What should investors in Vietnam do when gold, stocks reach new highs?

After a strong rally in prices of assets such as gold and stocks during the first eight months of 2025, experts advise investors in Vietnam to diversify their holdings to minimize short-term risks. Hoa Khoa, Minh Hue report.

Gold prices sharply increased in the first months of 2025. Photo by The Investor/Hoa Khoa.

In recent days, domestic gold prices have surged continuously, setting new all-time highs. Before the national holiday (September 1-2), SJC gold bars reached a new record of VND130.6 million ($4,957) per tael. Domestic gold prices remain approximately VND18 million ($683) per tael higher than global prices (excluding taxes and fees).

Specifically, Saigon Jewelry Company (SJC) listed the buying and selling prices of SJC gold bars at VND129.1-130.6 million per tael. SJC 9999 gold rings were also quoted at VND130.6 million (buying) and VND129.1 million (selling).

DOJI gold bars were traded at the same levels in Hanoi and Ho Chi Minh City: VND129.1 million (buying) and VND130.6 million (selling).

Global equities surged in the first months of 2025. Photo by The Investor/Hoa Khoa.

In line with gold, another asset - stocks - has also been on a record-breaking rally. The VN-Index, which represents the Ho Chi Minh Stock Exchange (HoSE), closed August at 1,682.21 points, up 11.96% from July and 32.8% from the end of 2024.

In August, most sectors saw positive movements, especially securities stocks, which impressed as market liquidity hit record highs. Banking also performed well thanks to credit growth, attractive valuations, and optimism about an upcoming upgrade in Vietnam’s stock market status. Real estate, seaports, insurance, retail, and steel also maintained strong performance.

Recently, the prices of gold, stocks, and real estate have continuously hit new peaks. Why are these investment channels continuously rising together?

Financial analyst Huynh Hoang Phuong: Most domestic asset classes have appreciated sharply since the beginning of the year due to both international and local favorable factors.

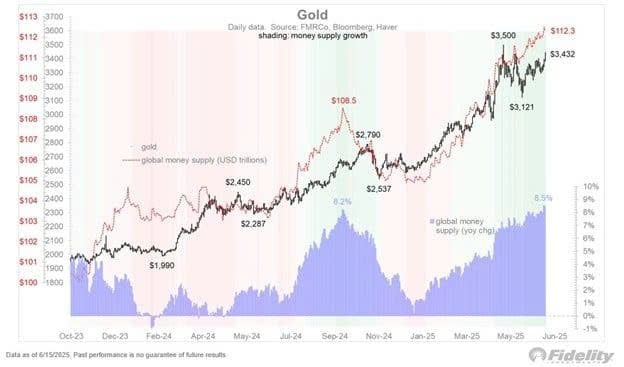

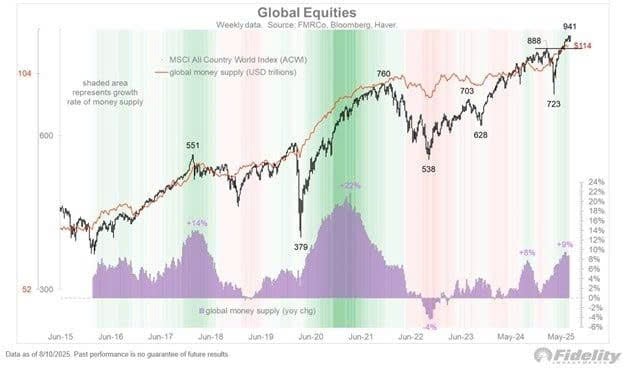

A common driver has been the global expansionary monetary policy, with money supply increasing rapidly. Vietnam has continued a prolonged loose monetary policy. Assets like stocks, gold, crypto, and real estate often correlate closely with money supply growth. However, each asset class has its own unique drivers.

Financial analyst Huynh Hoang Phuong. Photo by The Investor/Hoa Khoa.

The stock market surged 32.8% thanks to internal momentum from double-digit earnings growth prospects for listed companies in 2025-2026, as well as the potential for a market status upgrade. Additionally, government resolutions supporting private economic development have boosted long-term outlooks and attracted capital inflows.

Gold, aside from the increase in money supply, has been driven by geopolitical tensions leading to increased gold accumulation by central banks and a weakening VND against the USD.

Real estate markets show regional disparity. Price increases are fueled by supportive monetary policy (low interest rates, preferential loans) and expectations of major transportation infrastructure development over the next 5 years.

Nguyen The Minh, head of research & development for retail clients at Yuanta Securities Vietnam: The most fundamental reason for the optimism across investment channels is the low-interest environment. We are in an expansionary phase of monetary policy, with aggressive money injection.

Part of the capital is not flowing into production or business, but rather into stocks and gold. Notably, listed companies’ net profits in the past two quarters showed signs of weakening. Their post-tax profits still increased, but mainly due to non-core activities like asset sales or technical accounting.

Nguyen The Minh, head of research & development for retail clients at Yuanta Securities Vietnam. Photo by The Investor/Hoa Khoa.

Following President Donald Trump’s announcement of the new tariff policy in April, Vietnam’s stock market exploded both in score and liquidity. This trend occurred in multiple markets such as the U.S., South Korea, and Japan.

Domestic gold prices have hit all-time highs, while international gold has not, widening the gap between the two markets.

2025 is unique as both “defensive” (gold) and “aggressive” (stocks) assets have surged. In light of unpredictable future developments post-tariffs, investors are increasingly cautious and tend to balance their portfolios between offensive and defensive assets.

Real estate is a bit different, showing divergence between segments. Prices remain high, but liquidity is still weak.

Truong Dac Nguyen, chief investment officer of Blue Horizon JSC: The root cause lies in the State Bank of Vietnam’s (SBV) aggressive monetary easing in 2025. Credit growth as of July 28, 2025 reached 9.64% year-to-date, a high level in recent years, reflecting the strong and decisive money injection. Some of this excess capital naturally flows into investment channels.

Traditional savings, a common investment channel, currently offer the lowest interest rates in a decade - about 4.8% for 12-month deposits at major banks. This rate is too low to meet investors’ expectations.

As a result, capital is flowing into riskier investments to combat inflation and currency depreciation. This has led to the continuous surge in gold and stock prices.

Real estate gains are mainly driven by government efforts to remove legal bottlenecks in projects and push infrastructure. However, liquidity remains weak, showing that money has not yet fully entered this channel.

Truong Dac Nguyen, chief investment officer of Blue Horizon JSC. Photo by The Investor/Hoa Khoa.

Another reason for increased interest in investments is the difficulty facing the manufacturing sector. Although domestic consumption has rebounded (9.3% in the first seven months of 2025), it is still well below the 17.1% seen in 2022. Many manufacturing business owners, even with access to preferential loans, are hesitant to expand and instead seek profits through investments.

Vo Diep Thanh Thoai, head of retail clients at DNSE Securities: The growth of risky assets like gold and stocks hinges on low interest rates and the strong money supply from the central bank.

The SBV has set a credit growth target of around 16% for 2025 to support GDP growth above 8%, equating to about VND2.5 quadrillion ($117.67 billion)injected into the economy. This figure could increase to 18-20% (VND2.8-3.1 quadrillion) if GDP growth hits 10%.

The current phase is reminiscent of the Covid-19 period (2020-2021) when both stocks and gold surged. However, when asset prices rise purely due to cheap money without underlying fundamentals, capital starts to shift toward higher-performing channels.

Vo Diep Thanh Thoai, head of retail clients at DNSE Securities. Photo by The Investor/Hoa Khoa.

What should investors do? How should they allocate?

Huynh Hoang Phuong: As the monetary expansion cycle continues, investors should maintain a sizable allocation to assets instead of holding too much cash. However, given the sharp increase in asset prices in the first eight months, investors should diversify to minimize short-term risks.

Those who have not allocated effectively should wait patiently for short-term corrections in gold and financial assets before investing.

For real estate, prices in major cities are already high relative to income. Going forward, selective investment is key, with future transport connectivity being a critical factor.

Nguyen The Minh: Gold is unlikely to drop significantly in 2025 but may plateau. High prices could trigger profit-taking and capital rotation into stocks.

Additionally, Decree No. 232/2025/NĐ-CP ending the gold bar monopoly may increase supply and help domestic gold prices converge with global levels. Still, gold will remain a defensive asset.

Investors should combine gold and stocks in their portfolios: stocks for growth and gold for risk mitigation. Allocation depends on risk appetite, but I recommend 60% in stocks and 40% in gold and/or savings.

Truong Dac Nguyen: I expect the VN-Index to slow in the latter part of 2025 after a sharp rally, but investment opportunities will persist through early 2026. Investors should rotate into large-cap stocks less affected by recent tariff shocks.

Mutual funds can be an easier way to invest in the stock market, though many have underperformed the VN-Index this year. Individual investors have often earned better returns through direct trading. Exchange Traded Funds (ETFs), which mimic index movements, are a preferable option.

Gold remains a good inflation hedge. Investors can allocate a portion here. Real estate has potential, especially with positive legal developments.

By 2026, interest rates may inch up and capital could shift toward promising business ventures. This year also marks a period of stabilization as economic-supporting resolutions take effect.

Vo Diep Thanh Thoai: With gold and stocks at historical highs, investors must manage risk carefully when allocating capital.

Assuming low interest rates persist, investors capable of analyzing financial statements should target stocks with consistent profit growth from Q3/2025 to Q1/2026. This suggests real money is flowing into the economy and businesses.

Those with moderate risk tolerance should consider accumulating stocks now, as we are in an economic recovery cycle. I recommend allocating 40-45% of total assets to equities.

Gold, while rising, may only continue its uptrend amid economic instability. In periods of growth, it tends to flatten or decline. Therefore, I view gold as a hedge against unexpected scenarios, suggesting a 10-20% allocation.

- Read More

Vingroup plans $38 mln bond issuance to restructure debt

Vingroup (HoSE: VIC), Vietnam’s largest listed company by market cap, plans to issue VND1 trillion ($37.91 million) in bonds via private placement as it seeks to restructure debt.

Companies - Tue, November 25, 2025 | 3:52 pm GMT+7

Vietnam gov't proposes minimum $379 mln charter capital for offshore wind developers

The Vietnamese government has proposed that offshore wind power developers have a minimum charter capital of VND10 trillion ($379 million) each, according to a draft resolution designed to ease bottlenecks in the country’s 2026-2030 energy development plan.

Energy - Tue, November 25, 2025 | 3:41 pm GMT+7

Petrovietnam arm to venture into CO2 transportation, seabed minerals, geothermal

PVEP, the upstream arm of state giant Petrovietnam, plans to expand into new fields such as CO2 transportation and disposal (carbon capture, utilization, and storage), coal gas and underground mineral research, seabed minerals, and geothermal.

Industries - Tue, November 25, 2025 | 3:08 pm GMT+7

MB successfully closes landmark $500 mln inaugural green term loan facility agreement

Military Commercial Joint Stock Bank (MB) on Monday announced the successful closing of its three-year $500 million inaugural Green Term Loan Facility Agreement, marking a significant milestone in the bank’s sustainable financing journey.

Banking - Tue, November 25, 2025 | 2:17 pm GMT+7

Impact of rising exchange rates in Vietnam

Mirae Asset Securities analysts offer an insight into the impact of rising exchange rates on companies in Vietnam in a report dated November 21.

Economy - Tue, November 25, 2025 | 1:35 pm GMT+7

Vietnam's industrial park developers post strong earnings as tenant demand rebounds

Vietnam’s industrial real estate sector is showing stronger earnings and improving demand, with foreign tenants resuming lease negotiations after U.S. tariff policies became clearer, according to a brokerage report.

Industrial real estate - Tue, November 25, 2025 | 11:07 am GMT+7

Vietnamese export stocks under the radar despite strong earnings

Investor caution over tariff risks and the slowdown of major economies has prevented Vietnamese export stocks from making a strong price recovery.

Finance - Tue, November 25, 2025 | 8:44 am GMT+7

Indonesia plans 7 initial waste-to-energy plants next year

Indonesia will start the construction of seven waste-to-energy power plants in 2026 as the first step to develop 33 such facilities by 2029.

Southeast Asia - Mon, November 24, 2025 | 9:23 pm GMT+7

Malaysia predicted to be ASEAN’s second-fastest-growing economy, after Vietnam

Malaysia is poised to become the second-fastest-growing economy in the Association of Southeast Asian Nations (ASEAN) after Vietnam, data showed.

Southeast Asia - Mon, November 24, 2025 | 9:19 pm GMT+7

Thailand SCG-backed Bien Hoa Packaging plans delisting from HCMC bourse

Bien Hoa Packaging JSC, a 57-year-old manufacturer in Vietnam, plans to scrap its public-company status and delist from the Ho Chi Minh Stock Exchange (HoSE) as its free float fell below the minimum threshold under local securities law.

Companies - Mon, November 24, 2025 | 9:06 pm GMT+7

Real estate, industrials sectors lead in October M&A value in Vietnam

Grant Thornton analysts provide an insight to capital flows, the sectors attracting investor attention, and the market dynamics influencing the merger and acquisition (M&A) landscape in Vietnam in October.

Economy - Mon, November 24, 2025 | 4:39 pm GMT+7

Tobacco giant Vinataba to sell entire stake in instant noodle maker Colusa-Miliket

State-owned Vietnam National Tobacco Corporation (Vinataba) plans to divest its entire 20% stake in Colusa-Miliket, the company behind the iconic “Miliket” (two-shrimp) instant noodle brand, seeking to raise at least VND114 billion ($4.32 million).

Companies - Mon, November 24, 2025 | 4:10 pm GMT+7

VinSpeed cannot participate in North-South high-speed rail project under PPP model: exec

Pham Nhat Vuong, founder of VinSpeed High-Speed Rail Investment and Development JSC, has mapped out a clear 30-year financing plan for the gigantic North-South high-speed rail project, said an executive at Vingroup, a VinSpeed investor.

Infrastructure - Mon, November 24, 2025 | 3:51 pm GMT+7

Delivery major Viettel Post plans $21 mln logistics center in central Vietnam

Viettel Post, the courier arm of military-run telecom giant Viettel, has completed a site survey for a planned 21-hectare logistics center in the central province of Ha Tinh, with an estimated investment of nearly VND550 billion ($20.87 million).

Industries - Mon, November 24, 2025 | 11:49 am GMT+7

Honda Mobilityland eyes 600-ha sports, entertainment, tourism complex in southern Vietnam

Honda Mobilityland Corporation, a subsidiary of Japan’s Honda Motor Co., plans to build an international circuit in Tay Ninh province, towards developing a 600-hectare sports, entertainment, and tourism complex there.

Industries - Mon, November 24, 2025 | 11:23 am GMT+7

State-controlled shipping line Vosco steps up coal trading to seek new revenue drive

Vietnam Ocean Shipping JSC (Vosco), controlled by the state-run Vietnam Maritime Corporation, is moving deeper into coal trading as the shipping line increasingly bids for large import contracts for thermal power plants, marking a push beyond its core maritime transport business.

Companies - Mon, November 24, 2025 | 8:36 am GMT+7

- Consulting

-

The generation game: Adapting to an aging population

-

Decentralization and the potential for multi-center urban development in HCMC’s satellite areas

-

Powering growth from within

-

Key factors helping firms export to demanding markets: DH Foods exec

-

Vietnam corporate earnings to be driven by credit expansion, trading activity, property recovery

-

Vietnam's International Financial Center ambition can unlock new wave of innovation