European firms in Vietnam are showing 'remarkable resilience': EuroCham

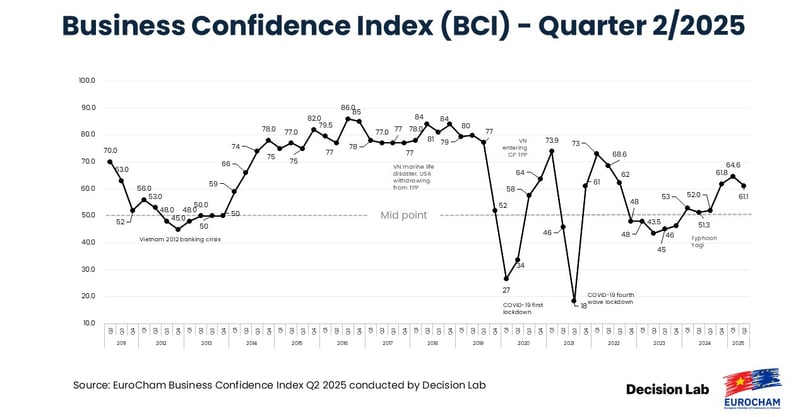

The Q2/2025 Business Confidence Index (BCI) released by EuroCham on Monday shows an evolving but still resilient outlook among European businesses operating in Vietnam. Below is the chamber's analysis of the implications of the BCI.

Despite turbulence in international markets and temporary bottlenecks in domestic reforms, businesses maintain confidence in Vietnam’s long-term growth trajectory.

The Business Confidence Index (BCI) eased slightly to 61.1 amidst global uncertainty, but the overarching message remains one of tempered optimism.

BCI offers critical insight into the shifting contours of Vietnam’s trade and investment landscape. From rising tariffs and administrative burdens to the growing traction of the EU-Vietnam Free Trade Agreement (EVFTA), the data underscores the evolving opportunities and persistent challenges for European investors.

European businesses in Vietnam remain confident in the investment climate," said EuroCham Chairman Bruno Jaspaert. "Around three in every four (72%) surveyed business leaders would recommend Vietnam as an investment destination – and this has been a consistent trend across recent BCI reports. That level of consistency speaks volumes."

Resilience amid rising global trade tensions

This steady confidence stands in contrast to the growing turbulence in global markets. As international trade tensions mount and supply chains remain under pressure, European businesses in Vietnam are showing remarkable resilience.

Among the key factors influencing sentiment is the unresolved impact of U.S. tariffs. Following the third round of Vietnam-U.S. trade negotiations in June with no definitive outcomes, uncertainty over tariff adjustments continues to weigh on strategic planning, particularly for companies managing cross-border supply chains.

Open-ended responses from this BCI survey repeatedly flagged these evolving cards as a concern – not yet a crisis, but a watchpoint.

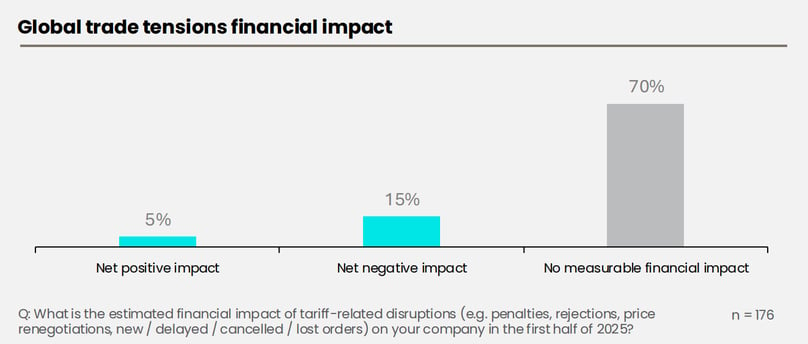

While business leaders are increasingly alert to rising global trade instability, most are yet to feel major financial impacts on the ground. The geopolitical environment continues to evolve, but so far, the effects on European businesses in Vietnam remain limited.

Although concerns around sourcing strategies and supply chain resilience are rising, only 15% of respondents reported net negative financial impacts – including penalties, cancelled orders, or price renegotiations. Notably, 70% said they had experienced no measurable impact, and 5% even reported net gains thus far.

Certificate of origin: A Strategic asset in trade diplomacy

One of the tools helping businesses maintain this resilience is the Certificate of Origin (C/O): a strategic asset that underpins preferential trade access and trust in increasingly complex global markets.

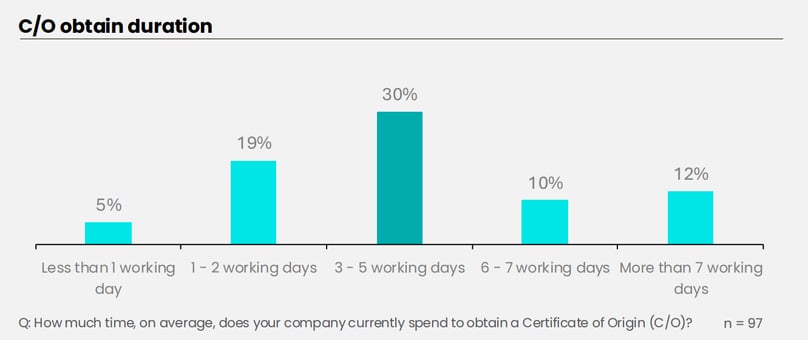

More than just a formality for tariffs exemption, C/O serves as a core pillar of credibility, traceability, and compliance in modern trade. 56% of BCI respondents reported submitting C/O documents on a monthly basis, especially among larger enterprises.

While the majority of businesses received their C/O within the standard 3-5 working days, 12% experienced delays of over a week, potentially disrupting order fulfillment and increasing costs. On the other hand, a standout 5% of businesses received C/O within 24 hours – a benchmark that reflects the growing efficiency of certain customs procedures.

Since May 5, 2025, the Ministry of Industry and Trade (MoIT) has taken over the C/O issuance process with plans to roll out a fully digital system nationwide. This move is widely welcomed by the business community. The digital transition is expected to reduce paperwork, improve turnaround times, and integrate more seamlessly with digital customs systems and electronic signatures.

As geopolitical shifts continue to redraw global supply chains, having a clear, verifiable origin story for products becomes an even more competitive advantage than ever," said chairman Jaspaert.

"This push toward digitalization is not just about reducing paperwork – it is about positioning Vietnam as a trusted, future-ready trade partner. If Vietnam can secure its entire supply chain and increase the share of truly ‘Made in Vietnam’ goods, it will gain a powerful edge in the global trade game.

"The Certificate of Origin is more than a passport to tariff advantages – it is a mark of credibility and trust in end markets. With digitalization, we can accelerate trade flows, reduce friction, and build a more transparent, resilient system that benefits all."

Balancing optimism and strategic caution

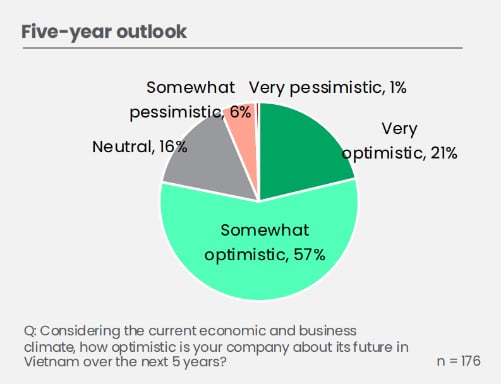

These trade facilitation efforts provide a necessary foundation for investor confidence. Evidently, long-term confidence is strengthening. A solid 78% of respondents (up 7 percentage points from Q1) expect improved business conditions over the next five years. This growing optimism signals continued belief in Vietnam’s structural growth story, even as the near-term picture remains clouded.

As reforms unfold, European businesses in Vietnam remain hopeful, but also pragmatic. The latest BCI data reflects a softened optimism – best described as a strategic pause amid a shifting economic landscape.

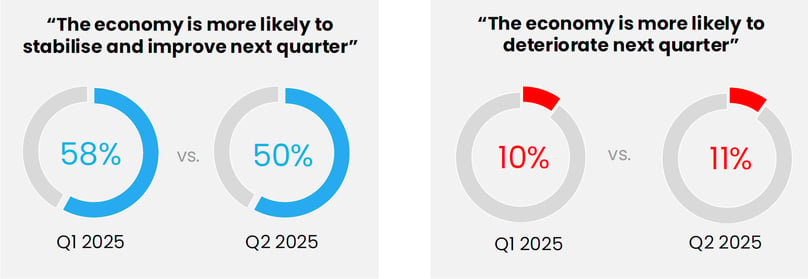

Thue Quist Thomasen – CEO of Decision Lab, the survey partner for BCI – noted: "The share of companies confident in economic stabilization for Q3/2025 has dipped slightly to 50% (down 8 percentage points from the previous quarter). However, this shift does not signal growing pessimism. Rather, it suggests that businesses expect limited near-term changes given the complexity of a volatile international environment. Most are not forecasting deterioration (11% reporting gloomy outlook, only up 1 percentage point since last quarter) – just a period of holding steady."

This wait-and-see stance is echoed in the sentiment breakdown: 39% of respondents hold a neutral short-term outlook, while 43% continue to rate their business prospects as “Good” or “Excellent”.

Yet through it all, resilience remains the dominant theme. Vietnam's steady growth, dynamic workforce, and expanding trade network continue to inspire confidence.

This future-facing optimism is grounded in clear business priorities. As outlined in EuroCham’s Whitebook 2025, European enterprises see several “must-win battles” essential for improving Vietnam’s FDI appeal: core infrastructure development, legal clarity, consistent enforcement, streamlined administrative procedures, and easier visa and work permit regulations. And yet, these very issues remain the most persistent bottlenecks in the business environment.

Administrative bottlenecks still dominate business concerns

While Vietnam has made visible progress on macroeconomic reforms, the day-to-day operational reality for many businesses continues to be defined by red tape. Administrative burdens remain the single most cited challenge to doing business, identified by 63% of BCI respondents – a consistent data trend.

Over the years of conducting the BCI, administrative inefficiencies have remained the central bottleneck. Broader structural challenges like inconsistent enforcement (44%), customs procedures (34%), and regulatory uncertainty continue to hinder long-term planning.

Among administrative pain points, obtaining work permits for foreign employees remains the most common complaint as cited by 33% of respondents. Other frequently noteworthy issues include firefighting regulations (28%), investment and enterprise registration (28%), import-export activities (28%), tax (26%), visa applications (21%), and land ownership rights (16%).

These overlapping administrative constraints not only delay business operations but also complicate long-term planning and investment decisions. “They undermine the competitiveness of Vietnam at a time when it is competing regionally for high-quality FDI,” stressed the EuroCham chairman. “Addressing these concerns is not just about streamlining paperwork – it is about delivering regulatory predictability, institutional accountability, and policy transparency.”

The recent shift to digitalizing administrative processes through Enterprise VNeID is a positive step toward building an efficient ‘one-stop shop’ for investors and businesses alike. In the early implementation phase, some technical challenges have emerged, particularly for the foreign business community, who is currently unable to register for VNeID. This highlights the importance of thorough testing, stakeholder engagement, and pre-launch consultations before rolling out nationwide systems.

Chairman Jaspaert accentuated: “With continued attentiveness and cross-ministerial coordination, I believe these initial hiccups can – and will – be resolved. As laid out in the Whitebook 2025, EuroCham continues to advocate for a comprehensive reform agenda that prioritises practical improvements in administrative procedures, law enforcement consistency, and government-business dialogue mechanisms.”

EVFTA turns five: Progress, potential, and gaps

These domestic challenges play out against the backdrop of expanding international engagements. As Vietnam and the EU celebrate five years of the EVFTA, the agreement stands as both a symbol of progress and a reminder of the work still ahead.

Two-thirds (66%) of surveyed businesses are actively engaged in EU-Vietnam trade or related supply chain services such as logistics, warehousing, and distribution, underscoring the deepening commercial ties between the two regions.

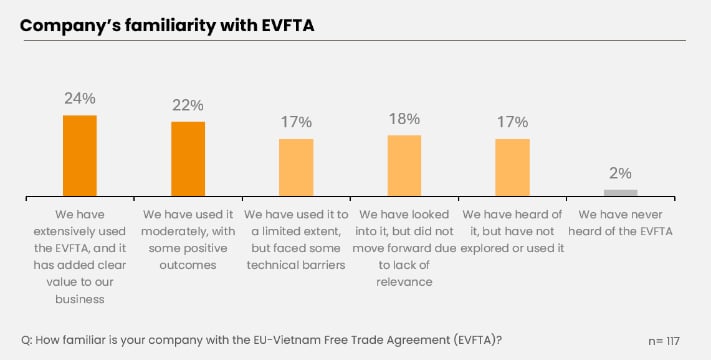

The results show a growing appreciation for the agreement’s benefits. “It is extremely promising to see that almost all (98.2%) of surveyed businesses are aware of the EVFTA,” said Chairman Jaspaert. “Nearly half report moderate to significant benefits to their operations – a positive sign that we are moving in the right direction.”

Larger enterprises tend to report greater benefits, particularly from EU-to-Vietnam exports. SMEs, on the other hand, are more involved in outbound trade from Vietnam to the EU.

One of the most remarkable changes this year is the sharp rise in the number of companies identifying tariff reductions as a key benefit (up from 29% in Q2 2024 to 61% in Q2 2025). This aligns with EVFTA’s phased tariff elimination schedule and signals increasing utilisation of its preferential terms.

Indeed, EU-Vietnam trade volume has surged by 40% since 2020, according to statistics from the Ministry of Industry and Trade. And while only 21% of the firms surveyed could quantify a direct financial gain from the EVFTA, those that did reported an average increase of 8.7% to their bottom line, with the most successful reporting up to 25%.

However, much like broader business operations in Vietnam, fully unlocking the EVFTA’s potential remains a work in progress. Persistent customs valuation issues (reported by 37% of respondents) have emerged as a key stumbling block. Business leaders noted frequent discrepancies in product classification between Vietnamese and EU customs authorities, leading to disputes over tariff rates and complicated resolution processes.

Other obstacles include complex or unclear regulatory frameworks, as well as communication gaps with local authorities – challenges that mirror those highlighted in broader business sentiment.

To address these barriers, businesses have proposed several solutions: streamlining import procedures, greater use of digital tools and e-registration platforms, and allowing self-certification for rules of origin. Additionally, 28% of respondents called for better customs guidance and enforcement, while 22% highlighted the need for broader removal of technical trade barriers.

While the five-year anniversary of the EVFTA marks meaningful progress, these findings show that deeper institutional alignment and capacity-building on both sides – government and business – will be essential to realising the agreement’s full promise.

Clarity, reform, and confidence for the road ahead

In many ways, the EVFTA illustrates what is possible when reforms and business alignment move in tandem. To fully seize this momentum, Vietnam must now double down on clarity and consistency: delivering not just access, but assurance.

The Q2/2025 BCI reaffirms Vietnam’s status as a leading destination for European investment. But sustaining this trajectory will require continued commitment to reform and responsiveness to business needs.

"European companies are clear about what they need: streamlined procedures, harmonised regulations, simplified work permits, tax refunds, and customs frameworks, and improved cross-border trade facilitation.

"These are not just business asks, but they are preconditions for high-quality, sustainable FDI. With clearer rules and stronger reform commitments, Vietnam is on the cusp of becoming a magnet for high quality investment and sustainable development," EuroCham Chairman Bruno Jaspaert concluded. “EuroCham is proud to stand with our partners here and serve as a bridge to this shared future.”

- Read More

VAFIE, Hung Yen province authority accompany taxpayers

The Vietnam's Association of Foreign Invested Enterprises (VAFIE) and Hung Yen province's tax authority on Tuesday held a workshop on corporate tax policy updates and key notes on 2025 corporate income tax filings.

Companies - Wed, November 26, 2025 | 8:15 pm GMT+7

Thailand’s Super Energy earns $81 mln in Jan-Sep revenue from Vietnam

Super Energy Corporation, a Thai renewable-energy developer, recorded about THB2.62 billion ($81.28 million) in revenue from its Vietnam operations in the first nine months of 2025, according to its Q3 earnings report.

Companies - Wed, November 26, 2025 | 4:51 pm GMT+7

Turning point of Vietnam's fund management industry: exec

Vietnam’s asset management industry is entering a pivotal phase as the country seeks to diversify capital flows and strengthen long-term funding, said Lu Hui Hung, CEO of Phu Hung Fund Management, citing the Ministry of Finance's recently issued Decision 3168.

Finance - Wed, November 26, 2025 | 4:42 pm GMT+7

Gelex Infrastructure okayed to launch IPO of 100 mln shares

Gelex Infrastructure JSC has received approval from the State Securities Commission of Vietnam to proceed with an initial public offering of 100 million shares, the company said.

Companies - Wed, November 26, 2025 | 3:52 pm GMT+7

Seven young PV Gas employees selected for Petrovietnam’s 'Outstanding Youth 2025' program

Seven young employees of PetroVietnam Gas (PV Gas) have been selected for Petrovietnam’s “Outstanding Youth 2025” program, an initiative aimed at identifying and developing high-potential talent across the state energy group.

Companies - Wed, November 26, 2025 | 3:01 pm GMT+7

Deep C Industrial Zones in northern Vietnam draws three new projects worth over $242 mln

Deep C Industrial Zones in Quang Ninh province has secured three new investment projects with combined registered capital of about VND6.38 trillion ($242 million), reinforcing its position as an attractive destination for manufacturing and logistics.

Industries - Wed, November 26, 2025 | 1:58 pm GMT+7

Billionaire Pham Nhat Vuong's son takes helm at VinMetal as Vingroup pledges support for loss-making steel producer Pomina

Vingroup, Vietnam's biggest listed company by market cap, said its steel subsidiary VinMetal will provide Pomina Steel with a zero-interest working capital loan for up to two years, helping the troubled steelmaker stabilize operations and restore cash flow.

Companies - Wed, November 26, 2025 | 12:38 pm GMT+7

HAGL chairman says he sold 'everything possible' to save the company

Hoang Anh Gia Lai (HAGL) has successfully restructured with its debt reduced from VND36 trillion ($1.37 billion) to over VND6 trillion ($227.5 million), now focusing on developing raw material areas to gain scale advantages.

Companies - Wed, November 26, 2025 | 8:18 am GMT+7

Vingroup subsidiary VinMetal may acquire loss-making steel producer Pomina: broker

Ho Chi Minh City Securities (HSC) analysts said a potential acquisition of steel manufacturer Pomina could be a strategic move that allows VinMetal to gain a faster foothold in the steel industry by using Pomina’s existing construction steel capacity.

Companies - Tue, November 25, 2025 | 8:05 pm GMT+7

Vingroup plans $38 mln bond issuance to restructure debt

Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, plans to issue VND1 trillion ($37.91 million) in bonds via private placement as it seeks to restructure debt.

Companies - Tue, November 25, 2025 | 3:52 pm GMT+7

Vietnam gov't proposes minimum $379 mln charter capital for offshore wind developers

The Vietnamese government has proposed that offshore wind power developers have a minimum charter capital of VND10 trillion ($379 million) each, according to a draft resolution designed to ease bottlenecks in the country’s 2026-2030 energy development plan.

Energy - Tue, November 25, 2025 | 3:41 pm GMT+7

Petrovietnam arm to venture into CO2 transportation, seabed minerals, geothermal

PVEP, the upstream arm of state giant Petrovietnam, plans to expand into new fields such as CO2 transportation and disposal (carbon capture, utilization, and storage), coal gas and underground mineral research, seabed minerals, and geothermal.

Industries - Tue, November 25, 2025 | 3:08 pm GMT+7

MB successfully closes landmark $500 mln inaugural green term loan facility agreement

Military Commercial Joint Stock Bank (MB) on Monday announced the successful closing of its three-year $500 million inaugural Green Term Loan Facility Agreement, marking a significant milestone in the bank’s sustainable financing journey.

Banking - Tue, November 25, 2025 | 2:17 pm GMT+7

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7