Vietnamese billionaires' fortune drops $2.4 bln

Hoa Phat Group chairman Tran Dinh Long. Photo courtesy of the company.

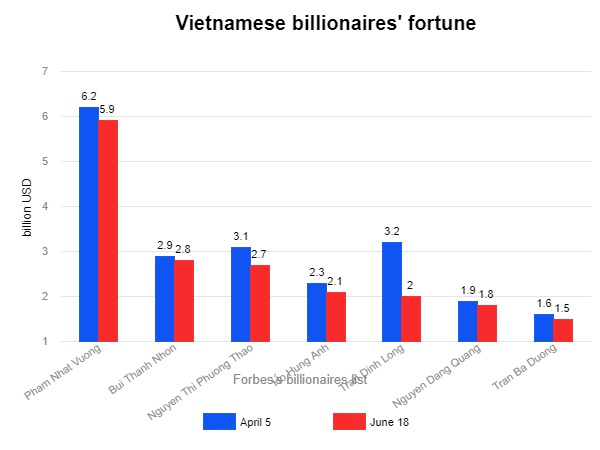

Total net worth of Vietnamese billionaires has plunged by $2.4 billion since Forbes’s ranking of the planet’s richest people in early April due to the local stock market's turbulence.

All seven Vietnamese representatives in Forbes’s list of U.S. dollar billionaires have experienced a slump in total assets, with their total wealth dropping to $18.8 billion as of June 18, according to the real-time billionaires list.

Given the VN-Index plummet of 17% since the end of March, steel maker Hoa Phat, listed on Ho Chi Minh City Stock Exchange (HoSE: HPG), had its stock value sink about 55.8%.

The drop margin has been enlarged following chairman Tran Dinh Long's statement about the steel industry's difficulties at the company's annual general meeting on May 24.

The move pulled Long’s fortune down by $1.2 billion, the biggest decline among Vietnamese U.S. dollar billionaires. He slipped to the fifth position in Vietnam and out of the top 1,000 wealthiest persons on earth, ranking 1477th, down 526 places from April.

The other six Vietnamese representatives in Forbes’s list of USD billionaires (from left: Pham Nhat Vuong, Nguyen Thi Phuong Thao, Ho Hung Anh, Nguyen Dang Quang, Bui Thanh Nhon, and Tran Ba Duong). Photo courtesy of the billionaires.

Vietnam’s richest person Pham Nhat Vuong, chairman of Vingroup, recorded a decrease of $300 million, or 5%, from $6.2 billion in April.

CEO of Vietjet Air Nguyen Thi Phuong Thao and chairman of Techcombank Ho Hung Anh observed their fortunes dropping by $400 million and $200 million respectively.

Other billionaires, namely Masan Group chairman Group Nguyen Dang Quang, Nova Group chairman Bui Thanh Nhon, and Thaco Group chairman Tran Ba Duong and his family jointly recorded a decrease of $100 million in assets.

However, several top brokers have expressed their positive outlooks on the Vietnamese stock market in the coming time.

VNDirect Securities predicted that the national economy would recover faster in the next quarters, which would significantly support the local stock market. Vietnam's GDP is predicted to grow by 5.6% year-on-year in the second quarter of 2022, up 0.6% quarter-on-quarter. It also forecasts Vietnam's GDP of 7.1% in 2022.

Viet Dragon Securities believed that there is not much information powerful enough to disrupt the market in June, with slight improvement in market liquidity from May’s average.

However, the Vietnamese stock market still confronts numerous external macro issues, including tightened monetary policy and unexpected global inflation movements due to the Russia-Ukraine war’s influence on fuel and food prices, the broker noted in a report.

These factors are projected to weigh on domestic inflation, posing a significant challenge to the stock market's momentum, especially in the context of more cautious capital flow and the absence of positive news, according to Viet Dragon.

SSI Securities also attributed the market’s volatility to the indirect impact of China's zezo-Covid policy. The US and Vietnam's stock market has dropped nearly 14% since the beginning of the year, indicating that these issues have partially reflected in the stock price.

However, growth of pandemic-affected sectors is predicted to be positive year-on-year in the second half of 2022, with public investment disbursement likely to be accelerated. The 2% interest rate support package would be also a driving force if executed in a proper manner, according to SSI Reseach.

- Read More

Decoding the attraction of 'A.I Real Combat' contest broadcast on Vietnam Television

Vietnam’s first national artificial intelligence competition, 'A.I Thực chiến' (A.I Real Combat), aired its opening round at 8 p.m. Wednesday on state broadcaster VTV2, with a rebroadcast on VTV3 two days later.

Companies - Thu, November 27, 2025 | 8:17 pm GMT+7

Foxconn Industrial Internet’s Vietnam revenue jumps 83% on automation, digitalization: CEO

Foxconn Industrial Internet (FII), a unit of Taiwanese electronics giant Foxconn, saw revenue from its new-technology applications in Vietnam rise 83% in the past fiscal year while headcount increased only 20%, driven by automation and digitalization.

Companies - Thu, November 27, 2025 | 4:56 pm GMT+7

SHB bank sees development drivers from capital-raising strategy, opportunities to attract foreign inflows

The upcoming capital-hike strategy is expected to position Saigon-Hanoi Bank (SHB) among the Top 4 private banks in Vietnam by charter capital, helping the lender maintain its competitive advantage via robust capital strength.

Banking - Thu, November 27, 2025 | 4:33 pm GMT+7

Vietnam's consumer finance major F88 launches first public bond issuance with 10% annual coupon

F88, a leading consumer finance company in Vietnam, has received regulatory approval for its first public bond issuance, offering a fixed annual coupon of 10% - a level seen as attractive amid low bank deposit rates and softer corporate bond yields.

Companies - Thu, November 27, 2025 | 4:16 pm GMT+7

Technology, innovation, digital transformation will drive Vietnam to high-income, developed-economy status by 2045: PM

Science-technology, innovation, and digital transformation will be key drivers for Vietnam to become a developed, high-income economy by 2045, Prime Minister Pham Minh Chinh said at a policy dialogue with World Economic Forum (WEF) managing director Stephan Mergenthaler.

Economy - Thu, November 27, 2025 | 3:25 pm GMT+7

220kV transmission line energized to facilitate electricity imports from Laos to Vietnam

National Power Transmission Corporation (EVNNPT) and the Central Power Projects Management Board (CPMB), in coordination with relevant units, on Wednesday successfully energized the 220kV Tuong Duong-Do Luong transmission line in the central province of Nghe An, facilitating the imports of electricity from Laos to Vietnam.

Companies - Thu, November 27, 2025 | 2:32 pm GMT+7

Government allows eligible Vietnamese citizens to enter Phu Quoc, Ho Tram, Van Don casinos

Vietnam has allowed eligible Vietnamese citizens to gamble at the Phu Quoc, Ho Tram and Van Don casinos starting November 26, per a government resolution issued on Tuesday.

Economy - Thu, November 27, 2025 | 2:02 pm GMT+7

HCMC signs partnership deals with World Economic Forum, blockchain giant Binance

Ho Chi Minh City on Wednesday issued a joint statement with the World Economic Forum (WEF) on an initiative to promote smart manufacturing and responsible industrial transformation in Vietnam, while signing an MoU with Binance to promote the development of the country's International Financial Center.

Economy - Thu, November 27, 2025 | 11:28 am GMT+7

Red Capital exits major shareholder position in EVN's subsidiary VSH

Red Capital Asset Management JSC has ceased to be a major shareholder of Vinh Son-Song Hinh Hydropower JSC (HoSE: VSH), a subsidiary of state-owned Vietnam Electricity (EVN), after sharply reducing its stake.

Companies - Thu, November 27, 2025 | 7:55 am GMT+7

VAFIE, Hung Yen province authority accompany taxpayers

The Vietnam's Association of Foreign Invested Enterprises (VAFIE) and Hung Yen province's tax authority on Tuesday held a workshop on corporate tax policy updates and key notes on 2025 corporate income tax filings.

Companies - Wed, November 26, 2025 | 8:15 pm GMT+7

Thailand’s Super Energy earns $81 mln in Jan-Sep revenue from Vietnam

Super Energy Corporation, a Thai renewable-energy developer, recorded about THB2.62 billion ($81.28 million) in revenue from its Vietnam operations in the first nine months of 2025, according to its Q3 earnings report.

Companies - Wed, November 26, 2025 | 4:51 pm GMT+7

Turning point of Vietnam's fund management industry: exec

Vietnam’s asset management industry is entering a pivotal phase as the country seeks to diversify capital flows and strengthen long-term funding, said Lu Hui Hung, CEO of Phu Hung Fund Management, citing the Ministry of Finance's recently issued Decision 3168.

Finance - Wed, November 26, 2025 | 4:42 pm GMT+7

Gelex Infrastructure okayed to launch IPO of 100 mln shares

Gelex Infrastructure JSC has received approval from the State Securities Commission of Vietnam to proceed with an initial public offering of 100 million shares, the company said.

Companies - Wed, November 26, 2025 | 3:52 pm GMT+7

Seven young PV Gas employees selected for Petrovietnam’s 'Outstanding Youth 2025' program

Seven young employees of PetroVietnam Gas (PV Gas) have been selected for Petrovietnam’s “Outstanding Youth 2025” program, an initiative aimed at identifying and developing high-potential talent across the state energy group.

Companies - Wed, November 26, 2025 | 3:01 pm GMT+7

Deep C Industrial Zones in northern Vietnam draws three new projects worth over $242 mln

Deep C Industrial Zones in Quang Ninh province has secured three new investment projects with combined registered capital of about VND6.38 trillion ($242 million), reinforcing its position as an attractive destination for manufacturing and logistics.

Industries - Wed, November 26, 2025 | 1:58 pm GMT+7

Billionaire Pham Nhat Vuong's son takes helm at VinMetal as Vingroup pledges support for loss-making steel producer Pomina

Vingroup, Vietnam's biggest listed company by market cap, said its steel subsidiary VinMetal will provide Pomina Steel with a zero-interest working capital loan for up to two years, helping the troubled steelmaker stabilize operations and restore cash flow.

Companies - Wed, November 26, 2025 | 12:38 pm GMT+7