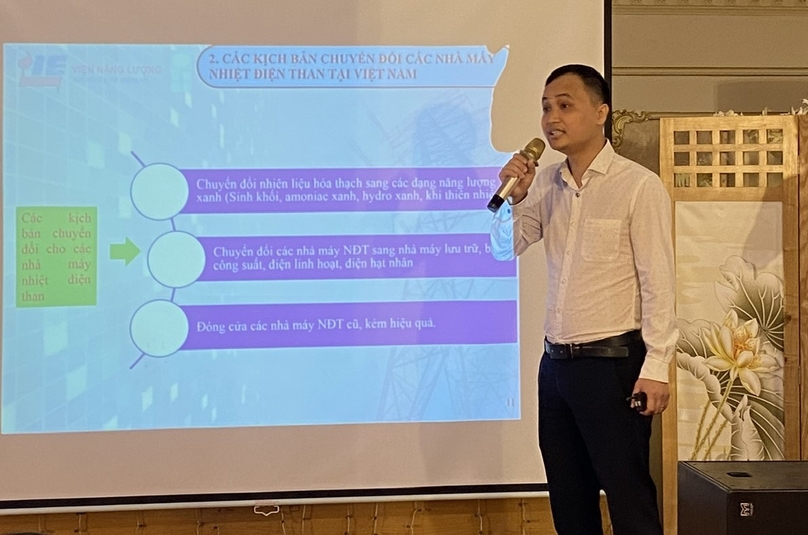

Nguyen Xuan Trung from the Institute of Energy presents his findings at a technical meeting on coal-fired power plant transition, Hanoi, March 29, 2024. Photo courtesy of UNDP.

During the 2000-2019 period, Vietnam's greenhouse gas (GHG) emissions increased by 292% per capita, from 0.65 tons to 2.57 tons, being the sixth fastest in the world. In particular, the electricity production industry is the leading GHG emitter, accounting for 29.08% of the country's total GHG emissions.

Under the eighth Power Development Plan (PDP8) adopted last May, Vietnam will phase out coal usage and close all CFPPs by 2050. Plants that have been operating for 20 years will have to shift to biomass and ammonia as input fuels, while plants with a lifespan of over 40 years and without a possible fuel conversion plan will be closed.

They have three scenarios for transition: (i) convert fossil fuels to green energy forms (biomass, green ammonia, green hydrogen, natural gas); (ii) convert coal-fired power plants to storage, capacity compensation, flexible power, and nuclear power plants; (iii) closing old, inefficient CFPPs, Trung said.

The plants will have to completely switch fuels to biomass and ammonia, with a combined capacity of 25,632-32,432 MW and annual output of 72.5-80.9 billion kWh.

However, the government has yet to announce a conversion roadmap for coal-fired power plants, Trung noted.

He called for the early adaptation of a specific roadmap that will include a list of plants that need to be converted, the methods and timelines for conversion, financial requirements, personnel options, environmental impacts, and negotiations about the closure and repurposing of inefficient and outdated coal-fired power plants.

He warned that there may be a shortage of electricity generation capacity as there is no backup plan for CFPPs that undergo fuel conversion by 2030.

To offset such a potential shortage, PDP8 envisions that electricity imports could increase to 8,000 MW by 2023, higher than the initially projected 3,000 MW.

CFPPs face closure

Vu Van Nam from the IoE said that Vietnam surpassed Indonesia to become the leader in the ASEAN region in 2021 with a total installed electricity capacity of 76.6 GW. The figure had increased to 80.6 GW at the end of 2022.

Vu Van Nam from the Institute of Energy presents his findings at a technical meeting on coal-fired power plant transition, Hanoi, March 29, 2024. Photo by The Investor/Quang Minh.

The possibility of conversion for CFPPs in Vietnam depends on various conditions such as plant lifespan, investment costs, and access to technology, clean fuels, and renewable energy storage options.

Nam noted that the IoE had conducted research at four CFPPs that are set to undergo fuel conversion soon. They are Pha Lai 1 and Pha Lai 2, Cao Ngan, and Ninh Binh in the northern province of Ninh Binh.

Among them, Pha Lai 1 CFPP will be the first to close down in Vietnam. To continue operating, it will have to cut emissions by 30% in 2026, 50% in 2030, and 100% by 2050. Similarly, Pha Lai 2 CFPP will be forced to stop in 10 years’ time or switch input fuels.

Pha Lai 1 coal-fired power plant in Quang Ninh province, northern Vietnam. Photo courtesy of the National Assembly portal.

Mai Quoc Long, chairman of Pha Lai Power Plant JSC, which runs Pha Lai 1&2, said that the firm is under great pressure to transition Pha Lai 1 but has yet to find financing.

Cao Ngan CFPP faces the same fate. Operational since 2007, it will have to undergo fuel conversion in 2027 when it reaches 20 years of operation. It will be closed in 2027 if it fails to switch to non-emission sources.

Roadblocks exist for fuel conversion

Trung from the IoE pointed out a number of challenges for the fuel conversion to cleaner sources like biomass and green ammonia and green hydrogen co-firing.

For example, for the biomass co-firing alternative, there are difficulties in collecting biomass because Vietnam's biomass materials are scattered across many localities. Some 80 companies in Vietnam produce about 4.44 million tons of biomass per year, but about 3 million tons is exported to South Korea and Japan.

CFPPs that have a low capacity (less than 300 MW) and are close to biomass supply sources are suitable plants to convert to biomass combustion.

In addition, there is a lack of policies, regulations, and legal mechanisms regarding technical, financial, and environmental aspects that can serve as a foundation to implement or negotiate and develop strategies for fuel supply.

Meanwhile, green ammonia and green hydrogen are not yet mature technologically, or not commercially viable on a large scale, and production costs are high.

Both green ammonia and green hydrogen are new types of fuels that have not been widely produced, and their production, storage, and transportation costs are high. Their availability depends on the development of production technology and renewable energy, especially offshore wind power in Vietnam.

Another barrier is finance for transition. With huge financial needs, various solutions have been proposed, such as diversifying funding sources, investment mechanisms, and incentivizing and creating a favorable environment for investors. However, these proposed solutions are not yet clear, transparent, or safe.

They also entail many risks, such as a lack of mechanisms and policies regarding privatization, methods of mobilizing private and foreign capital, forms of cooperation, and bond issuance.

There is a shortage of legal frameworks to implement the transition and technical standards, and support mechanisms are unclear for the transition in terms of tax, fees, and loans. Pricing policies are not appealing enough to investors, Trung added.

- Read More

Taseco Group marks 20th anniversary, receives Second Class Labor Medal

Taseco Group in December 20 celebrated its 20th anniversary and received the Second Class Labor Medal – a prestigious award from the Party and State recognizing the company's outstanding contributions to socio-economic development.

Companies - Sun, December 28, 2025 | 12:55 pm GMT+7

Top 10 standout international events in 2025

The U.S.'s imposition of reciprocal tariffs, the Thailand-Cambodia border conflict, and the AI race are among the 10 prominent international events in 2025 as selected by Vietnam News Agency.

Politics - Sun, December 28, 2025 | 12:40 pm GMT+7

Vietnam’s jewelry major PNJ to pay cash dividend, seek share bonus as stock defies market slump

Phu Nhuan Jewelry JSC (HoSE: PNJ) said it will pay an interim cash dividend for 2025 at a rate of 10% and seek shareholder approval to issue bonus shares in January next year. Its stock has risen against a broader market correction.

Companies - Sun, December 28, 2025 | 11:12 am GMT+7

HCMC to launch Free Trade Zone linked to Cai Mep Ha Port

Ho Chi Minh City plans to establish a free trade zone (FTZ) linked to Cai Mep Ha Port, with future expansions to Can Gio, An Binh and Bau Bang, optimizing unique local advantages while maintaining a unified management model, according to a new resolution.

Infrastructure - Sun, December 28, 2025 | 8:00 am GMT+7

Vingroup's hospitality arm appoints new CEO

Vinpearl Joint Stock Company, a leading investor and operator of resorts and theme parks in Vietnam, has appointed Ngo Thi Huong as its new CEO, starting from Friday.

Companies - Sat, December 27, 2025 | 9:02 pm GMT+7

Advisory council recommends Vietnamese government not expand monetary policy in 2026, exercise more caution

Vietnam’s National Financial and Monetary Policy Advisory Council has recommended that the Government refrain from expanding monetary policy in 2026, adopt a more cautious approach, and coordinate monetary and fiscal policies in a balanced manner.

Consulting - Sat, December 27, 2025 | 4:01 pm GMT+7

Nguyen Thanh Phuong exits BVBank board, leads strategy board

Nguyen Thanh Phuong will step down from the board of directors at Vietnam’s private lender BVBank (BVB) for the 2025-2030 term, as decided at an extraordinary shareholders’ meeting on Friday.

Banking - Sat, December 27, 2025 | 12:03 pm GMT+7

PV Gas plans over $3.8 bln investment for 2026-2030, eyes LNG infrastructure, M&A as priorities

PV Gas, the investor of Thi Vai LNG terminal in Ho Chi Minh City, plans to invest more than VND100 trillion ($3.8 billion) in the 2026-2030 period, with LNG infrastructure and mergers and acquisitions (M&A) among its strategic priorities, said parent company Petrovietnam.

Industries - Sat, December 27, 2025 | 10:32 am GMT+7

HCMC proposes adding 5 metro lines connecting Long Thanh airport, Binh Duong, Vung Tau

The Ho Chi Minh City People’s Committee has proposed adding five metro lines to the appendix of the parliamentary Resolution No. 188 on piloting special mechanisms and policies to develop the urban railway network in Hanoi and HCMC.

Infrastructure - Sat, December 27, 2025 | 8:00 am GMT+7

Thaco enlarges charter capital by one-third ahead of Vingroup’s exit from high-speed rail bid

Vietnamese conglomerate Thaco Group has increased its charter capital by a third, just one day before rival Vingroup announced its withdrawal from the planned North-South high-speed railway project.

Companies - Fri, December 26, 2025 | 5:11 pm GMT+7

Le Ngoc Son appointed as Petrovietnam chairman

Petrovietnam's (PVN) CEO Le Ngoc Son has been appointed chairman of the state-owned group's members’ council.

Companies - Fri, December 26, 2025 | 4:54 pm GMT+7

Vietnamese fast food consumers spend average $5.5 per visit, chicken meals dominate

Vietnamese consumers are spending an average of VND144,500 ($5.5) per receipt at major fast-food chains, according to a December report by market research firm Q&Me.

Society - Fri, December 26, 2025 | 2:53 pm GMT+7

The aviation ecosystem game: Can Sun Group win?

Phu Quoc holds a rare advantage in having established a relatively comprehensive aviation ecosystem, comprising the expanded Phu Quoc International Airport and an airline bearing the island’s name – Sun PhuQuoc Airways.

Companies - Fri, December 26, 2025 | 2:44 pm GMT+7

Vingroup units, Idico sign strategic deal on clean energy, green transport

Four arms of Vingroup (HoSE: VIC) on Thursday signed a strategic cooperation agreement with major industrial park developer Idico, targeting clean energy supply and electrification of transport across the latter’s industrial zones.

Companies - Fri, December 26, 2025 | 2:19 pm GMT+7

Fueling Vietnam’s growth

Vietnam is heavily investing in large-scale, long-term projects in energy and infrastructure sectors which require billions of dollars far more than can be easily raised through internal business profits or tight domestic loans, writes Tim Evans, CEO, HSBC Vietnam.

Economy - Fri, December 26, 2025 | 1:38 pm GMT+7

Visa, Sun Group partner to empower personalized, data-driven tourism

Sun Group last Saturday signed a comprehensive strategic partnership with Visa to elevate the travel experience of international visitors to Vietnam through digital innovation, seamless cashless payments, and data-driven marketing solutions.

Companies - Fri, December 26, 2025 | 12:21 pm GMT+7