Vietnam among top choices for global investors: Cushman & Wakefield survey

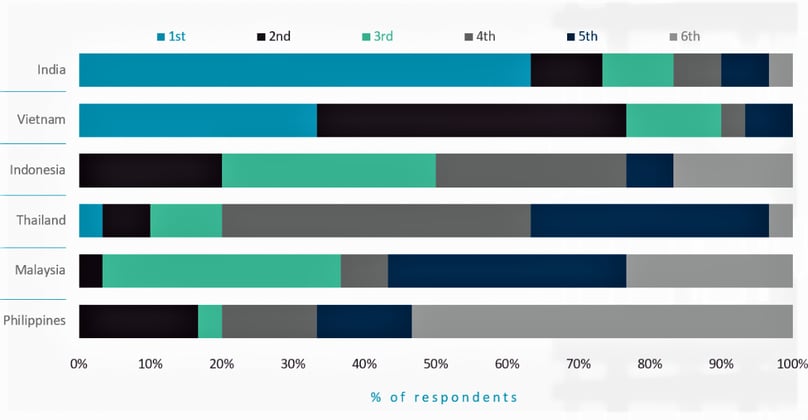

Vietnam is the emerging market of choice on a first- and second-place preferred basis in a new Cushman & Wakefield global survey, taking almost 80% of the votes, ahead of India’s 75%.

Geographically, India is ranked by over 60% of the respondents as their preferred emerging market, excluding mainland China, in which to invest, the survey shows.

Cushman & Wakefield survey data shows the votes of choice for investment destinations.

The realty service company said in a release Thursday that investors worldwide are having to “look laterally” to find opportunities for growth in the current market but can still successfully deploy capital as ongoing uncertainty in the macroeconomic environment slows early-year momentum.

Citing findings in the survey, it noted that representatives from leading investment organizations said rising interest rates and an inflationary environment had caused a “pause” in the market as investors re-weighted their portfolios within the current conditions.

Despite the slowdown, investor sentiment was leaning towards a cautious resumption of deal flow to Asia Pacific later in 2022 once global players from the U.S. and Europe had adjusted to the current conditions, said Gordon Marsden, regional director, Asia Pacific Capital Markets at Cushman & Wakefield.

Nguyen Hue Boulevard in District 1, Ho Chi Minh City - Vietnam’s economic powerhouse. Photo courtesy of ADB.

Asked how they would split $1 billion across different sectors, investors voted to allocate more to logistics than to office, with a significant additional allocation to alternatives including data centers - a sector with solid tailwinds that is undersupplied - and multifamily.

Despite softening yields, over 35% of the respondents believed the logistics sector remains fundamentally undersupplied, with a further 30% expecting positive but slower growth within the sector.

Another finding is the focus on industry and logistics was particularly evident in Greater China, where it was the largest sector by investment volume in Hong Kong in H1/2022.

In mainland China, industry and logistics is currently the second-largest sector by investment volume, accounting for approximately 25% of the total investments in the first half of this year, up from around 10% in 2020 and 2021, and only 2% in 2019, according to Cushman & Wakefield data.

Diversification within the living sector was also evident as compressed yields forced investors to think more strategically and look beyond traditional multifamily properties for growth, Cushman & Wakefield said. In Japan, the aging population was identified as a demographic tailwind for senior living accommodation while strong policy support prompted another investment firm to focus its attention on the childcare industry in Australia.

Dr. Dominic Brown, head of insight and analysis, Asia Pacific at Cushman & Wakefield, said in the company release: “The rising significance of the living sector should not be underestimated. Diversity within the sector allows for different investment strategies.

“Furthermore, the frequent lease renewal opportunities can act as a hedge against inflation, providing a blend of near-term inflation protection and longer-term growth opportunities.”

As investors adjust to the higher interest rate environment, Marsden said there was an evident move away from more opportunistic strategies. “Just over 50% of investors indicated that they considered the best risk/return ratio today to be in value-add Tier 1 opportunities,” the regional director of Cushman & Wakefield said, adding that emerging economies placed second with just under 20% of the votes.

In the first six months of 2022, Vietnam recorded a new high with $10.06 billion in capital from foreign investors disbursing into Vietnam. This is the highest growth rate over the past five years. In which, real estate ranked second, accounting for 26% of total capital, with leading investors from Singapore, Japan, Denmark, China, and Korea.

“Industrial and logistics properties, development land, hotels and offices are being sought after by investors,” said Trang Bui, CEO of Cushman & Wakefield Vietnam.

“To attract more foreign direct investment, Vietnam is focusing investments on upgrading important transportation facilities like highways and seaports and increasing competition index ranking. These upgrades are contributing to robust growth in the economy and especially in the logistics and industrial sectors,” she said.

Vietnam’s upbeat growth outlook is bucking the slowing trend elsewhere in Asia, with relatively subdued inflation as an exception to the regional rule, the International Monetary Fund said Tuesday.

On the same day, Moody's raised Vietnam's rating from Ba3 to Ba2, meaning outlook changed from positive to stable.

The upgrade reflects Vietnam’s growing economic strengths relative to peers and greater resilience to external macroeconomic shocks that are indicative of improved policy effectiveness, the credit rating agency stated.

- Read More

Korean textile maker Panko Vina to shut Vietnam operations from Feb

Panko Vina Co Ltd, a South Korean textile manufacturer, will cease all production and business operations in Vietnam from February 1, 2026, ending more than 23 years of operations in the country.

Companies - Wed, December 24, 2025 | 9:13 pm GMT+7

Vietnam's garment giant Vinatex posts second-highest profit in 30 years despite trade headwinds

Vietnam National Textile and Garment Group (Vinatex), the country's top garment maker, expects consolidated profit to reach VND1,355 billion ($51.5 million) in 2025, the second-highest result in its 30-year history, despite mounting global trade and cost pressures on the industry.

Companies - Wed, December 24, 2025 | 5:03 pm GMT+7

Finding a new balance

The State Bank of Vietnam's proactive and flexible monetary policy in 2026 is expected to maintain market operations within a stable range. For businesses, particularly those in the external sector, it remains essential to proactively hedge against exchange rate and interest rate risks to protect their bottom line, writes Vu Binh Minh, associate director, FX Trading, MSS, HSBC Vietnam.

Consulting - Wed, December 24, 2025 | 4:47 pm GMT+7

Thai giant Central Retail sells Vietnam electronics business to Pico for $36 mln

Thailand’s Central Retail has announced the sale of its Vietnamese electronics retail business to local retailer Pico Holdings JSC for nearly THB1.14 billion ($36 million), as it sharpens its focus on core businesses in the country.

Companies - Wed, December 24, 2025 | 2:00 pm GMT+7

What should investors reasonably expect from IPO stocks?

Experience from both Vietnam and global markets shows that initial public offering (IPO) stocks rarely deliver immediate gains. However, investors who select companies with solid fundamentals and maintain a long-term holding strategy can be rewarded for their patience.

Finance - Wed, December 24, 2025 | 10:45 am GMT+7

Vingroup completes $325 mln overseas bond issuance

Vingroup, Vietnam's biggest listed company by market capitalization, has completed its international issuance of bonds totaling $325 million, with a 5-year maturity, and listed on Austria's Vienna Stock Exchange.

Finance - Wed, December 24, 2025 | 10:17 am GMT+7

Vietnam's public investment-linked stocks seen benefiting in 2026

Capital flows in 2026 are expected to favor sectors that stand to benefit from Vietnam’s public investment drive, including infrastructure, energy, and construction, market experts said.

Finance - Wed, December 24, 2025 | 9:33 am GMT+7

High gold prices to drive prices of property, goods in Vietnam: Sunhouse chairman

In a scenario where gold prices remain elevated in Vietnam, the real estate market is likely to follow suit, pushing income levels higher and driving up prices across other goods, said Nguyen Xuan Phu, chairman of Sunhouse, a leading home appliance manufacturer, while outlining his 2026-2030 forecast.

Economy - Wed, December 24, 2025 | 8:00 am GMT+7

Malaysia’s economy grows robustly in 2025: IMF

Malaysia has shown notable resilience amid global trade tensions and policy uncertainty, with its economy growing at a healthy pace this year, supported by strong domestic consumption and investment, solid employment growth, and a global upcycle in the technology sector, according to Masahiro Nozaki, Mission Chief for Malaysia at the International Monetary Fund (IMF).

Southeast Asia - Tue, December 23, 2025 | 10:07 pm GMT+7

Indonesia to stop rice imports next year

Indonesia will not import rice for either consumption or industrial use next year, citing sufficient domestic production, according to a government official.

Southeast Asia - Tue, December 23, 2025 | 10:04 pm GMT+7

Indonesia faces challenge of balancing wages, labor costs

Indonesia plans to raise minimum wages by about 5-7% in 2026 under a new formula signed into law by President Prabowo Subianto, a move that could test the country’s cost competitiveness in Southeast Asia.

Southeast Asia - Tue, December 23, 2025 | 10:00 pm GMT+7

Philippines extends sugar import ban

The Philippine Government has decided to extend its ban on sugar imports until the end of December 2026, as domestic supply has improved.

Southeast Asia - Tue, December 23, 2025 | 9:56 pm GMT+7

Duc Giang Chemical stock comes under heavy selling pressure as bottom-fishing shares return

DGC shares of Duc Giang Chemical Group JSC (DGC) closed Tuesday at VND71,600 apiece, down 4% from Monday which saw a 6.27% increase after four sessions of sharp declines last week.

Companies - Tue, December 23, 2025 | 9:49 pm GMT+7

Hanoi clears zoning for major mall project after Aeon exit, Thaco arm steps in

Hanoi authorities have approved a detailed zoning plan for an 8.03-hectare mixed-use site in Hoang Mai district, paving the way for a shopping mall-led development after Japan’s Aeon withdrew and a unit of Vietnam’s Thaco Group moved in.

Real Estate - Tue, December 23, 2025 | 5:05 pm GMT+7

Viettel Commerce partners with China’s Dreame Technology to expand home appliance ecosystem in Vietnam

Viettel Commerce and Import-Export Co. Ltd., one of the core pillars in trade and logistics of the military-run telecom giant Viettel, has signed a strategic cooperation agreement with China-based Dreame Technology, a global high-end technology brand, in Hanoi.

Companies - Tue, December 23, 2025 | 3:38 pm GMT+7

Former LPBank chairman becomes acting Sacombank CEO

Former chairman of Vietnamese private lender LPBank Nguyen Duc Thuy on Tuesday assumed the role of acting CEO at Sacombank, immediately after completing the handover at LPBank.

Banking - Tue, December 23, 2025 | 3:30 pm GMT+7