Moody's upgrades outlook of Techcombank in 2024 to 'stable'

Moody's Ratings has revised the outlook of Techcombank from negative to stable, the U.S. credit rating agency said Wednesday.

Moody's also affirmed Techcombank's Baseline Credit Assessment (BCA) and Adjusted BCA of ba3, LT FC and LC Counterparty Risk Ratings (CRRs) of Ba2, and its LT Counterparty Risk (CR) Assessment of Ba2 (cr).

At the same time, Moody's affirmed the bank's Not-Prime (NP) short-term (ST) FC and LC deposit ratings, NP ST FC and LC issuer ratings, NP ST FC and LC CRRs, and NP(cr) ST CR Assessment.

Baseline Credit Assessment Index (BCA) of Techcombank at ba3 continues to make the lender stay in the group of leading Vietnamese banks in terms of business profile and risk profile, the bank highlighted.

Techcombank is a leading private bank in Vietnam. Photo courtesy of the bank.

Techcombank is the first bank to have outlook upgraded by Moody's in 2024, reflecting the rating agency’s recognition of its resilience in a challenging environment of 2022-2023.

The ratings, BCA affirmation and outlook revision to stable are based on Techcombank's above industry average capitalization and profitability, supported by its stable funding.

Specifically, Techcombank's capital adequacy and performance ratios continue to be higher than industry averages, supported further by diverse funding sources.

According to the Moody’s report, Techcombank's above industry average capitalization and profitability will support its ratings. Its Tier 1 capital ratio was at 14% as of end-December 2023 while its return on average assets (ROAA) was 2.4% in 2023, compared to the peer average ROAA of 1.4% over the same period.

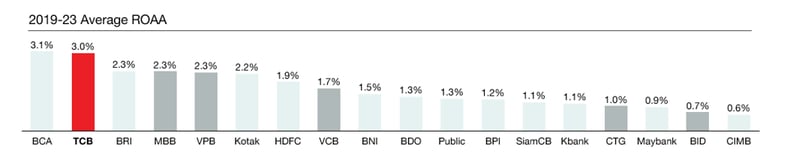

According to data published by S&P Capital IQ at the end of February 2024 on the ROA index of South East Asia and India banks with book value of more than $3 billion during 2019-2023, Central Asian Bank (BCA) of Indonesia and Techcombank of Vietnam are leading with ROAs of 3.1% and 3.0%, respectively.

Average ROAA of banks in Southeast Asia and India with book value over $3 billion in 2019-2023. Photo courtesy of S&P Capital IQ.

Techcombank's funding and liquidity will remain broadly stable. Its deposit base improved in 2023 with gains in its current and savings account deposits (CASA) ratio to 40%, a level that is one of the highest among Vietnamese banks rated by Moody's. The bank's efforts to mobilize deposits and the satisfactory liquidity in the system supported its good deposit growth in 2023.

Moody's expects credit risks from the bank's sizeable exposure to the real estate sector to stabilize over the next 12-18 months. Moody’s assessed that Techcombank will benefit from the recovery of the real estate market, as home purchases increase, contributing to a rise in both absolute and ratio of home loans to real estate loans.

This remark is particularly derived from the bank’s focus on lending investors, developers of real estate of better quality than the market's average level. Moody’s said that Techcombank's credit risk related to real estate loans will be stable over the next 12-18 months.

According to Moody's, real estate transactions in Vietnam have shown many positive signs, with market supply expected to increase, in an environment where interest rates have fallen sharply from 200 to 300 points recently.

The recovery of the economy, plus positive and timely policies and direction of the Government will contribute to a stronger recovery of the real estate market in the near future. High capital adequacy ratio, and ability to operate effectively (including profitability) is also an important factor in Moodys' assessment.

- Read More

Decoding the attraction of 'A.I Real Combat' contest broadcast on Vietnam Television

Vietnam’s first national artificial intelligence competition, 'A.I Thực chiến' (A.I Real Combat), aired its opening round at 8 p.m. Wednesday on state broadcaster VTV2, with a rebroadcast on VTV3 two days later.

Companies - Thu, November 27, 2025 | 8:17 pm GMT+7

Foxconn Industrial Internet’s Vietnam revenue jumps 83% on automation, digitalization: CEO

Foxconn Industrial Internet (FII), a unit of Taiwanese electronics giant Foxconn, saw revenue from its new-technology applications in Vietnam rise 83% in the past fiscal year while headcount increased only 20%, driven by automation and digitalization.

Companies - Thu, November 27, 2025 | 4:56 pm GMT+7

SHB bank sees development drivers from capital-raising strategy, opportunities to attract foreign inflows

The upcoming capital-hike strategy is expected to position Saigon-Hanoi Bank (SHB) among the Top 4 private banks in Vietnam by charter capital, helping the lender maintain its competitive advantage via robust capital strength.

Banking - Thu, November 27, 2025 | 4:33 pm GMT+7

Vietnam's consumer finance major F88 launches first public bond issuance with 10% annual coupon

F88, a leading consumer finance company in Vietnam, has received regulatory approval for its first public bond issuance, offering a fixed annual coupon of 10% - a level seen as attractive amid low bank deposit rates and softer corporate bond yields.

Companies - Thu, November 27, 2025 | 4:16 pm GMT+7

Technology, innovation, digital transformation will drive Vietnam to high-income, developed-economy status by 2045: PM

Science-technology, innovation, and digital transformation will be key drivers for Vietnam to become a developed, high-income economy by 2045, Prime Minister Pham Minh Chinh said at a policy dialogue with World Economic Forum (WEF) managing director Stephan Mergenthaler.

Economy - Thu, November 27, 2025 | 3:25 pm GMT+7

220kV transmission line energized to facilitate electricity imports from Laos to Vietnam

National Power Transmission Corporation (EVNNPT) and the Central Power Projects Management Board (CPMB), in coordination with relevant units, on Wednesday successfully energized the 220kV Tuong Duong-Do Luong transmission line in the central province of Nghe An, facilitating the imports of electricity from Laos to Vietnam.

Companies - Thu, November 27, 2025 | 2:32 pm GMT+7

Government allows eligible Vietnamese citizens to enter Phu Quoc, Ho Tram, Van Don casinos

Vietnam has allowed eligible Vietnamese citizens to gamble at the Phu Quoc, Ho Tram and Van Don casinos starting November 26, per a government resolution issued on Tuesday.

Economy - Thu, November 27, 2025 | 2:02 pm GMT+7

HCMC signs partnership deals with World Economic Forum, blockchain giant Binance

Ho Chi Minh City on Wednesday issued a joint statement with the World Economic Forum (WEF) on an initiative to promote smart manufacturing and responsible industrial transformation in Vietnam, while signing an MoU with Binance to promote the development of the country's International Financial Center.

Economy - Thu, November 27, 2025 | 11:28 am GMT+7

Red Capital exits major shareholder position in EVN's subsidiary VSH

Red Capital Asset Management JSC has ceased to be a major shareholder of Vinh Son-Song Hinh Hydropower JSC (HoSE: VSH), a subsidiary of state-owned Vietnam Electricity (EVN), after sharply reducing its stake.

Companies - Thu, November 27, 2025 | 7:55 am GMT+7

VAFIE, Hung Yen province authority accompany taxpayers

The Vietnam's Association of Foreign Invested Enterprises (VAFIE) and Hung Yen province's tax authority on Tuesday held a workshop on corporate tax policy updates and key notes on 2025 corporate income tax filings.

Companies - Wed, November 26, 2025 | 8:15 pm GMT+7

Thailand’s Super Energy earns $81 mln in Jan-Sep revenue from Vietnam

Super Energy Corporation, a Thai renewable-energy developer, recorded about THB2.62 billion ($81.28 million) in revenue from its Vietnam operations in the first nine months of 2025, according to its Q3 earnings report.

Companies - Wed, November 26, 2025 | 4:51 pm GMT+7

Turning point of Vietnam's fund management industry: exec

Vietnam’s asset management industry is entering a pivotal phase as the country seeks to diversify capital flows and strengthen long-term funding, said Lu Hui Hung, CEO of Phu Hung Fund Management, citing the Ministry of Finance's recently issued Decision 3168.

Finance - Wed, November 26, 2025 | 4:42 pm GMT+7

Gelex Infrastructure okayed to launch IPO of 100 mln shares

Gelex Infrastructure JSC has received approval from the State Securities Commission of Vietnam to proceed with an initial public offering of 100 million shares, the company said.

Companies - Wed, November 26, 2025 | 3:52 pm GMT+7

Seven young PV Gas employees selected for Petrovietnam’s 'Outstanding Youth 2025' program

Seven young employees of PetroVietnam Gas (PV Gas) have been selected for Petrovietnam’s “Outstanding Youth 2025” program, an initiative aimed at identifying and developing high-potential talent across the state energy group.

Companies - Wed, November 26, 2025 | 3:01 pm GMT+7

Deep C Industrial Zones in northern Vietnam draws three new projects worth over $242 mln

Deep C Industrial Zones in Quang Ninh province has secured three new investment projects with combined registered capital of about VND6.38 trillion ($242 million), reinforcing its position as an attractive destination for manufacturing and logistics.

Industries - Wed, November 26, 2025 | 1:58 pm GMT+7

Billionaire Pham Nhat Vuong's son takes helm at VinMetal as Vingroup pledges support for loss-making steel producer Pomina

Vingroup, Vietnam's biggest listed company by market cap, said its steel subsidiary VinMetal will provide Pomina Steel with a zero-interest working capital loan for up to two years, helping the troubled steelmaker stabilize operations and restore cash flow.

Companies - Wed, November 26, 2025 | 12:38 pm GMT+7

- Consulting

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation